felixthecat

TSP Analyst

- Reaction score

- 41

- AutoTracker

Oh my, the F fund took some punishment. Compared to C/S...that is a hit (not in a good way either). Thanks for the update. G Fund are the winners today. Congrats.

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

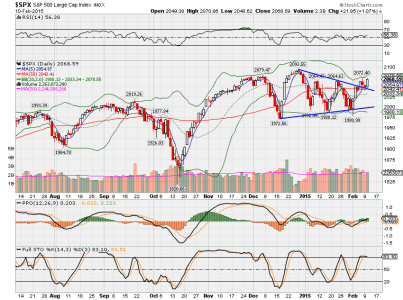

oh...oh...thats exactly what I did today!!!Relative Strength graph of the S&P 500 vs EFA (C Fund vs I Fund):

View attachment 32347

I cleaned up this graph because there were too many ancillary indicators that were causing some confusion. Hopefully this view is a little easier to read.

As you can see from the graph, the C Fund has been outperforming the I Fund most of last year, since the trendline is going from the lower left to the upper right. This trend peaked in early January, and the tides turned in favor of the I Fund.

However, now the lower sloping trendline has been broken by the C Fund, which is appearing to regain it's strength. Today's weakness in the I Fund really shows up in the graph at the far right, as the line moves higher, showing C Fund strength.

I believe it remains to be seen if this is going to be a long lasting trend change, or if this is just a bump on the road back down. To make an IFT from the I Fund to either C or S may backfire if the trend changes again. And with this skittish market, I'm going to sit tight until I see more evidence that it's time to transfer funds.

oh...oh...thats exactly what I did today!!!

I believe it remains to be seen if this is going to be a long lasting trend change, or if this is just a bump on the road back down. To make an IFT from the I Fund to either C or S may backfire if the trend changes again. And with this skittish market, I'm going to sit tight until I see more evidence that it's time to transfer funds.

when the dollar breaks, CSI breaks, a deep bear market begins and not one of us will have a safe place to hide our money...

That makes me feel better. I made a last minute reallocation because C fund was looking like it has room for upward movement and the "I" fund makes me nervous. I can see where it could go up (Weekly Slow Stochastic has upward slope), but everything is soooo volatile right now. Wish I would have exited Thursday... But on to the next campaign!!No worries, you may have made the correct move. I'm going to hold an a longer, just to be sure.

No risk, no reward, sometimes you gotta put it out there to reel in the big fish.

From my perspective, if the ECB injects liquidity, it's great for EFA, but at the same time it cheapens the EURO, much was the case of our QEs. How this balances out for the I-Fund remains to be seen. At the same time, Japan's interest in a weak YEN further strengthens the U.S dollar in relation to the increased profit margin of Japan's auto industry.

The million dollar question is what does the Fed do with the dollar, we clearly aren't defending it, but at some point in time, we'll need to reel it back in. It is at this point in time I'll have concerns for the American markets, and if the American markets lead the world markets, then what does this mean for all of us?

Under my disillusioned thought process, when the dollar breaks, CSI breaks, a deep bear market begins and not one of us will have a safe place to hide our money...

No risk, no reward, sometimes you gotta put it out there to reel in the big fish.

From my perspective, if the ECB injects liquidity, it's great for EFA, but at the same time it cheapens the EURO, much was the case of our QEs. How this balances out for the I-Fund remains to be seen. At the same time, Japan's interest in a weak YEN further strengthens the U.S dollar in relation to the increased profit margin of Japan's auto industry.

The million dollar question is what does the Fed do with the dollar, we clearly aren't defending it, but at some point in time, we'll need to reel it back in. It is at this point in time I'll have concerns for the American markets, and if the American markets lead the world markets, then what does this mean for all of us?

Under my disillusioned thought process, when the dollar breaks, CSI breaks, a deep bear market begins and not one of us will have a safe place to hide our money...

There is another fly in the ointment, the Feds have talked about raising interest rates sometime this summer. As long as the ECB can pull off their magic trick, raising rates here will make the overseas market look a little more inviting even if the dollar stays balanced to the Euro and the Yen.

Please help me understand. Why would raising interests rates here make oversees markets a little more inviting with the dollar in balance with Euro and Yen? Would it be because the stocks or bond values here would drop?There is another fly in the ointment, the Feds have talked about raising interest rates sometime this summer. As long as the ECB can pull off their magic trick, raising rates here will make the overseas market look a little more inviting even if the dollar stays balanced to the Euro and the Yen.

Yep...that's all we can do. There are so many moving parts I'm not even sure of which parts to look at or rely on to make a decision. This years seems much tougher!Perhaps this is the case, truth is there are so many moving parts here, that by the time I figure out what's going on, the move is over and we're moving over to the next "big thing." But none of this is really a concern of mine, I'll trade what I see and make the best of whatever situation we're handed.

Shoulda woulda coulda taken advice from my 3rd grade self, and sold at the top of the box. Today looks like we're gonna head back down for another re-test.

Sheesh.

Shoulda woulda coulda taken advice from my 3rd grade self, and sold at the top of the box. Today looks like we're gonna head back down for another re-test.

Sheesh.

:trink26:

Been there...done that...got the negative returns to prove it...

No worries, you aren't wrong until you make the wrong move. We should be happy a 3rd grader can identify a trading range which has 5 hits on the bottom, with 3 on top, making it fairly easy to exhaust the sellers before we get to the top of the trading range. To boot, nobody seems to care that this was the lowest volume we've had in 20 days, hinting at a lack of conviction.

In the back of my mind, I'm thinking that if this market breaks to the upside, I'm already in, but if breaks to the downside, this narrow trading range isn't going to make much difference if I need to sell. So I'll just hang on a bit longer. But I really have no conviction on which way this market is gonna go. If I had to guess, I'd say down. Perhaps a good 10% correction would get this constipated market cleared up.

Plop plop, fizz fizz, oh what a relief it is.

:Flush: