-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Oil Slick Stuff

- Thread starter nnuut

- Start date

RealMoneyIssues

TSP Legend

- Reaction score

- 101

It appears that Gas in on it's way to $4.00 a gallon again, Lovely just Lovely! View attachment 17625

Probably $5, with a quick pitstop at $4...

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

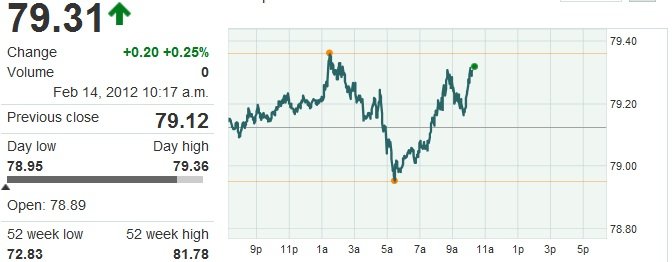

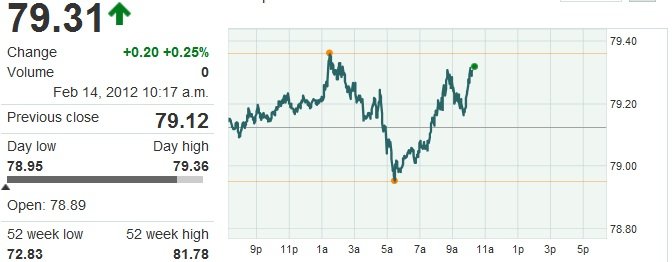

The Dollar isn't being nice this morning.:suspicious:

U.S. Dollar Index (DXY), DXY Index Quote - (NYE) DXY, U.S. Dollar Index (DXY) Index Price

U.S. Dollar Index (DXY), DXY Index Quote - (NYE) DXY, U.S. Dollar Index (DXY) Index Price

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Feb. 14, 2012, 12:59 p.m. EST

[h=1]Experts talk down $5 gasoline this summer[/h][h=2]One trader says war with Iran could spike prices at the pump[/h]

By Steve Gelsi, MarketWatch

NEW YORK (MarketWatch) — While the cost of a gallon of gasoline could possibly touch $5 for the first time this summer, at least two commodity pundits said Tuesday it’s more likely that prices will remain closer to $4 a gallon.

Experts talk down $5 gasoline this summer - Market Extra - MarketWatch

[h=1]Experts talk down $5 gasoline this summer[/h][h=2]One trader says war with Iran could spike prices at the pump[/h]

By Steve Gelsi, MarketWatch

NEW YORK (MarketWatch) — While the cost of a gallon of gasoline could possibly touch $5 for the first time this summer, at least two commodity pundits said Tuesday it’s more likely that prices will remain closer to $4 a gallon.

Experts talk down $5 gasoline this summer - Market Extra - MarketWatch

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Here they go again, $5 a gallon may be cheap. :nuts:

Musings: Can't People Find A New Way To Regulate O&G Industry?

by G. Allen Brooks Parks Paton Hoepfl & Brown

Musings: Can't People Find A New Way To Regulate O&G Industry?

by G. Allen Brooks Parks Paton Hoepfl & Brown

On January 18th, Representative Denis Kucinich (D-Ohio), along with five liberal Democrats in the House of Representatives, introduced a bill that displays not only a lack of understanding about the basics of business, but also champions some of the most failed government economic policies of the past 40 years. The bill, H.R. 3784, otherwise known as the "Gas Price Spike Act of 2012," would, as its preamble sets forth: "…amend the Internal Revenue Code of 1986 to impose a windfall profit tax on oil and natural gas (and products thereof) and to allow an income tax credit for purchases of fuel-efficient passenger vehicles, and to allow grants for mass transit." For this group of politicians, profits are as dirty as the crude oil they are derived from. While the preamble sets forth the premise of regulating energy industry profitability, the proposed mechanisms in the bill demonstrate the worst of a social engineering mandate.

The "Gas Price Spike Act of 2012," would, as its preamble sets forth: "…amend the Internal Revenue Code of 1986 to impose a windfall profit tax on oil and natural gas

RIGZONE - Musings: Can't People Find A New Way To Regulate O&G Industry?

RIGZONE - Musings: Can't People Find A New Way To Regulate O&G Industry?

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

RealMoneyIssues

TSP Legend

- Reaction score

- 101

WooHoo !!! That means all the oil stocks will be up, and with AAPL going like gangbusters, great economic news, and a bullish sentiment we are headed to SPX-1400 sooner than expected !!!

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

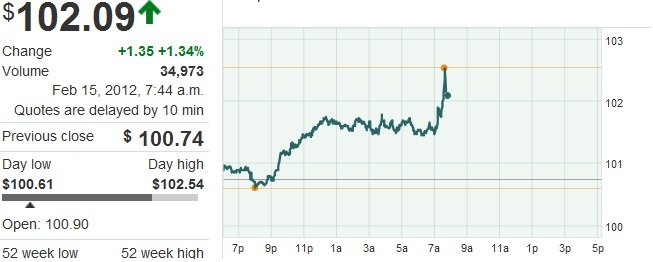

Crude Oil Electronic - NYMEX March 2012

$101.60 +$0.86 +0.85%

Feb 15, 2012, 9:32 a.m.

Crude Oil - Electronic (NYMEX) Mar 2012, CL2H Future Quote - (NMN) CL2H, Crude Oil - Electronic (NYMEX) Mar 2012 Future Price

$101.60 +$0.86 +0.85%

Feb 15, 2012, 9:32 a.m.

Crude Oil - Electronic (NYMEX) Mar 2012, CL2H Future Quote - (NMN) CL2H, Crude Oil - Electronic (NYMEX) Mar 2012 Future Price

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Feb. 15, 2012, 9:30 a.m. EST

Oil higher on fears of supply disruption, Iran

Oil higher on fears of supply disruption, Iran - MarketWatch

Oil higher on fears of supply disruption, Iran

Oil higher on fears of supply disruption, Iran - MarketWatch

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Feb. 15, 2012, 10:06 a.m. EST

Oil at five-week high on fear of curbed supply

Iran reportedly cuts some European shipments

Oil at five-week high on fear of curbed supply

Iran reportedly cuts some European shipments

Oil at five-week high on fear of curbed supply - Futures Movers - MarketWatchThe U.S. doesn’t allow oil imports from Iran, but analysts have said any fears of supply disruption in the Middle East could create havoc in the market.

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Crude inventories Down a bit this morning.

EIA Petroleum Status Report[TABLE="class: actual_consensus_box"]

[TR]

[TD]Crude oil inventories (weekly change)

[/TD]

[TD="class: actual_consensus_box_numbers"]0.3 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"]-0.2 M barrels

[/TD]

[/TR]

[TR]

[TD]Gasoline (weekly change)

[/TD]

[TD="class: actual_consensus_box_numbers"]1.6 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"]0.4 M barrels

[/TD]

[/TR]

[TR]

[TD]Distillates (weekly change)

[/TD]

[TD="class: actual_consensus_box_numbers"]1.2 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"]-2.9 M barrels

[/TD]

[/TR]

[/TABLE]

Economic Calendar - Bloomberg

EIA Petroleum Status Report[TABLE="class: actual_consensus_box"]

[TR]

[TD]Crude oil inventories (weekly change)

[/TD]

[TD="class: actual_consensus_box_numbers"]0.3 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"]-0.2 M barrels

[/TD]

[/TR]

[TR]

[TD]Gasoline (weekly change)

[/TD]

[TD="class: actual_consensus_box_numbers"]1.6 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"]0.4 M barrels

[/TD]

[/TR]

[TR]

[TD]Distillates (weekly change)

[/TD]

[TD="class: actual_consensus_box_numbers"]1.2 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"]-2.9 M barrels

[/TD]

[/TR]

[/TABLE]

Economic Calendar - Bloomberg

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

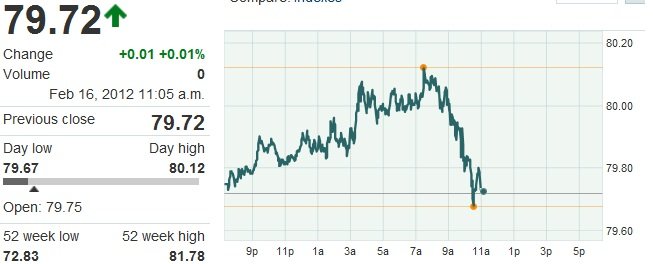

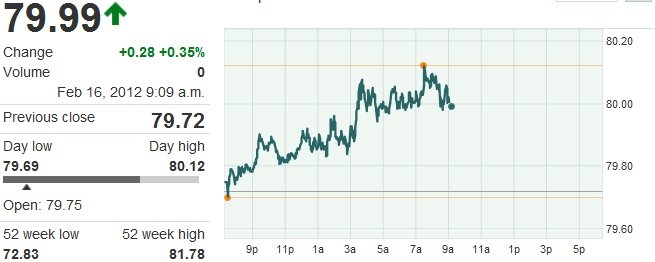

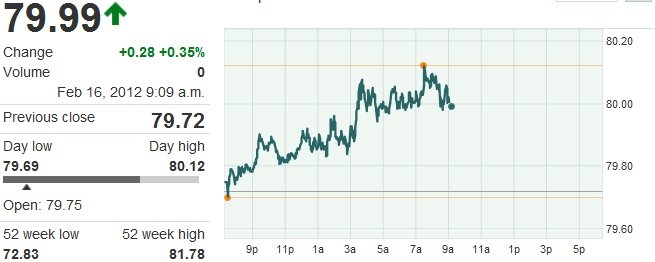

The Dollar is holding back the Markets today! U.S. Dollar Index (DXY), DXY Index Quote - (NYE) DXY, U.S. Dollar Index (DXY) Index Price

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Crude Oil - Electronic (NYMEX) Mar 2012

$101.27 -$0.53 -0.52%

Feb 16, 2012 1:43 p.m.

Crude Oil - Electronic (NYMEX) Mar 2012, CLH2 Future Quote - (NMN) CLH2, Crude Oil - Electronic (NYMEX) Mar 2012 Future Price

$101.27 -$0.53 -0.52%

Feb 16, 2012 1:43 p.m.

Crude Oil - Electronic (NYMEX) Mar 2012, CLH2 Future Quote - (NMN) CLH2, Crude Oil - Electronic (NYMEX) Mar 2012 Future Price

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Feb. 16, 2012, 8:40 a.m. EST

Crude oil pulls back as Iran responds to EU

Futures fall from five-week high

By Clare Hutchison, MarketWatch

LONDON (MarketWatch) — Crude-oil futures pulled back on Thursday, as the dollar strengthened against the euro and media reports said Iran has responded to European Union attempts to resume talks on the country’s nuclear program.

Crude oil pulls back as Iran responds EU - Futures Movers - MarketWatch

Crude oil pulls back as Iran responds to EU

Futures fall from five-week high

By Clare Hutchison, MarketWatch

LONDON (MarketWatch) — Crude-oil futures pulled back on Thursday, as the dollar strengthened against the euro and media reports said Iran has responded to European Union attempts to resume talks on the country’s nuclear program.

Crude oil pulls back as Iran responds EU - Futures Movers - MarketWatch

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Dollar spiking, Markets Down, Oil Down.:nuts:

U.S. Dollar Index (DXY), DXY Index Quote - (NYE) DXY, U.S. Dollar Index (DXY) Index Price

U.S. Dollar Index (DXY), DXY Index Quote - (NYE) DXY, U.S. Dollar Index (DXY) Index Price

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Dollar has turned around to the down side, this is good but who knows how it will end up at close.

U.S. Dollar Index (DXY), DXY Index Quote - (NYE) DXY, U.S. Dollar Index (DXY) Index Price

U.S. Dollar Index (DXY), DXY Index Quote - (NYE) DXY, U.S. Dollar Index (DXY) Index Price

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Not quite.:blink:

Crude Oil - Electronic (NYMEX) Mar 2012

$101.75 -$0.08 -0.08%

Feb 16, 2012 4:22 p.m.

Crude Oil - Electronic (NYMEX) Mar 2012, CLH2 Future Quote - (NMN) CLH2, Crude Oil - Electronic (NYMEX) Mar 2012 Future Price

Crude Oil - Electronic (NYMEX) Mar 2012

$101.75 -$0.08 -0.08%

Feb 16, 2012 4:22 p.m.

Crude Oil - Electronic (NYMEX) Mar 2012, CLH2 Future Quote - (NMN) CLH2, Crude Oil - Electronic (NYMEX) Mar 2012 Future Price

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Feb. 16, 2012, 1:40 p.m. EST

Oil at six-week high on positive data

Natural gas rallies on larger-than-expected supply draw

Oil at six-week high on positive data - Futures Movers - MarketWatch

Oil at six-week high on positive data

Natural gas rallies on larger-than-expected supply draw

Oil at six-week high on positive data - Futures Movers - MarketWatch