RealMoneyIssues

TSP Legend

- Reaction score

- 101

That's right! So we better start partying like it's 1999!

Mai Tai's, Blue Hawaiians and brewski's on me!y'all come on over.

See you in June

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

That's right! So we better start partying like it's 1999!

Mai Tai's, Blue Hawaiians and brewski's on me!y'all come on over.

That's right! So we better start partying like it's 1999!

Mai Tai's, Blue Hawaiians and brewski's on me!y'all come on over.

I would be surprised if we got any kind of rally tomorrow, but as Tom has shown, the Thursday before Good Friday has typically been a strong day. We'll have to wait and see which force wins out.

View attachment 18493

Of course you are correct. Taking tomorrow off from work, and I've lost all track of the days. Must be from lack of donuts. Mmmmmmm donuts!

Hey, thanx for the nice read from Porter Stansberry I enjoyed it.

This is a chilling article, if you're brave enough to read it...

The Money Masters Are Living In Fear

"The S&P 500 has risen every April for the past five years. The index has returned an average of 4.5% in April over the same period, making it the best month for the market by far." Sure glad I'm scared to death of the lily pad and the F fund.

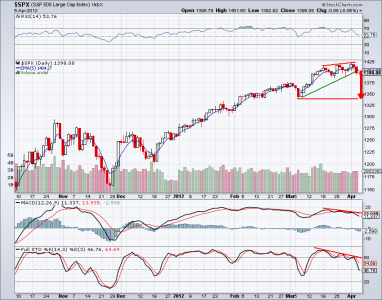

The Indicator That's Predicted Every Single Rally Leg in 2012 May Be the Key to Predicting a Market Top

"Wall Street tends to inundate us with the kind of complex analyst-crafted research that makes us "simple folks" believe that investing should be left up to the "pros."

But KIS (Keep it simple) isn't dead and there's one deceptively easy-to-understand indicator that's identified the beginning of every rally leg since 2012 began.

This little-known indicator not only provides buy signals, it also - and in the current market condition, more importantly – reveals when up side momentum is broken."

That's the ETF monitor. I'm guessing you do not subscribe since you are in the G fund and they called for a buy last week. If you are, congratulations, a friend of mine is a day trader and he swears that they are accurate the majority of the time.

Agreed. Good test of the 50 dma and a good place to buy if you have dry powder IMO.You may be three weeks to late - we could see the bottom today.

You may be three weeks to late - we could see the bottom today.