nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Where is the LIA?Facts, not opinions:

World experienced hottest June on record in 2019, says US agency

https://www.bbc.com/news/world-us-canada-49040058

Climate Change: How Do We Know?

https://climate.nasa.gov/evidence/

View attachment 44620

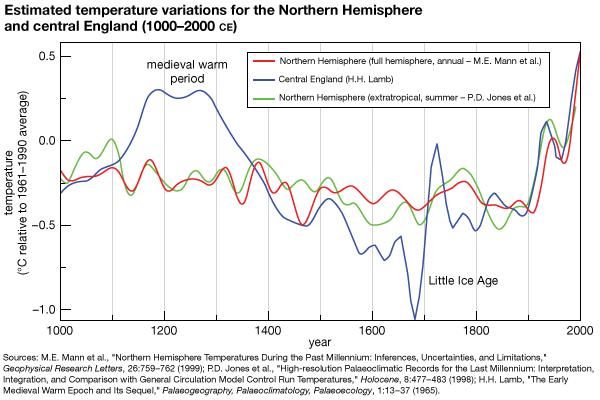

Little Ice Age (LIA), climate interval that occurred from the early 14th century through the mid-19th century, when mountain glaciers expanded at several locations, including the European Alps, New Zealand, Alaska, and the southern Andes, and mean annual temperatures across the Northern Hemisphere declined by 0.6 °C (1.1 °F) relative to the average temperature between 1000 and 2000 CE. The term Little Ice Age was introduced to the scientific literature by Dutch-born American geologist F.E. Matthes in 1939. Originally the phrase was used to refer to Earth’s most recent 4,000-year period of mountain-glacier expansion and retreat. Today some scientists use it to distinguish only the period 1500–1850, when mountain glaciers expanded to their greatest extent, but the phrase is more commonly applied to the broader period 1300–1850. The Little Ice Age followed the Medieval Warming Period (roughly 900–1300 CE) and preceded the present period of warming that began in the late 19th and early 20th centuries.[more]

https://www.britannica.com/science/Little-Ice-Age