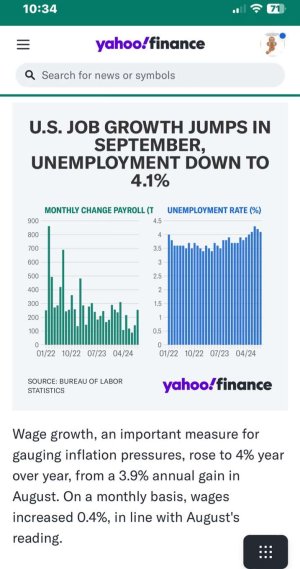

Total nonfarm payroll employment

increased by 175,000 in April, and the unemployment rate

changed little at

3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains

occurred in health care, in social assistance, and in transportation and warehousing.

This news release presents statistics from two monthly surveys. The household survey measures

labor force status, including unemployment, by demographic characteristics. The establishment

survey measures nonfarm employment, hours, and earnings by industry. For more information

about the concepts and statistical methodology used in these two surveys, see the Technical

Note.

Household Survey Data

Both the unemployment rate, at

3.9 percent, and the number of unemployed people, at 6.5

million, changed little in April. The unemployment rate has remained in a narrow range of 3.7

percent to 3.9 percent since August 2023. (See table A-1.)

Among the major worker groups, the unemployment rate for adult men (3.6 percent) increased in

April. The rate for Blacks (5.6 percent) decreased, offsetting an increase in the prior month.

The jobless rates for adult women (3.5 percent), teenagers (11.7 percent), Whites (3.5 percent),

Asians (2.8 percent), and Hispanics (4.8 percent) showed little change over the month. (See

tables A-1, A-2, and A-3.)

The number of long-term unemployed (those jobless for 27 weeks or more), at 1.3 million, was

essentially unchanged in April. The long-term unemployed accounted for 19.6 percent of all

unemployed people. (See table A-12.)

The labor force participation rate held at

62.7 percent in April, and the employment-population

ratio was little changed at 60.2 percent. These measures have shown little change over the

year. (See table A-1.)

more:

Access Denied