Another big volume day, buy only modest gains to show for it (I fund was down slightly). Still, resilience continues to be the theme for a market seemingly bent on moving ever higher.

Market data released today included weekly initial jobless claims, which were higher than expected at 484,000, while continuing claims also surprised to the upside coming in at 4.64 million. March industrial production only rose 0.1% (lower than expected), while capacity utilization came in at 73.2% (close to being in-line with expectations). The Empire State Manufacturing Survey came in higher at 31.9, while the Philadelphia Fed Survey posted a 20.2 (better than forecast).

The dollar gained 0.4%, which kept the I fund in the red at the close, while C and S posted very modest gains.

Let's look at today's charts:

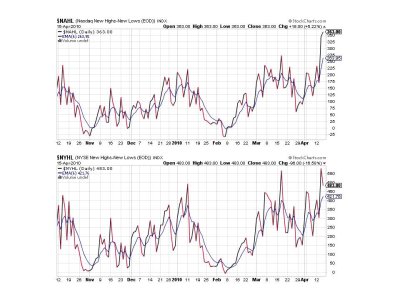

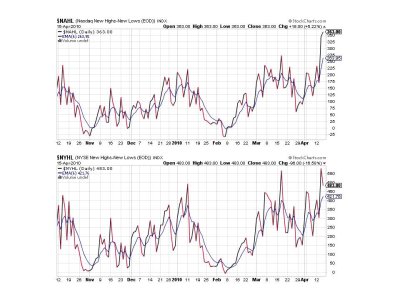

Still on a buy for both NAMO and NYMO.

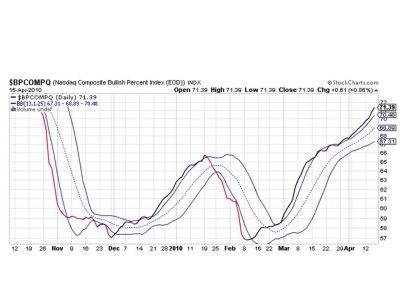

Still looking very good here.

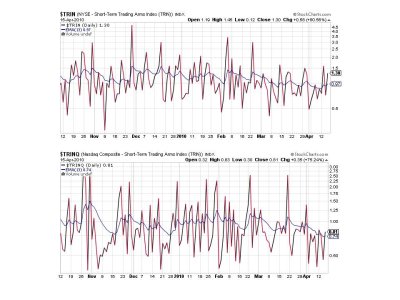

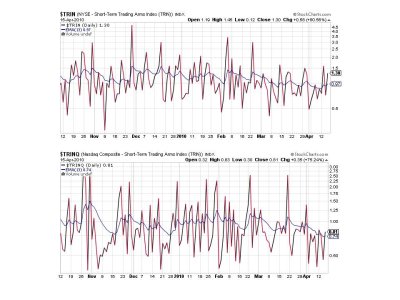

Both TRIN and TRINQ flipped to sells.

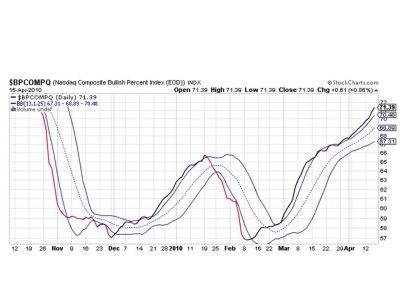

Up again. Still looks bullish.

So 5 of 7 signals remain on a buy, which keeps the system on a buy. The charts continue to look bullish and I don't see any sign of a possible reversal yet. That's it for this evening, see you tomorrow.

Market data released today included weekly initial jobless claims, which were higher than expected at 484,000, while continuing claims also surprised to the upside coming in at 4.64 million. March industrial production only rose 0.1% (lower than expected), while capacity utilization came in at 73.2% (close to being in-line with expectations). The Empire State Manufacturing Survey came in higher at 31.9, while the Philadelphia Fed Survey posted a 20.2 (better than forecast).

The dollar gained 0.4%, which kept the I fund in the red at the close, while C and S posted very modest gains.

Let's look at today's charts:

Still on a buy for both NAMO and NYMO.

Still looking very good here.

Both TRIN and TRINQ flipped to sells.

Up again. Still looks bullish.

So 5 of 7 signals remain on a buy, which keeps the system on a buy. The charts continue to look bullish and I don't see any sign of a possible reversal yet. That's it for this evening, see you tomorrow.