MrJohnRoss

Market Veteran

- Reaction score

- 58

MJR,

Can you post once you have decided if and when you plan to buy TZA? Thank you.

Waiting for end of day MOSI data. This was the kind of day that I feared would happen, where the markets look like they're rolling over for days, so you jump out, and suddenly you get a big up-tick. *SMDH*.

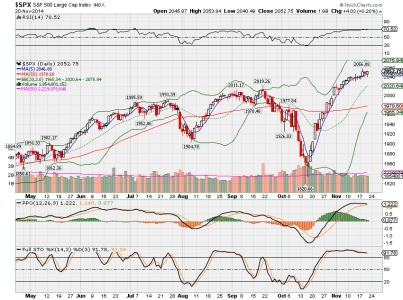

Eh well, I'm thinking this is a short term head-fake rally, as the momentum on most of the indices look to be waning. I certainlly could be wrong. The market is very good at making you look like a fool from time to time, but I don't believe now is the time to jump back in. Looking at the RSI, we're crossing into the danger territory, so it's just a matter of time, IMHO, until we get at least a mild pull-back.

Worst case scenario is some rat-a-tat-tat up and down days (like we had from March thru mid May) that really cause confusion and traders to give up, or at least doubt, their systems. "Trading in a box" is what I call it. Unless you're a day trader, those kind of markets are pretty sucky.

I do love the action in the miners, tho! Dang, GDXJ, NUGT and JNUG are killin' it! It is a bit of a head scratcher, as usually the metals/miners don't perform well when stocks do well, since they're competing for the same dollar. $USD was down slightly, so that could be part of the reason, but I really think the miners were quite simply extremely oversold and due for a big bounce.

Also interesting to see bonds do well today. I thought for sure they'd be down, with the market heading higher.