DigDugII;bt4915 said:

As far as taking a break goes, JTH said the other day that cranking out a blog every day isn't easy. He is correct. And the writing is on the wall that I need to scale back the time I put into it. I have a day job like most everyone else who reads my blog and that job is becoming more challenging in terms of time and travel. Ten and half hours of every day goes into my day job, and when I get home I still have to make dinner and take care of any other day to day issues as well as find time to blog.

For the moment I need time to carefully weigh my options first. I do not intend to stop blogging, but some changes will have to be made to better accommodate my schedule.

Wow, 10.5 hours/day is a full schedule. I avg. at least 45/wk and another 5.5 hours/wk commuting. Then it's straight to 3 kids baseball/softball practices/games for 3 different teams several times/week......so I know how you feel when it comes to the 'free time' that's left at the end of the day. I have to however, allow myself a little time nearly every night, even it it's after midnight, to appreciate you and other's much appreciated hard work.

I got 'promoted' to a higher position a few months ago, however they failed to mention that they were eliminating the TDA for my old position so now I get to do 2 jobs for a little more than the price of 1. I sure wish I got paid the GS23 equivalent!

Eliminating raises, increasing FERS and FEHB contributions, increasing high 3's to high 5's, what's next....Social Security? Lots of things to look forward to in the next 12 - 15 more years before I can retire so some serious financial planning was in order. At age 50, I have too much time served to start a new career, so that's when I decided to take control of my investments around 4 years ago. Although I just joined TSP Talk this past December, I have routinely monitored the website for the last 4 and daily for the last 2. Wow, what a positive difference in my annual return when I stopped putting the sheep out to pasture and checking on the flock a few times/year hoping that the wolves would manage my assets wisely! I've averaged around 18%/year during the same timeframe and I owe a lot of this new-found success to folks like you, Mr. Crowely, and others that I know have donated a LOT of their time sharing their expertise and financial analyses to other Federal workers like me that don't know squat about the subject. I know there's a good bit of luck involved (like I wish I would have captured the full impact of that 1.71% gain today, but had it gone the other way I would have been hating it more simply because I ignored a lot of the 'proceed with caution' signs) and I don't pretend to know very much, however I do continue to learn and have made some good moves as a result.

I consider it a lot like 'educated gambling' and hanging out at the casino with the card counters! When talking with other Federal friends I always encourage them to take control of their accounts and add this website to their Favorites Bar AFTER they sign up!

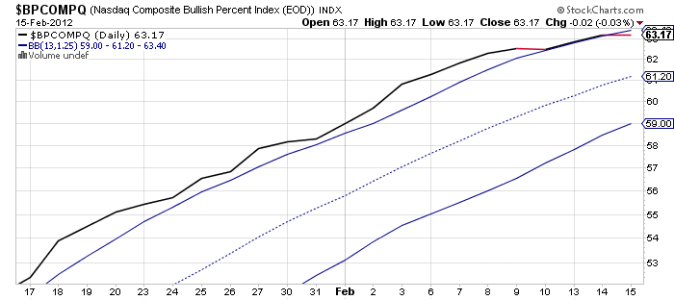

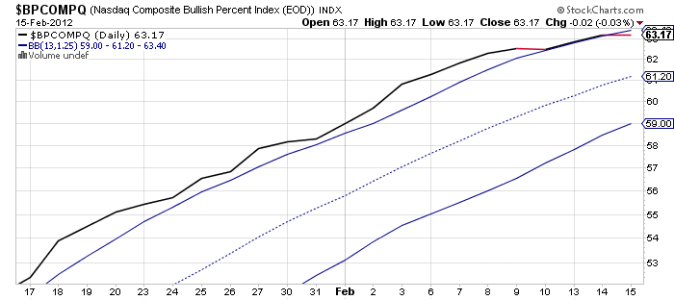

Regarding your 7-Sentinels, where do you get the charts that you were posting? I like the new format but if there is one thing that wildlife biologists readily understand that is applicable to finances, is trend charts.

Thanks again for all of your valuable input!

DD[/QUOTE]

With respect to each bolded area of your post...

First, the work hours include travel time. I'm not "that" dedicated.

Second, squeezing productivity is happening just about everywhere now.

Third, BINGO! We all need to be aware of the ramifications to our retirements as a result of the fiscal debacle slowly unfolding before our eyes.

Fourth, "educated gambling" is probably not far from the truth. We think alike.

Thanks for the post. I'll speak more to some of these points down the road.