I'm not inclined to be much of a risk taker with my TSP account, at least not like I used to be. I let my Roth IRAs incur most of the risk these days as I stay fully invested in those. I suppose one could say I'm using TSP as a type of hedge in the event a major decline hits the markets.

But I'm not expecting one of those anytime soon. I think the Egyptian situation was ample reason for this market to sell-off and when that didn't do it I began to think this uptrend was darn near iron clad. At least for now, because sooner or later a for-real, golly-gee decline will come.

So today's weakness drew me partially back into the market with my TSP account as I put 25% each into the C and S funds. The rest I kept in the G fund until I get a confirmed buy signal from the Seven Sentinels. And while today didn't get me there, market action paused enough to take at least a partial position in stocks. And the Sentinels, while technically on a sell, have issued 2 unconfirmed buy signals in the past 2 weeks. That and the fact that this market has seen very little downside since the sell signal was triggered was all part of my reason for taking some exposure in the market.

There really wasn't much to drive the market today, so let's go to the charts:

NAMO and NYMO both dipped below their respective 6 day EMAs and triggered sells. But by itself that has little meaning as they are relatively neutral.

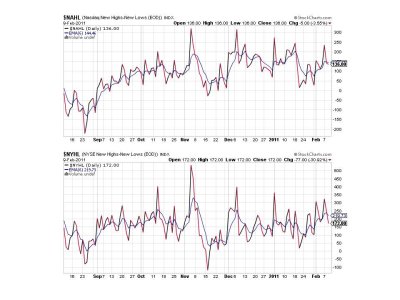

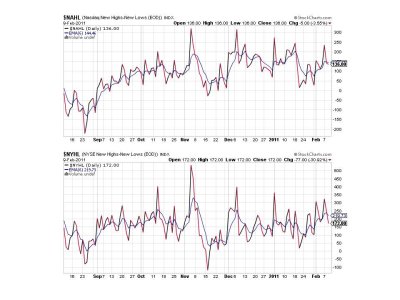

NAHL and NYHL also dipped below their 6 day EMAs, triggering sells.

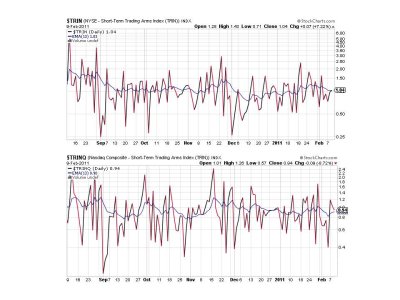

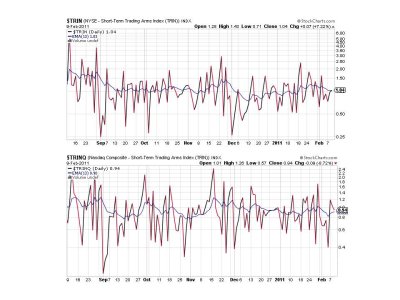

TRIN and TRINQ are also flashing sells, but are also neutral.

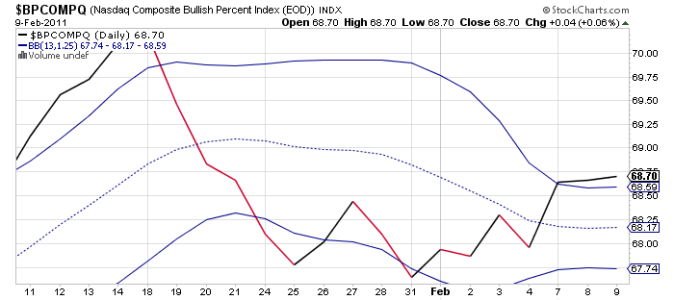

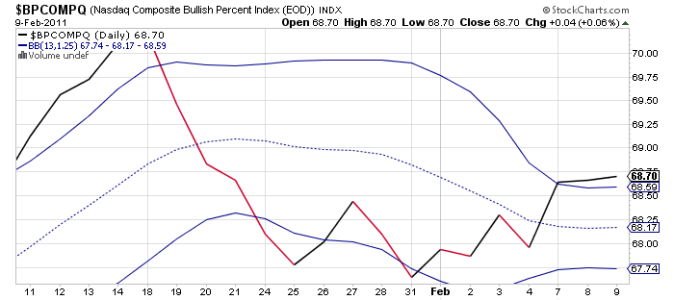

BPCOMPQ remains on a buy and ebbed a bit higher today.

So while 6 of the signals are flashing sells, the system looks neutral overall in the very short term. I have to side with the heavy and persistent bullish bias that this market has and look for higher prices down the road. Support has been quite solid on every dip and often those dips only last intraday, which means those of us in TSP don't often get a chance to buy in at lower prices. I am looking for a confirmed buy signal in the coming days, but jumped the gun a bit today in case we see yet another launch to the upside before it can be given.

But I'm not expecting one of those anytime soon. I think the Egyptian situation was ample reason for this market to sell-off and when that didn't do it I began to think this uptrend was darn near iron clad. At least for now, because sooner or later a for-real, golly-gee decline will come.

So today's weakness drew me partially back into the market with my TSP account as I put 25% each into the C and S funds. The rest I kept in the G fund until I get a confirmed buy signal from the Seven Sentinels. And while today didn't get me there, market action paused enough to take at least a partial position in stocks. And the Sentinels, while technically on a sell, have issued 2 unconfirmed buy signals in the past 2 weeks. That and the fact that this market has seen very little downside since the sell signal was triggered was all part of my reason for taking some exposure in the market.

There really wasn't much to drive the market today, so let's go to the charts:

NAMO and NYMO both dipped below their respective 6 day EMAs and triggered sells. But by itself that has little meaning as they are relatively neutral.

NAHL and NYHL also dipped below their 6 day EMAs, triggering sells.

TRIN and TRINQ are also flashing sells, but are also neutral.

BPCOMPQ remains on a buy and ebbed a bit higher today.

So while 6 of the signals are flashing sells, the system looks neutral overall in the very short term. I have to side with the heavy and persistent bullish bias that this market has and look for higher prices down the road. Support has been quite solid on every dip and often those dips only last intraday, which means those of us in TSP don't often get a chance to buy in at lower prices. I am looking for a confirmed buy signal in the coming days, but jumped the gun a bit today in case we see yet another launch to the upside before it can be given.