What started as a decent decline was bought by institutional investors early on in the trading day and by about 11:00 EST the S&P settled into a tight range not far from its previous closing price. That lasted until 2:00 when the minutes from the last FOMC meeting were announced in which the Fed indicated the possibility of further Quantitative easing. That was enough to push the market back into positive territory for most of the major indexes all the way up to the closing bell.

The dollar started out the day with gains, but the FOMC announcement, predictably, pushed it into negative territory, but it only close 0.1% down against a basket of currencies.

The underlying strength in this market was evident today as it didn't take long to reverse the selling pressure. My short term system went to a sell early on, but went back to neutral this afternoon. Here's today's charts:

It's been a pretty tight range now for NAMO and NYMO, but the momentum has remained mostly above the neutral line since early September. Both are flashing buys today.

NAHL and NYHL both flipped to sells, but like NAMO and NYMO are in a tight range.

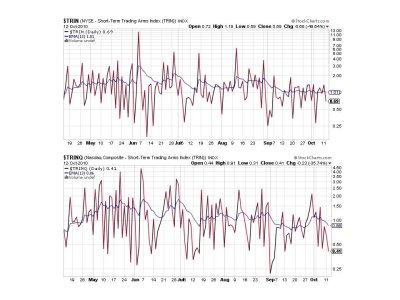

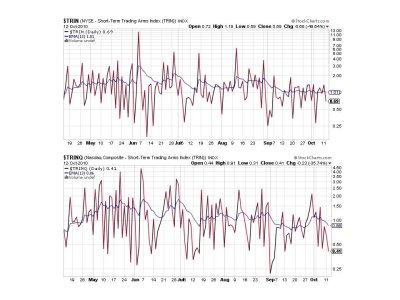

Both TRIN and TRINQ are flashing buys, but they do suggest the recent bout of weakness may not be over just yet. But I'm not looking for anything dramatic at the moment.

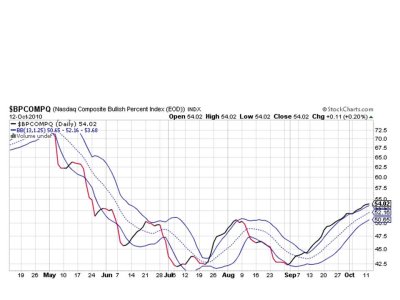

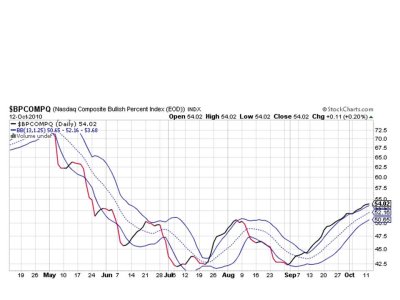

BPCOMPQ remains on a buy, but is leveling off a bit. I still view this signal as bullish though.

So we have 5 of 7 signals on buys, which keeps the system on a buy.

I've reviewed sentiment across several polls and bullishness is rising, but most polls are closer to neutral than anything else. Still, it's probably an early warning to be aware of. I may begin to lighten up on strength at this point.

The dollar started out the day with gains, but the FOMC announcement, predictably, pushed it into negative territory, but it only close 0.1% down against a basket of currencies.

The underlying strength in this market was evident today as it didn't take long to reverse the selling pressure. My short term system went to a sell early on, but went back to neutral this afternoon. Here's today's charts:

It's been a pretty tight range now for NAMO and NYMO, but the momentum has remained mostly above the neutral line since early September. Both are flashing buys today.

NAHL and NYHL both flipped to sells, but like NAMO and NYMO are in a tight range.

Both TRIN and TRINQ are flashing buys, but they do suggest the recent bout of weakness may not be over just yet. But I'm not looking for anything dramatic at the moment.

BPCOMPQ remains on a buy, but is leveling off a bit. I still view this signal as bullish though.

So we have 5 of 7 signals on buys, which keeps the system on a buy.

I've reviewed sentiment across several polls and bullishness is rising, but most polls are closer to neutral than anything else. Still, it's probably an early warning to be aware of. I may begin to lighten up on strength at this point.