It was a boring trading day, but the market did post some modest gains in spite of the lack of data or news. Still, watching the paint dry would have been more entertaining.

As a side note, earnings season begins next week, so that should give the market more catalysts from which to derive some direction. Maybe that's what this market is waiting for as share volume is still at holiday levels.

Here's today's charts:

NAMO/NYMO remain on buys, but there's little momentum here.

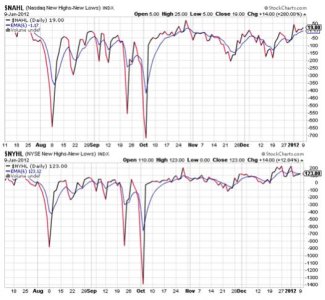

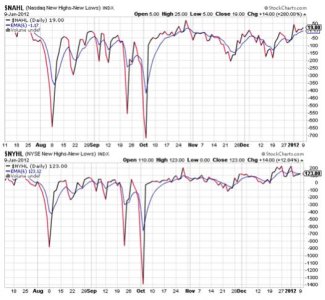

NAHL and NYHL are also on buys.

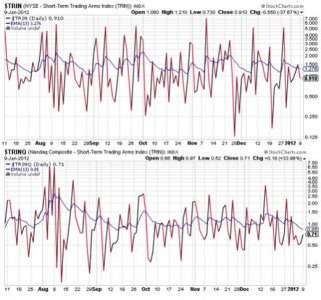

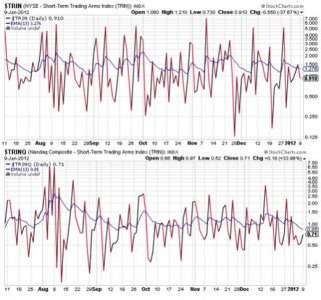

Two buys for TRIN and TRINQ.

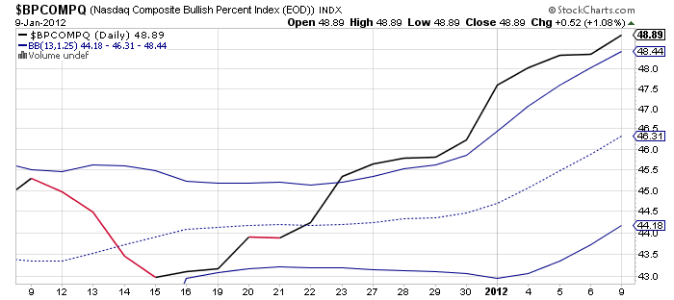

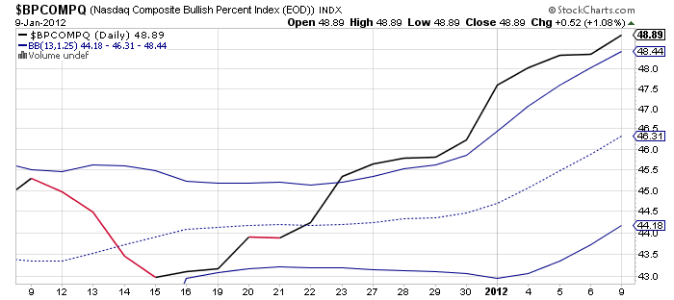

BPCOMPQ took an upward tack after being flat-lined Friday. Is this a clue to short term direction?

So all signals are on buys, which keeps the Seven Sentinels in an official intermediate term buy condition.

Yesterday, I had said there appears to be a floor under this market and today provided a bit more evidence of that. But this market hasn't exactly broken out to the upside either, and that keeps me in the G fund for now.

As a side note, earnings season begins next week, so that should give the market more catalysts from which to derive some direction. Maybe that's what this market is waiting for as share volume is still at holiday levels.

Here's today's charts:

NAMO/NYMO remain on buys, but there's little momentum here.

NAHL and NYHL are also on buys.

Two buys for TRIN and TRINQ.

BPCOMPQ took an upward tack after being flat-lined Friday. Is this a clue to short term direction?

So all signals are on buys, which keeps the Seven Sentinels in an official intermediate term buy condition.

Yesterday, I had said there appears to be a floor under this market and today provided a bit more evidence of that. But this market hasn't exactly broken out to the upside either, and that keeps me in the G fund for now.