Today was the kind of choppy trading I had expected last Friday, but as it turned out I got a better buying opportunity than I'd expected.

Of note today, the existing home sales numbers fell 16.7% month-over-month to an annualized rate of 5.45 million units, which led to weakness early on in the major averages, but overall things held up pretty well considering the damage that was done last week. And it was Monday after all, and that makes it practically a lock for a rally.

So I opted to try and catch a bounce early on this week as conditions were oversold on many indicators, going 50/50 CS for a one or two day trade. The Seven Sentinels are still on a sell and did not influence my decision to make a short term trade. Remember, the Seven Sentinels are an intermediate term system and not designed for day to day trading.

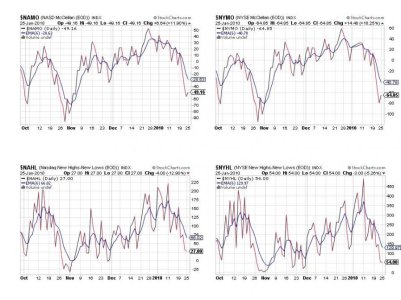

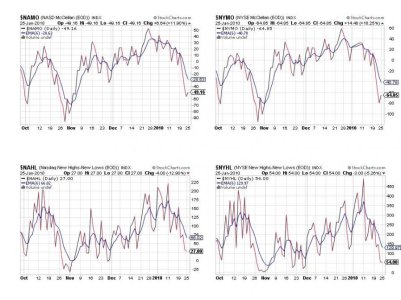

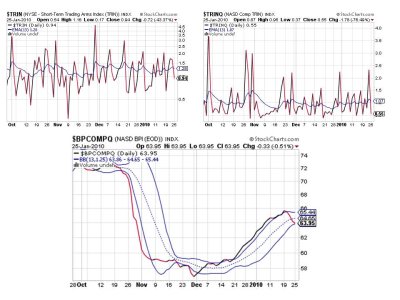

Here's today's charts:

Still four for four on a sell here.

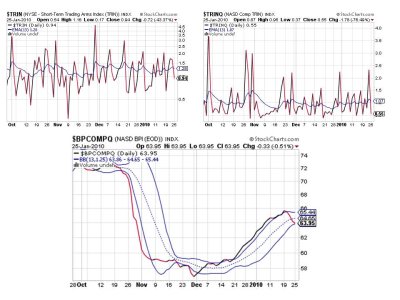

TRIN and TRINQ flipped to a buy, but BPCOMPQ inched a bit lower, tagging the lower bollinger band.

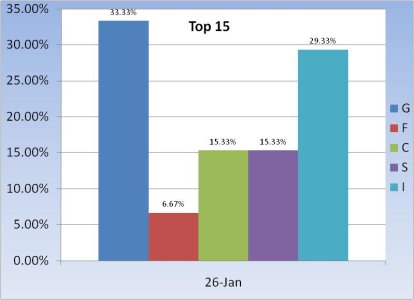

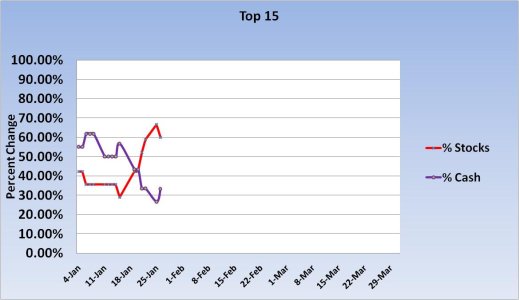

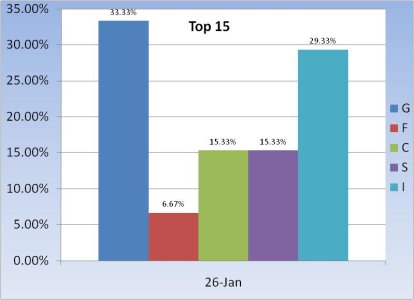

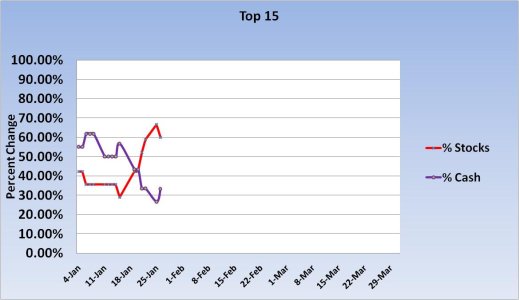

Our Top 15 sold a bit into today's rally, and did some reallocation, but overall held steady for the moment.

So we remain in a sell condition with the Seven Sentinels. Market character appears to be changing as good earnings are being met with more selling than buying interest. Late this afternoon Apple reported a profit increase with improved margins. Will the market treat this stock any different tomorrow?

We are oversold so a bounce should not be a surprise, but any serious buying pressure with follow-through remains to be seen. I am 100% stocks for a fast trade, but will sell quickly if a rally develops.

See you tomorrow.

Of note today, the existing home sales numbers fell 16.7% month-over-month to an annualized rate of 5.45 million units, which led to weakness early on in the major averages, but overall things held up pretty well considering the damage that was done last week. And it was Monday after all, and that makes it practically a lock for a rally.

So I opted to try and catch a bounce early on this week as conditions were oversold on many indicators, going 50/50 CS for a one or two day trade. The Seven Sentinels are still on a sell and did not influence my decision to make a short term trade. Remember, the Seven Sentinels are an intermediate term system and not designed for day to day trading.

Here's today's charts:

Still four for four on a sell here.

TRIN and TRINQ flipped to a buy, but BPCOMPQ inched a bit lower, tagging the lower bollinger band.

Our Top 15 sold a bit into today's rally, and did some reallocation, but overall held steady for the moment.

So we remain in a sell condition with the Seven Sentinels. Market character appears to be changing as good earnings are being met with more selling than buying interest. Late this afternoon Apple reported a profit increase with improved margins. Will the market treat this stock any different tomorrow?

We are oversold so a bounce should not be a surprise, but any serious buying pressure with follow-through remains to be seen. I am 100% stocks for a fast trade, but will sell quickly if a rally develops.

See you tomorrow.