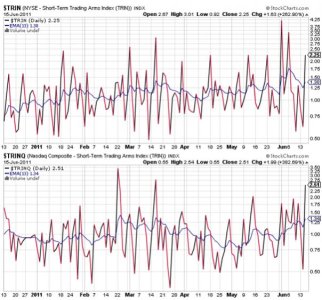

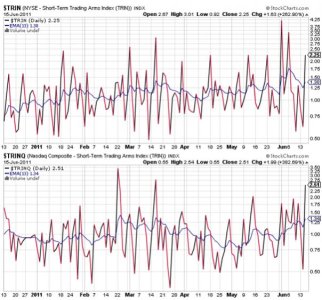

Well, I wasn't surprised that we saw some selling pressure today as I did point out in yesterday's blog that TRIN and TRINQ were both suggesting an overbought market, which means a pullback is likely. But after such a strong rally on what appeared to be a possible key reversal day I certainly didn't think we'd see the market take out Monday's lows so soon. Especially given that market character had typically seen a market run in one direction for days at a time on an initial burst of strength (or weakness depending on the type of reversal). But then, QE2 was far from complete during those days. Now it's just a couple of weeks from ending, with no read on where the Fed goes from there. And the Eurozone isn't helping, nor our own economic data. But given the bearish sentiment, bearish data could eventually set the table for a significant rally. Apparently, we aren't there yet.

But it's just one day, and OPEX can be a volatile week.

In any event, today's action dropped the S&P 500 to a three month low and it's now with spitting distance of its 200-day moving average. And it's about 8% down from it's May high.

So what's the excuse for the selling this time? Nothing new really, just more concern over fiscal instability and social unrest in Greece. The Euro got hammered as a result and if you hadn't noticed, the I fund really took a beating as the dollar rallied in large measure on the Euro's weakness.

On the domestic front, the May CPI reading showed a 0.2% increase, which was just a bit higher than economists expectations, while core CPI was up 0.3%, which was also higher than expected.

June's Empire Manufacturing Survey came in at -7.8, which was much lower than the 10.0 that economists were looking for. Also, May industrial production increased a 0.1%, which once again was lower than estimates.

Treasuries bounced back on today's rout of equities, which saw the yield on the 10-year Note drop back below 3.00%.

Back to sells for NAMO and NYMO. The good news is that they didn't tag new lows.

NAHL and NYHL also flipped back to sells.

Yesterday, TRIN and TRINQ predicted selling pressure due to an overbought condition. Today, they are both saying we're oversold, which (if we're still in a bull market) should translate into another rally very soon.

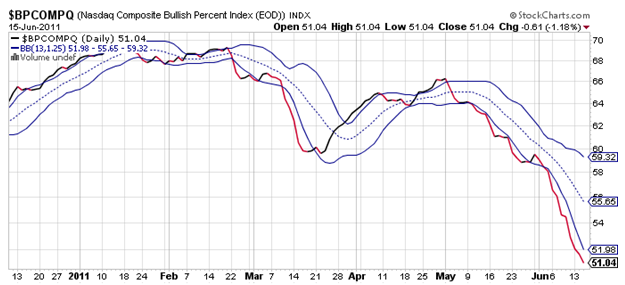

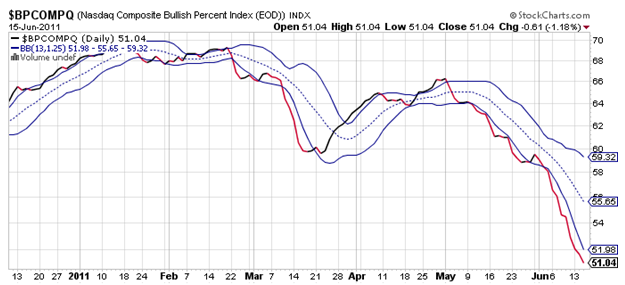

No relief for the bulls here. BPCOMPQ continues its slide and remains on a sell.

So after seeing 6 buy signals yesterday, all signals have now flipped back to sells, but the system remains in a sell condition regardless.

I'm not backing off my expectation from yesterday's blog comments just yet. Today was a big curve ball, no doubt, but I'm still thinking the low comes very soon and some measure of a rally will materialize. That's my pre-FOMC announcement outlook. What happens after that is anyone's guess right now.

But it's just one day, and OPEX can be a volatile week.

In any event, today's action dropped the S&P 500 to a three month low and it's now with spitting distance of its 200-day moving average. And it's about 8% down from it's May high.

So what's the excuse for the selling this time? Nothing new really, just more concern over fiscal instability and social unrest in Greece. The Euro got hammered as a result and if you hadn't noticed, the I fund really took a beating as the dollar rallied in large measure on the Euro's weakness.

On the domestic front, the May CPI reading showed a 0.2% increase, which was just a bit higher than economists expectations, while core CPI was up 0.3%, which was also higher than expected.

June's Empire Manufacturing Survey came in at -7.8, which was much lower than the 10.0 that economists were looking for. Also, May industrial production increased a 0.1%, which once again was lower than estimates.

Treasuries bounced back on today's rout of equities, which saw the yield on the 10-year Note drop back below 3.00%.

Back to sells for NAMO and NYMO. The good news is that they didn't tag new lows.

NAHL and NYHL also flipped back to sells.

Yesterday, TRIN and TRINQ predicted selling pressure due to an overbought condition. Today, they are both saying we're oversold, which (if we're still in a bull market) should translate into another rally very soon.

No relief for the bulls here. BPCOMPQ continues its slide and remains on a sell.

So after seeing 6 buy signals yesterday, all signals have now flipped back to sells, but the system remains in a sell condition regardless.

I'm not backing off my expectation from yesterday's blog comments just yet. Today was a big curve ball, no doubt, but I'm still thinking the low comes very soon and some measure of a rally will materialize. That's my pre-FOMC announcement outlook. What happens after that is anyone's guess right now.