MrJohnRoss

Market Veteran

- Reaction score

- 58

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

How Low Can Apple Go? / CNN Money

"... Apple's revenues grew nearly twice as fast as Amazon's last year. But Apple's stock is trading this week at less than 14.3 times earning. If it were trading, as Amazon does, at 190 times earnings, it would selling for more than $7,800 a share. ..."

As I've said before, as AAPL goes, so goes the market.

Short term, with no other factors (US economy, Eurozone Woes, etc) you are probably right; however, a single stock, no matter how important people feel their products are (oh, and how much CNBC hypes it), "controls" the market.

By the way... Happy Star Wars Day everyone!

May the 4th be with you! :laugh:

Futures down about 150 tonight. Looks like I'll be headed to the lily pad on Monday morning...

At least you will have some gains left still...I'll be headed to negative territory once again. I'm about to throw the towel in on the stock market. I am not positive overall since I started my TSP that's for sure and every move I make in my brokerage account seems to be wrong as well. I make all of the wrong moves time after time and I think I would "make more" by making nothing (or a measly .75% interest rate of a savings account).

Obviously I'm frustrated because I can't get anything to do with stocks correct.

Hang in there. I've been there, done that as well. You will improve as you learn. Not that I'm doing great this year (I like to add "yet" to that because I think I will do better as the year progresses). The one thing I've learned is you have to have a goal or goals and a "system" -- and stick to it as best you can. In my view, it doesn't have to be based on detailed TA or lots of indicators. A simple goal is to not lose money -- that tends to make you conservative and possibly miss big runs like I did December through April, but -- on the upside -- you'll avoid some if not most of the dives as well. I get into trouble when I stray off course and make IFTs based on information that isn't part of my normal basic rule set. ... Having said all that, I feel like I should let you know that I'm not killing it, but I'm doing consistently better than I had in the past by either "holding" or making IFTs on a whim or whatever info struck a chord with me. ... One thing you might try is keeping most of your money in one of the Life Strategy funds and playing with only a small percentage of it while you're figuring what works best for you personally. Good luck!

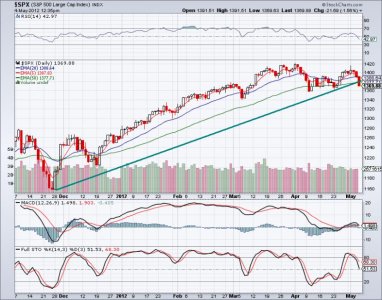

It appears to me that the market is trying to decide which direction it wants to go. There's a lot of turmoil in the markets, but very little upside or downside bias at this point (although if I had to guess, I'd say we're headed in the down direction). I'm going to elect to hold tight to my long positions at this time, and see what the next day or two brings. There's a good possibility that we are in a "oversold" condition, and the likelyhood of a decent rally seems very plausible.

MaStA, the market is one hell of a monster to try to figure out. I recommend trying to leave your emotions out of it (very hard to do, I know), and use every trading opportunity as a learning lesson. Use a journal to keep track of your trades, why you made them, and how you plan to avoid certain mistakes again. Over time, I think you'll become a much better trader, and you'll be amazed at how good you'll become.

Best of luck everyone!