Spaf

Honorary Hall of Fame Member

- Reaction score

- 45

imported post

Well my strategy!

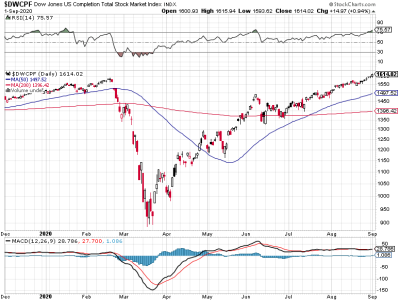

I use a combination of stats and sentiment. For reference see incrediblecharts.com (Trading guide/indicators) for how I use Moving averages (MA) and the parabolic SAR with the technical charts found on Yahoo finance. I use a MA that is slightly under 1/2 the market cycles (or a MA of 20 days).

Currently, if today holds up, the MA and P-SAR should indicate a buy, hopefully. If this holds and the sentiment is favorable, especially oil, and market talk and members continue to say that October is a good month. RE: Tom and his chart on seasonality. The stats and sentiment will be positive and (all a go) I will reallocate funds out of the hanger to be flying on Oct 1. I'm thinking S=70 and I=30.

Well my strategy!

I use a combination of stats and sentiment. For reference see incrediblecharts.com (Trading guide/indicators) for how I use Moving averages (MA) and the parabolic SAR with the technical charts found on Yahoo finance. I use a MA that is slightly under 1/2 the market cycles (or a MA of 20 days).

Currently, if today holds up, the MA and P-SAR should indicate a buy, hopefully. If this holds and the sentiment is favorable, especially oil, and market talk and members continue to say that October is a good month. RE: Tom and his chart on seasonality. The stats and sentiment will be positive and (all a go) I will reallocate funds out of the hanger to be flying on Oct 1. I'm thinking S=70 and I=30.