James48843

TSP Talk Royalty

- Reaction score

- 992

...DRILL DRILL DRILL and keep it here and stop exporting most of it overseas, regulate.

Those are contradictory goals for the oil companies.

It's not about helping the American citizen. To the oil companies, it's ALL about the money. Nothing more.

You could drill, drill, drill all day long, and the oil companies will do exactly what they want to do with the XP pipeline. It's not about helping the American economy- it's ONLY about getting their precious oil to world markets, where they can make more money. Period.

cut off Iranian oil? Sure- BP loves that idea, as does Exxon Mobile, Citgo, Marathon, and all the rest. Because cutting off Iranian oil only means the price will go UP UP UP for all oil products, in every market in the world. Oil is a global commodity- and cutting off anywhere, means higher prices everywhere, and that's exactly what big oil wants.

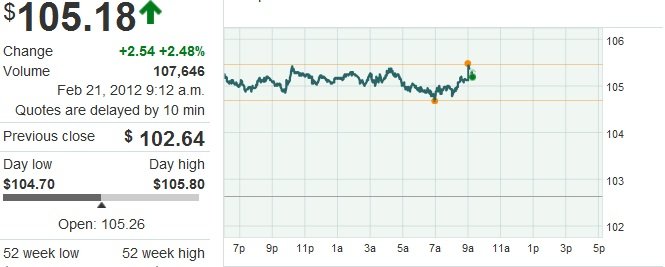

Invest in BP.

[h=2]BP p.l.c. Common Stock (BP)[/h] -NYSE

47.62

Last edited: