-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Oil Slick Stuff

- Thread starter nnuut

- Start date

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Just paid $4.29 at Costco yesterday. They have the cheapest on the west side of the BI.

RealMoneyIssues

TSP Legend

- Reaction score

- 101

Just paid $4.29 at Costco yesterday. They have the cheapest on the west side of the BI.

I might ask this again in June when I head there for a week.

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

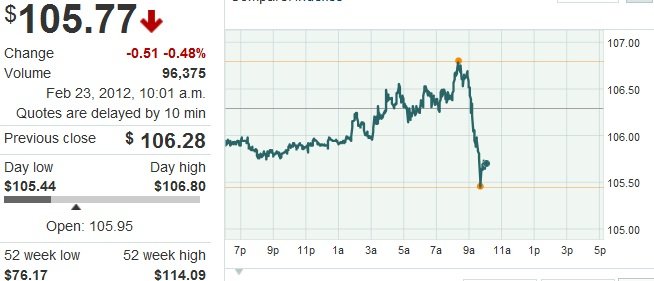

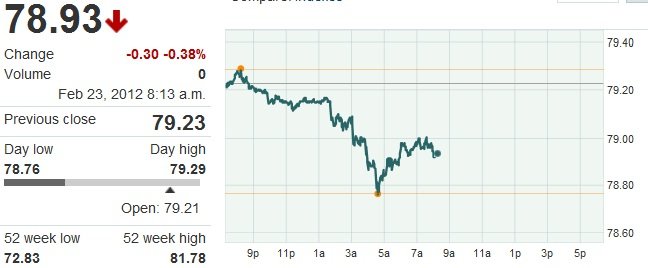

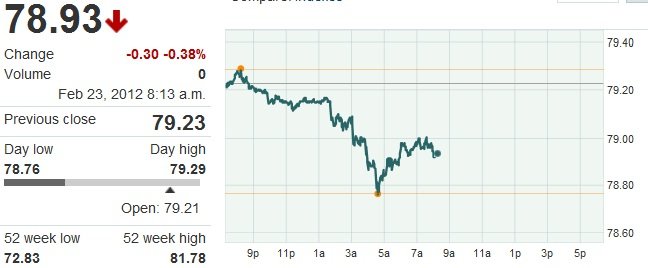

Dollar down this morning, you should know what that means by now.

U.S. Dollar Index (DXY), DXY Index Quote - (NYE) DXY, U.S. Dollar Index (DXY) Index Price

U.S. Dollar Index (DXY), DXY Index Quote - (NYE) DXY, U.S. Dollar Index (DXY) Index Price

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

konakathy

Market Veteran

- Reaction score

- 41

I might ask this again in June when I head there for a week.

Dude! Start saving your pennies, it's not cheap over here.

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

RealMoneyIssues

TSP Legend

- Reaction score

- 101

Dude! Start saving your pennies, it's not cheap over here..... but, who cares, you're in Hawaii !!!

True, a week in Kona and a week on Oahu, then back to reality

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

[TABLE="class: tablewrapper"]

[TR]

[TD="class: econo-reportname, colspan: 2"]EIA Petroleum Status Report

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]

[TD="class: econo-releaseinfo"]Released On 2/23/2012 11:00:00 AM For wk2/17, 2012

[/TD]

[TD="class: actual_consensus_box_numbers"]-0.2 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"] 1.6 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"]0.4 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"] -0.6 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"]-2.9 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"] -0.2 M barrels

[/TD]

[/TD]

[/TR]

[/TABLE]

[/TD]

[/TR]

[/TABLE]

With supplies of curde up and gas down it shouldn't effect price much. The dollar is controlling the Market today.

