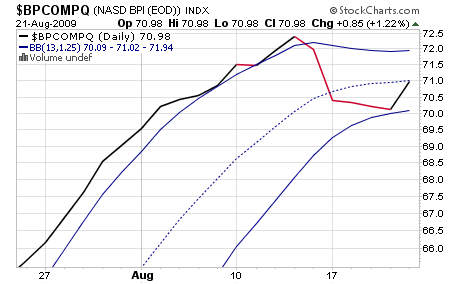

After four straight days of upward momentum and a break through resistance on the S&P Friday, the SS still remains on a sell, although it's trying to issue another buy signal. Six of the signals remain on a buy, but $BPCOMPQ remains the sole indicator on a sell.

The signal did curl up off the lower bollinger band, but it's going to take more strength to push back into buy territory.

Now that OPEX is over, we get to see if things change. I'm expecting some selling this coming week, but not necessarily enough to do any damage to the trend. But I think there will be enough selling pressure in the coming days to prevent a full buy signal on the SS.

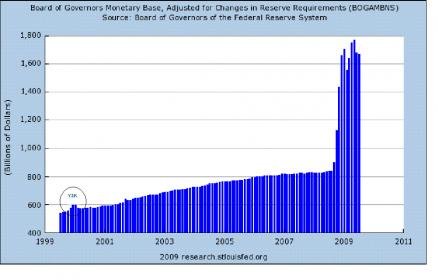

It's too early to say that the last sell signal will be trumped early. I think all of these signals are valid, but the underlying strength in the market is a direct result of massive liquidity being pumped into the system. This is not a good thing. Far from it in fact. There are plenty of pitfalls in front of this market, and many of them will not be resolved any time soon.

This is a scary chart. Just wait till they try to recover that liquidity.

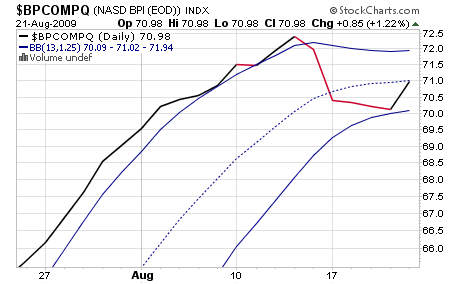

The signal did curl up off the lower bollinger band, but it's going to take more strength to push back into buy territory.

Now that OPEX is over, we get to see if things change. I'm expecting some selling this coming week, but not necessarily enough to do any damage to the trend. But I think there will be enough selling pressure in the coming days to prevent a full buy signal on the SS.

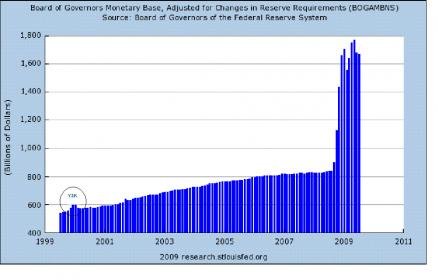

It's too early to say that the last sell signal will be trumped early. I think all of these signals are valid, but the underlying strength in the market is a direct result of massive liquidity being pumped into the system. This is not a good thing. Far from it in fact. There are plenty of pitfalls in front of this market, and many of them will not be resolved any time soon.

This is a scary chart. Just wait till they try to recover that liquidity.