After opening the trading session well into the red it took dip buyers less than 15 minutes to pile back in. In about an hour the broader market was back near the neutral line and from there chopped its way to a mixed close.

I'm not surprised by the dip buying. Many traders who found themselves on the sidelines as this market relentlessly pushed higher were looking for a buying opportunity. Any buying opportunity. And they finally got one today.

Still, the trading was listless overall with little real direction or leadership and volume remained quite thin. That makes me think this market is waiting for something. The President's State of the Union Address is tonight and that's certainly a possible market driver. And the FOMC began its meeting today too. Tomorrow afternoon they'll issue an announcement on their economic policy moving forward. So tomorrow's action could be very interesting.

Overseas, Greece has been making the headlines again as talks between creditors and Pols are seeing friction.

There were no domestic reports released today.

Here's today's charts:

NAMO and NYMO remain near their respective 6 day EMAs and are not providing any clues to short term direction.

NAHL and NYHL both turned lower and are on sells. But only barely.

TRIN is sitting right on its trigger point, while TRINQ is on a sell. Not much help here.

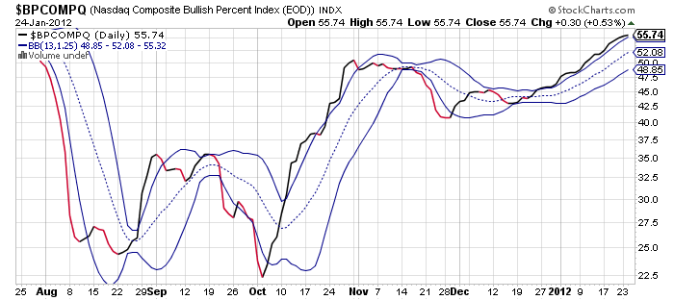

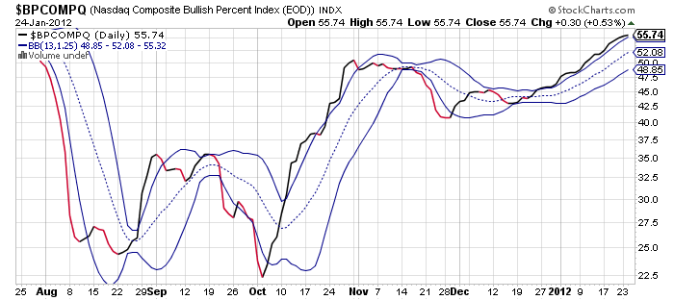

BPCOMPQ tracked sideways again, but remains in a buy condition.

So the signals remain mixed and that keeps the system in a buy condition.

We're due for some selling pressure and tonight's SOTU address could provide that. And the FOMC policy statement released tomorrow afternoon will provide the market with another potential catalyst. But while we're due for some downside action, I'm not overly confident we'll get it. If it does come look at volume to get a clue of how serious it might be. Given the paltry volume we've been seeing lately, an increase either way could be very telling in the short term.

One thing I'd like to mention this evening is what it would take to flip the Seven Sentinels back to a sell condition. All the signals are near their respective trigger points, so getting all seven to concurrently flip to sell signals would not be hard at this point. However, to get an official sell signal NYMO has to hit a 28 day trading low, and as of tonight that number is about a negative fifty-two (-52). We are well away from that level at this point.

However, within the next few trading days that trigger point for NYMO is going to rise substantially, which would make it easier to roll the system over.

That's just something to keep in mind for now as I don't see this system changing its status in the near term and it may not happen for some time if we continue to grind higher instead.

I'm not surprised by the dip buying. Many traders who found themselves on the sidelines as this market relentlessly pushed higher were looking for a buying opportunity. Any buying opportunity. And they finally got one today.

Still, the trading was listless overall with little real direction or leadership and volume remained quite thin. That makes me think this market is waiting for something. The President's State of the Union Address is tonight and that's certainly a possible market driver. And the FOMC began its meeting today too. Tomorrow afternoon they'll issue an announcement on their economic policy moving forward. So tomorrow's action could be very interesting.

Overseas, Greece has been making the headlines again as talks between creditors and Pols are seeing friction.

There were no domestic reports released today.

Here's today's charts:

NAMO and NYMO remain near their respective 6 day EMAs and are not providing any clues to short term direction.

NAHL and NYHL both turned lower and are on sells. But only barely.

TRIN is sitting right on its trigger point, while TRINQ is on a sell. Not much help here.

BPCOMPQ tracked sideways again, but remains in a buy condition.

So the signals remain mixed and that keeps the system in a buy condition.

We're due for some selling pressure and tonight's SOTU address could provide that. And the FOMC policy statement released tomorrow afternoon will provide the market with another potential catalyst. But while we're due for some downside action, I'm not overly confident we'll get it. If it does come look at volume to get a clue of how serious it might be. Given the paltry volume we've been seeing lately, an increase either way could be very telling in the short term.

One thing I'd like to mention this evening is what it would take to flip the Seven Sentinels back to a sell condition. All the signals are near their respective trigger points, so getting all seven to concurrently flip to sell signals would not be hard at this point. However, to get an official sell signal NYMO has to hit a 28 day trading low, and as of tonight that number is about a negative fifty-two (-52). We are well away from that level at this point.

However, within the next few trading days that trigger point for NYMO is going to rise substantially, which would make it easier to roll the system over.

That's just something to keep in mind for now as I don't see this system changing its status in the near term and it may not happen for some time if we continue to grind higher instead.