Economic Calendar - Bloomberg

[TR]

[TD="class: econo-reportname, colspan: 2"]EIA Petroleum Status Report

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]

[TABLE="class: actual_consensus_box"] [TR="class: actual_consensus_toprow"] [TD] | Prior | Actual |

| Crude oil inventories (weekly change) | ||

| Gasoline (weekly change) | ||

| Distillates (weekly change) |

[TD="class: econo-releaseinfo"]Released On 2/23/2012 11:00:00 AM For wk2/17, 2012

[/TD]

[TD="class: actual_consensus_box_numbers"]-0.2 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"] 1.6 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"]0.4 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"] -0.6 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"]-2.9 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"] -0.2 M barrels

[/TD]

[/TR]

[/TABLE]

[/TD]

[/TR]

[/TABLE]

With supplies of curde up and gas down it shouldn't effect price much. The dollar is controlling the Market today.

Economic Calendar - Bloomberg

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

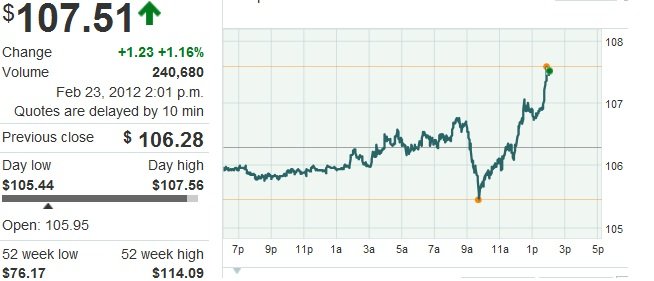

How do you like these Bananas?

Crude Oil - Electronic (NYMEX) Apr 2012, CLJ2 Future Quote - (NMN) CLJ2, Crude Oil - Electronic (NYMEX) Apr 2012 Future Price

This isn't supply talking here.

Crude Oil - Electronic (NYMEX) Apr 2012, CLJ2 Future Quote - (NMN) CLJ2, Crude Oil - Electronic (NYMEX) Apr 2012 Future Price

This isn't supply talking here.

RealMoneyIssues

TSP Legend

- Reaction score

- 101

How do you like these Bananas?

Sounds like more stocks are going to skyrocket. Time for me to break out my bike.

SPX-1400 or Bust !!

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

There is a point when the price of oil and gas crash the Markets.Sounds like more stocks are going to skyrocket. Time for me to break out my bike.

SPX-1400 or Bust !!

RealMoneyIssues

TSP Legend

- Reaction score

- 101

There is a point when the price of oil and gas crash the Markets.

Nope, we are use to these high prices. Now that they have consolidated at $3.50 for so long (doubled in 2 years), they will head up and will now probably level off around 4.25-4.50 for about a 6-9 months, then do it again for $5.50 by next spring...

It is going to be some great earnings quarters as energy stocks report fantastic earnings, causing their stocks to go up. Other transportation costs will be passed on (to the consumer, and like good sheep, pay it) and those stocks will go up. Add that to QE 2.5 and QE3 (probably going on now) and we have a huge up year for 2012 and 17k DJIA by the end of 2013.

It's written in the stars !!

RealMoneyIssues

TSP Legend

- Reaction score

- 101

Do Ya really thinkso? I'll remember that.

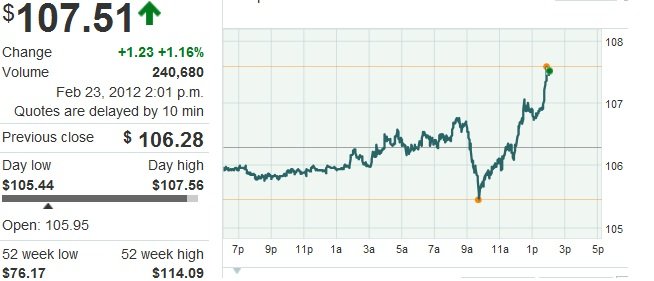

Crude just hit $108 and $110 is right around the corner... tomorrow?

James48843

TSP Talk Royalty

- Reaction score

- 905

Do Ya really thinkso? I'll remember that.

Futures markets showing April gasoline prices climbing much higher than current levels.

And BP today at $ 47.87 a share,

Exxon-Mobil now trading at $ 87.02 a share.

Yep- Oil companies dancing up and down over their windfall.

RealMoneyIssues

TSP Legend

- Reaction score

- 101

Yep- Oil companies dancing up and down over their windfall.

Was THAT your point earlier?