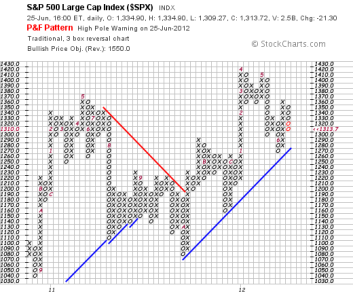

OK- Well, this morning, the P&F Chart hit it's BEARISH PRICE OBJECTIVE of 1380, which was predicted back on October 19th.

THIS MORNING's LOW WAS 1373.

The one thing I'll say about the P&F system is that there are many times when it is correct. Yes, it misses every now and then, but it hits a lot too, and is helpful to me as ONE FACTOR- but only one factor, that I use myself in making decisions.

Normally, reaching a price objetive is not the final word on when to change positions. It is quite common that sometimes a direction goes PAST a price objective (either up or down) and keeps going for a little while more. I am not sure if we are now done with the decline since Oct 19th as of today, or if we may keep drifting down a little lower. It could be either answer. So, today, I'm going to hold off for another day or two to see where it takes us. If we are at a bottom, we'll still be able to buy back in near here. If not, we can learn that too.

Here is the chart today:

We've met the forecasted 1380 S&P 500 bearish price objective, which was signaled back on October 19th. And we've done it in just about three weeks. Interesting.

Are we done now?

I'm not sure.

I'll wait another day and see how things look, before deciding whether to jump back in or not.

Today's S&P500- met bearish price objective, and now I am looking for a re-entry point.

Maybe tomorrow, maybe not. Let's see how today and tomorrow morning shake out.

Take care out there!