Spaf

Honorary Hall of Fame Member

- Reaction score

- 45

imported post

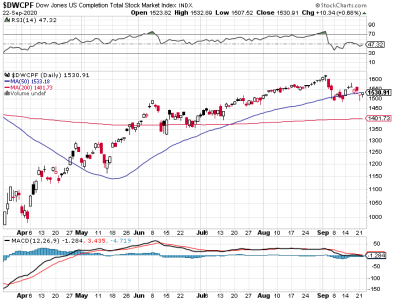

According to the stats the S fund is currently above the moving average of 20 days and the Parabolic SAR has returned a entry indicator. The I fund is currently above the moving average of 20 days but the P-SAR has not returned a entry indicator. Reason: it had a lower dip in Sept and still has a little to make up for. A similiar international fund by Fidelity has been showing entry for the last 8 days.

I wanted to post this Friday afternoon so that everone in stocks can have a little peace over the weekend (and a good thing for your fingernails)!

PS: And, I also copied Toms Seasonality chart for October, for sentiment.

According to the stats the S fund is currently above the moving average of 20 days and the Parabolic SAR has returned a entry indicator. The I fund is currently above the moving average of 20 days but the P-SAR has not returned a entry indicator. Reason: it had a lower dip in Sept and still has a little to make up for. A similiar international fund by Fidelity has been showing entry for the last 8 days.

I wanted to post this Friday afternoon so that everone in stocks can have a little peace over the weekend (and a good thing for your fingernails)!

PS: And, I also copied Toms Seasonality chart for October, for sentiment.