Trade was pretty choppy today, but the the broader averages did manage to close well off its lows of the day and Nasdaq even managed a very modest gain. But I doubt too many bulls are feeling comfortable right now.

And economic data didn't do the market any favors today either. April Industrial production came in flat, in spite of estimates for a 0.5% increase. And Capacity Utilization came in at 76.9%, which was below estimates of 77.7%.

Perhaps the worst news of the day was April housing starts, which tagged an annualized rate of 523,000, well below estimates of 563,000 units. Not surprisingly given the housing starts number, building permits fell to an annualized rate of 551,000 from 574,000 permits.

So housing woes continue, which can't help but put a lid any continued economic recovery.

The dollar did fall today for a 0.3% loss against a basket of major foreign currencies. But that's not much given its gains of late. A continued rise in the dollar will more than likely put more pressure back on the stocks.

Let's take a look at the charts:

NAMO and NYMO continued lower and remain on sells. NYMO is now about 10 points away from hitting a new 28 day trading low. That's important in order to confirm any sell signal the system may issue as we move forward.

NAHL and NYHL also continued lower and remain in sell conditions.

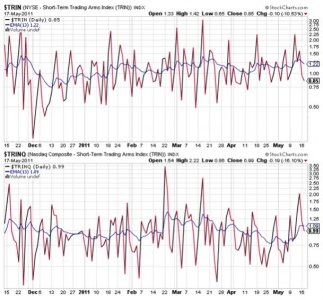

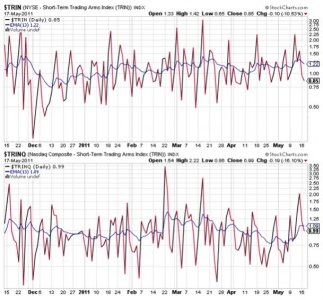

TRIN and TRINQ are now both flashing buys.

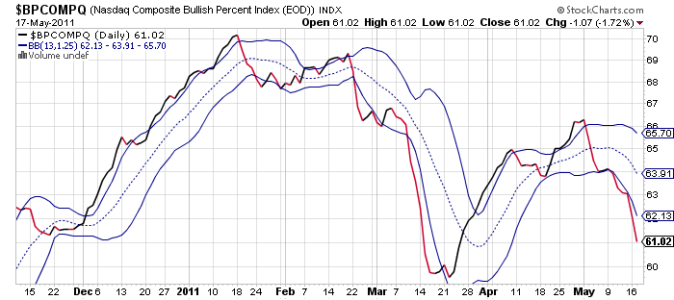

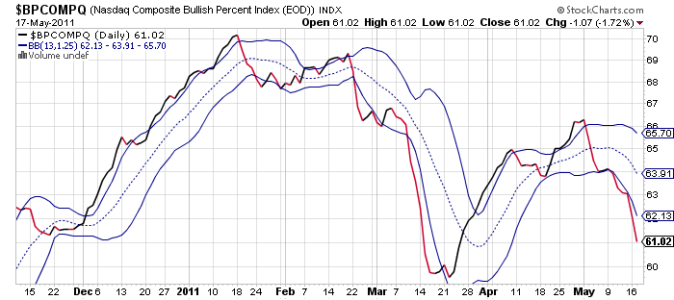

BPCOMPQ fell again, and continues to point to lower prices.

So the system remains in a buy condition given the TRIN and TRINQ buy signals as well as the lack of a fresh 28 day trading low in NYMO.

It wouldn't take a great deal more of selling pressure to put this system in a sell condition.

It really comes down to this. Can the powers that be keep this market propped up in spite of all the negative elements still plaguing our economy? It may take QE3, but should the Fed choose that path the market may not necessarily cheer. Of course QE2 isn't over yet, but everyone knows when it ends, so a lot of money will be looking for a safe haven sooner rather than later as risk is rising with each day. And that's why Treasuries are finding favor again.

That's the picture of the next few weeks, but focusing on the rest of this week I would think we're due for a bounce. And I would be very surprised if we didn't get one. However, assuming we do, I'm of the opinion it will be sold. But that's just my opinion. There's too many unknowns right now and risk on, risk off trade is in play.

And economic data didn't do the market any favors today either. April Industrial production came in flat, in spite of estimates for a 0.5% increase. And Capacity Utilization came in at 76.9%, which was below estimates of 77.7%.

Perhaps the worst news of the day was April housing starts, which tagged an annualized rate of 523,000, well below estimates of 563,000 units. Not surprisingly given the housing starts number, building permits fell to an annualized rate of 551,000 from 574,000 permits.

So housing woes continue, which can't help but put a lid any continued economic recovery.

The dollar did fall today for a 0.3% loss against a basket of major foreign currencies. But that's not much given its gains of late. A continued rise in the dollar will more than likely put more pressure back on the stocks.

Let's take a look at the charts:

NAMO and NYMO continued lower and remain on sells. NYMO is now about 10 points away from hitting a new 28 day trading low. That's important in order to confirm any sell signal the system may issue as we move forward.

NAHL and NYHL also continued lower and remain in sell conditions.

TRIN and TRINQ are now both flashing buys.

BPCOMPQ fell again, and continues to point to lower prices.

So the system remains in a buy condition given the TRIN and TRINQ buy signals as well as the lack of a fresh 28 day trading low in NYMO.

It wouldn't take a great deal more of selling pressure to put this system in a sell condition.

It really comes down to this. Can the powers that be keep this market propped up in spite of all the negative elements still plaguing our economy? It may take QE3, but should the Fed choose that path the market may not necessarily cheer. Of course QE2 isn't over yet, but everyone knows when it ends, so a lot of money will be looking for a safe haven sooner rather than later as risk is rising with each day. And that's why Treasuries are finding favor again.

That's the picture of the next few weeks, but focusing on the rest of this week I would think we're due for a bounce. And I would be very surprised if we didn't get one. However, assuming we do, I'm of the opinion it will be sold. But that's just my opinion. There's too many unknowns right now and risk on, risk off trade is in play.