The market has now strung together three days of gains in a row, although it's been on light volume. It hasn't really been a surprise to see a rally in here, especially given that the market tends to a have an upward bias towards the end of the month. And this month has holiday right at the end. Let's take a look at SPX and see where this rally may take us.

As you can see, SPX has been trading in short term, relatively tight trading cycles since the beginning of May. I've drawn some lines to show how the peaks and troughs of those cycles have been trending lower each time. Right now we are at resistance on that upper trend line, which suggests a short term top may be at hand. But even if we hit a top today, support is not far below as those lower trend lines show. But the intermediate trend is down, so if we do move lower next week as this current channel suggests, I would expect to see SPX bounce near 1300, and that could possibly be a bottom for the intermediate term before another launch higher.

Let's see what the Seven Sentinels show:

NAMO and NYMO ramped up a bit more today and are now back in positive territory, but just like the SPX chart, these charts suggest momentum is also hitting a peak. Both remain in a buy condition.

NAHL and NYHL also improved and remain in buy conditions.

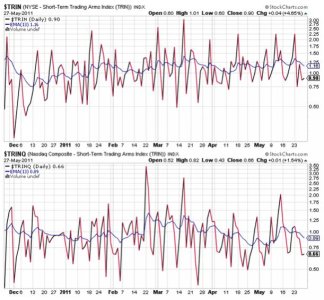

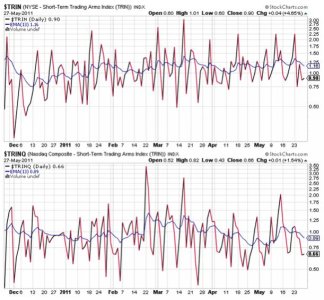

TRIN and TRINQ also remain on buys.

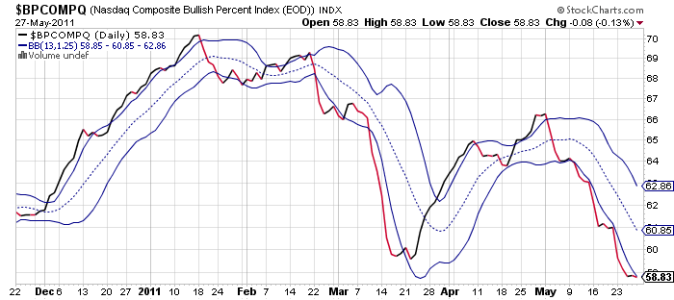

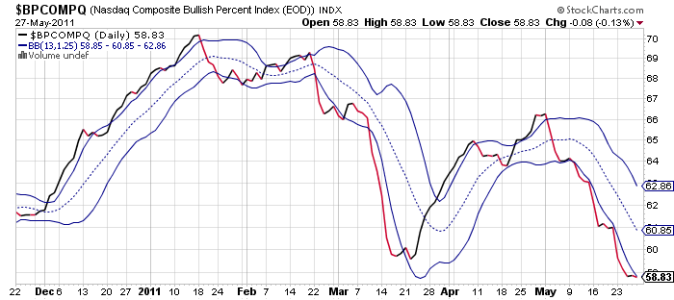

BPCOMPQ actually moved a bit lower today and just isn't confirming this latest rally as anything more than very short term. It remains in a sell condition.

So the Seven Sentinels remain in a sell condition and the charts suggest this latest rally may have peaked today. But this market is moving between peaks and troughs in short time frames, so another decline may not last long. And as I pointed out on the SPX chart above, should we indeed move lower next week, that 1300 area would be a target for support, which is where I would look for a bounce.

As a reminder, the U.S. markets will be closed on Monday in observance of Memorial Day. For all you Veterans out there, thanks for your service!!!

As you can see, SPX has been trading in short term, relatively tight trading cycles since the beginning of May. I've drawn some lines to show how the peaks and troughs of those cycles have been trending lower each time. Right now we are at resistance on that upper trend line, which suggests a short term top may be at hand. But even if we hit a top today, support is not far below as those lower trend lines show. But the intermediate trend is down, so if we do move lower next week as this current channel suggests, I would expect to see SPX bounce near 1300, and that could possibly be a bottom for the intermediate term before another launch higher.

Let's see what the Seven Sentinels show:

NAMO and NYMO ramped up a bit more today and are now back in positive territory, but just like the SPX chart, these charts suggest momentum is also hitting a peak. Both remain in a buy condition.

NAHL and NYHL also improved and remain in buy conditions.

TRIN and TRINQ also remain on buys.

BPCOMPQ actually moved a bit lower today and just isn't confirming this latest rally as anything more than very short term. It remains in a sell condition.

So the Seven Sentinels remain in a sell condition and the charts suggest this latest rally may have peaked today. But this market is moving between peaks and troughs in short time frames, so another decline may not last long. And as I pointed out on the SPX chart above, should we indeed move lower next week, that 1300 area would be a target for support, which is where I would look for a bounce.

As a reminder, the U.S. markets will be closed on Monday in observance of Memorial Day. For all you Veterans out there, thanks for your service!!!