MrJohnRoss

Market Veteran

- Reaction score

- 58

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

Here's a pic of where I went for Thanksgiving. Big Sur, CA. Very unconventional, but had a wonderful time. The weather was perfect.

View attachment 26156

Did you get a chance to eat at the Lucia Lodge? Great fish and chips.

Just love that area...beautiful. I stayed in Carmel many years ago and had lunch at Mission Ranch. That entire drive along highway 1 down to BigSur is breathtaking!!

NUGT/DUST system generated a switch at Friday's close to NUGT. You may want to wait to confirm the move tomorrow, but the system would have bought at Friday's close at $32.60.

If you held DUST during the entire last trade, you would have netted +20.5% in eight trading days.

URTY/SRTY system continues to hold URTY.

Keep your eye on VXX. We are close to a short term buy there as well.

Well, hopefully you confirmed today's action before switching to NUGT. The PM's are absolutely getting crushed, along with the miners. DUST is up big, and reverses the previous signal, obviously.

For those of you looking to get into gold and/or silver, your opportunity will soon arrive. Look for a double bottom in GLD (around 115) and SLV (around 17.75). Then probably a dead cat bounce. We're almost there.

URTY/SRTY looks like it's going to switch to SRTY. Maybe the market correction is finally going to show it's face? Mr. VIX is beginning to rear his ugly head. VXX looks to be in the beginning stages of a possible move higher, with the Stoch and PPO providing a bullish crossover.

Yee-haw.

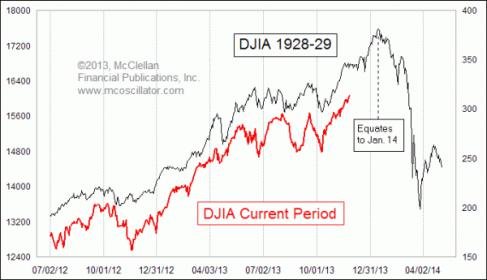

yes Mr Ross.. That is scary ..just when I'm getting up some thoughts of truly jumping all in. :toung:"I recently became aware of a fascinating price pattern analog uncovered by legendary technical analyst Tom DeMark. He figured out that the recent pattern of stock price movements looks a whole lot like the lead-up to the 1929 top." ~ Tom McClellan - The McClellan Market Report

View attachment 26175

Sure caught my eye. Maybe I'll be vigilant around the 14th of January. However, wasn't October the month it crashed back in ought 29? And is the time period July 2012 to Nov 2013, 16 months, the same as the time period, 16 months, during the rise up to the crash? Chart lines can be accordioned, ie, stretched or compressed. Did catch my eye though."I recently became aware of a fascinating price pattern analog uncovered by legendary technical analyst Tom DeMark. He figured out that the recent pattern of stock price movements looks a whole lot like the lead-up to the 1929 top." ~ Tom McClellan - The McClellan Market Report

View attachment 26175

I'm not saying become carefree in January but consider this viewpoint about the chart."I recently became aware of a fascinating price pattern analog uncovered by legendary technical analyst Tom DeMark. He figured out that the recent pattern of stock price movements looks a whole lot like the lead-up to the 1929 top." ~ Tom McClellan - The McClellan Market Report

View attachment 26175

Bounce today?

NUGT/DUST will continue to hold DUST, even though we had a loss today of -8.9%. Not enough to trigger a switch.

GLD and SLV had a very nice bounce off their lows today. This may be a prime time to think about getting into the metals if you don't have any exposure. I think the upside potential is excellent, and the downside is very limited, IMHO.

URTY/SRTY will continue to hold SRTY, with a slight gain today of +0.75%.

VXX fell back -0.77% today, but I would still consider it a hold.

Still waiting for the right time to move back into equities, but I believe we still may have a ways to go. Ideally, I'd like to see the market continue it's slide and work off some of it's froth. The 50 day is at ~1748, so we'd need to sell off about 45 points on the S&P, or about -2.5% just to get back to "average". Would love to see a dip below that before Santa fills our stockings with a nice buying opportunity.

Nugt is approaching it's 52 week low. Might be a good time to buy? Thoughts?