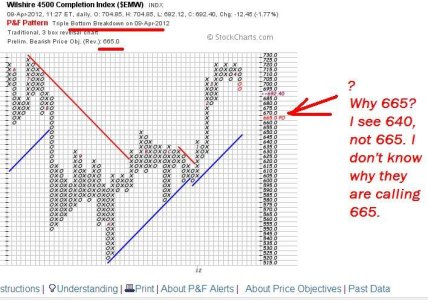

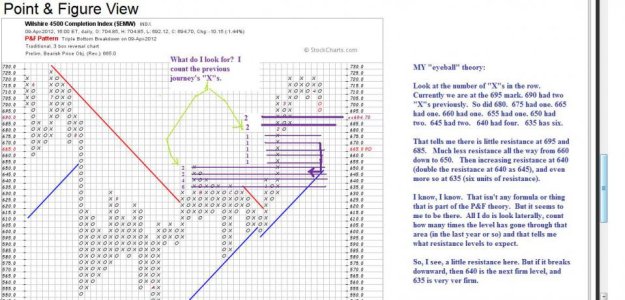

Finally, somebody provides comments on interpreting P&F I can wrap my brain around. but its my own fault, I confess I haven't put any study time into these, I just look at them and they look like a Rohrshach blot to me, can't make heads nor tails out of them, not intuitive at all for me and so I've steered my TA interests in other directions.

Incidentally, S has completed 9 up on weekly DeMarks, heading into next 13, which can reach their goal through any combination of sideways/up from here for as long as it takes to get to the next big 4week DeMark flip downwards. Support for the 9-up on weekly comes in at 630, btw.