Stocks started out at the open in positive territory and continued to march higher for the first half hour of trading, but that turned out to be their highs of the day as they then chopped their way into the red before recovering as the afternoon session worn on. They finished the day mixed and relatively flat.

The euro continued its recovery, which has been helping anyone who's currently invested in the I fund as the dollar has been weakening as the euro has risen.

No economic data was released today and volume was decidedly light once again.

Here's today's charts:

NAMO flipped to a sell today, while NYMO closed neutral. Not much of a tell here.

NAHL is neutral as well, while NYHL is flashing a buy. Nothing worth noting here either.

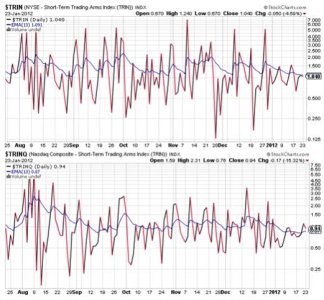

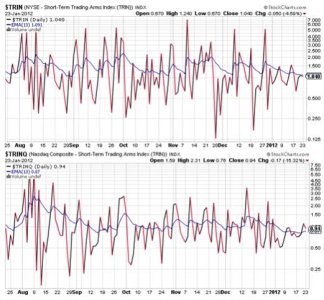

TRIN is just barely in a buy status, while TRINQ is on a modest sell. Neutral readings overall.

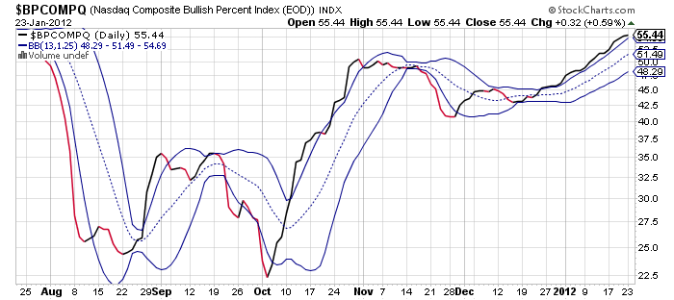

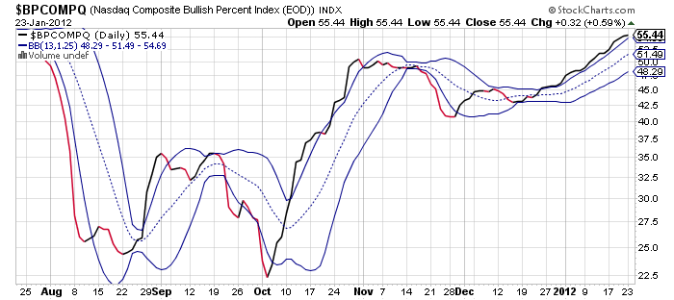

BPCOMPQ tracked a bit sideways today and remains in a buy condition.

So the signals are mixed, which keeps the Seven Sentinels in an intermediate term buy condition.

As I've pointed out, the signals aren't giving me much of a clue right now other than to suggest choppy market conditions. I am watching BPCOMPQ for any hint that it may turn lower, which could signal a change in at least the short term trend. But given volume is low, I'd not expect anything dramatic to the downside without some catalyst to trigger it. Without a reason to sell-off we could continue to grind higher too, and that would be consistent with the Seven Sentinels buy signal as well as our sentiment survey buy signal.

The euro continued its recovery, which has been helping anyone who's currently invested in the I fund as the dollar has been weakening as the euro has risen.

No economic data was released today and volume was decidedly light once again.

Here's today's charts:

NAMO flipped to a sell today, while NYMO closed neutral. Not much of a tell here.

NAHL is neutral as well, while NYHL is flashing a buy. Nothing worth noting here either.

TRIN is just barely in a buy status, while TRINQ is on a modest sell. Neutral readings overall.

BPCOMPQ tracked a bit sideways today and remains in a buy condition.

So the signals are mixed, which keeps the Seven Sentinels in an intermediate term buy condition.

As I've pointed out, the signals aren't giving me much of a clue right now other than to suggest choppy market conditions. I am watching BPCOMPQ for any hint that it may turn lower, which could signal a change in at least the short term trend. But given volume is low, I'd not expect anything dramatic to the downside without some catalyst to trigger it. Without a reason to sell-off we could continue to grind higher too, and that would be consistent with the Seven Sentinels buy signal as well as our sentiment survey buy signal.