MrJohnRoss

Market Veteran

- Reaction score

- 58

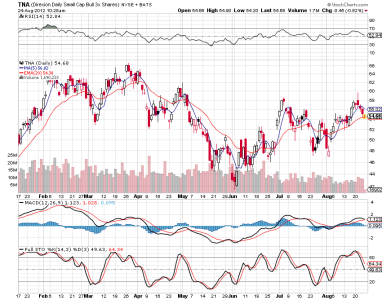

Still trying to develop the TNA/TZA timing system, which uses a combination of a fairly simple spreadsheet, and technical analysis charting.

Reviewing the last trade, I got in a day early (see green up arrow). I only used the spreadsheet signal, and should have waited for the chart to confirm. Lesson learned.

The sell signal was confirmed by both methods, and produced a sell signal at nearly the exact top (see red down arrow).

It was at this point that a brave person (obviously not me) would have bought TZA for the down cycle.

Here's what TZA has done since that signal:

8/20: 16.39

8/21: 16.42

8/22: 16.64

8/23: 16.98

That's obviously an uptrend, and would have produced a nice little 3.6% gain so far this week. Again, lesson learned.

I plan to continue to post my moves here, in case anyone is interested. Hopefully this information is helpful to some of you.

Not sure where all of this is leading. Let's see how this plays out for the rest of the year, and then perhaps, if it performs well, I can expand this to a wider audience.

Just realize that even if the system has a success rate of 70-80%, that means 20-30% of the trades will lose money.

Any suggestions or comments are appreciated.

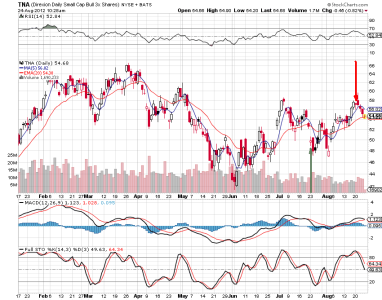

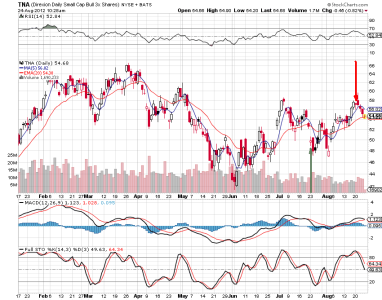

Reviewing the last trade, I got in a day early (see green up arrow). I only used the spreadsheet signal, and should have waited for the chart to confirm. Lesson learned.

The sell signal was confirmed by both methods, and produced a sell signal at nearly the exact top (see red down arrow).

It was at this point that a brave person (obviously not me) would have bought TZA for the down cycle.

Here's what TZA has done since that signal:

8/20: 16.39

8/21: 16.42

8/22: 16.64

8/23: 16.98

That's obviously an uptrend, and would have produced a nice little 3.6% gain so far this week. Again, lesson learned.

I plan to continue to post my moves here, in case anyone is interested. Hopefully this information is helpful to some of you.

Not sure where all of this is leading. Let's see how this plays out for the rest of the year, and then perhaps, if it performs well, I can expand this to a wider audience.

Just realize that even if the system has a success rate of 70-80%, that means 20-30% of the trades will lose money.

Any suggestions or comments are appreciated.

Attachments

Last edited: