-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

nasa1974's Account Talk

- Thread starter nasa1974

- Start date

- Reaction score

- 815

The roller coaster ride was somewhat enjoyable yesterday until I got to the top of the last hill. That drop was so steep I had to hang on for dear life because my sticky pants failed. Good thing I was wearing my depends.

The good news I guess is at least I finished the day in the green. Woo! Hoo! Just less than 50 bucks. Green is green, right? I don't want to talk about Tuesday.

The good news I guess is at least I finished the day in the green. Woo! Hoo! Just less than 50 bucks. Green is green, right? I don't want to talk about Tuesday.

felixthecat

Analyst

- Reaction score

- 41

- AutoTracker

The roller coaster ride was somewhat enjoyable yesterday until I got to the top of the last hill. That drop was so steep I had to hang on for dear life because my sticky pants failed. Good thing I was wearing my depends.

The good news I guess is at least I finished the day in the green. Woo! Hoo! Just less than 50 bucks. Green is green, right? I don't want to talk about Tuesday.

Well, not saying anything about Tuesday or today.

- Reaction score

- 815

Well, not saying anything about Tuesday or today. 濫冷

Agreed. :banghead:

tonyarante

First Allocation

- Reaction score

- 0

tonyarante

First Allocation

- Reaction score

- 0

Epic

TSP Pro

- Reaction score

- 365

So, Monday the "S" fund gained 0.17% and Tuesday it lost 0.17%. That came to a negative $13.06 for my account. :suspicious:

Expenses maybe ? ? ? :dunno:

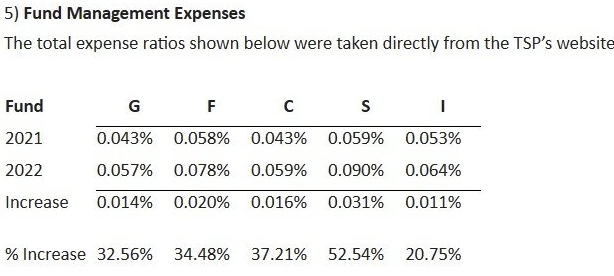

"Historically, the TSP has touted its low expenses. That’s no longer the case. Look at the C fund. The most-recent total expense ratio for the C fund is 5.9 basis points. The same S&P 500 index fund at Fidelity has a cost of 1.5 basis points and at Charles Schwab, it’s 2.0 basis points. How can the FRTIB continue to tout low operational expenses in the literature? The C Funds’ cost burden is nearly triple that of Charles Schwab’s S&P 500 Index Fund (SWPPX) and almost FOUR times higher than Fidelity’s similar fund (FXAIX).

The total expense ratio for the S Fund increased by more than 50%! Unconscionable."

from >>> https://www.barfieldfinancial.com/n...-thrift-investment-board-from-dan-jamison-cpa

- Reaction score

- 2,415

So, Monday the "S" fund gained 0.17% and Tuesday it lost 0.17%. That came to a negative $13.06 for my account. :suspicious:

It's compounding. As an extreme example, if you were up 50% one day and down 50% the next, you wouldn't be even (0%). You would be down 25%.

Start with $100

After 50% loss on day 1 = $50

After 50% gain ($25) on day 2 = $75

- Reaction score

- 815

I really have to look into moving my TSP into my personal IRA. I have to do it for sure next summer, but I don't think I'll wait. I was hoping to recover some of my losses from 2022 but I think I'm fooling myself since I didn't think about the "C" or "I" funds. Up until 2022 I would best my personal IRA by about 10%.

- Reaction score

- 815

So, do we finish out the week on a positive note?

This isn't very scientific since I am making an observation about the "S" fund.

Out of the 18 Friday's this year 11 have been positive and 7 have been negative. All 4 Fridays in January were positive, and all 4 Fridays in February were negative. March had 3 positive and 2 negative Fridays. April was 3 positive and 1 negative. So far May has one positive.

My magic 8 ball and Ouija board are no help.

So, how do we finish out the second week in May? I guess we will know by 4pm today.

This isn't very scientific since I am making an observation about the "S" fund.

Out of the 18 Friday's this year 11 have been positive and 7 have been negative. All 4 Fridays in January were positive, and all 4 Fridays in February were negative. March had 3 positive and 2 negative Fridays. April was 3 positive and 1 negative. So far May has one positive.

My magic 8 ball and Ouija board are no help.

So, how do we finish out the second week in May? I guess we will know by 4pm today.

WorkFE

TSP Legend

- Reaction score

- 513

So, how do we finish out the second week in May? I guess we will know by 4pm today.

61% Positive

39% Negative

I like the odds; I just don't like that we will most likely just break even for the week overall.

WorkFE

TSP Legend

- Reaction score

- 513

Very depressing.

I am anticipating a slow grind for the foreseeable future.

I suspect this is the norm until they figure out DEBT Ceiling/Budget. But even then layoffs are still occurring, banks failures are news, rise in barrowing cost etc. etc. etc.

These things are not going away any time soon.

I suppose one good piece of news is that IMF expects growth in the USA to be 1.6%. Thats better than Canada, UK, Italy, Japan, Germany and France.

I am anticipating a slow grind for the foreseeable future.

I suspect this is the norm until they figure out DEBT Ceiling/Budget. But even then layoffs are still occurring, banks failures are news, rise in barrowing cost etc. etc. etc.

These things are not going away any time soon.

I suppose one good piece of news is that IMF expects growth in the USA to be 1.6%. Thats better than Canada, UK, Italy, Japan, Germany and France.