Futures portended big gains at the opening bell today, and big gains is what we got. Only problem was that it lasted for only a few minutes before the bears came out yet again to send the major averages from gains of more than 1% to moderate losses in less than 30 minutes.

News that House and Senate leaders had agreed to some measure of a debt ceiling deal was the catalyst that initially sent stocks soaring, but a weak ISM Index for July coupled with news that Moody's might still consider downgrading the U.S. credit rating if Congress failed to seriously address the Nation's burgeoning debt load quickly brought the bears out of the woodwork.

But as ugly as the reversal had been for bulls, the fact that the S&P 500 managed to mitigate its losses late in the afternoon and close above its 200-day moving average was somewhat of a victory. But it did penetrate that level for a period of time today, so it remains to be seen whether the bulls can hold that 200-day moving average.

And while the C and S funds managed to close with only moderate losses, the I fund wasn't quite so lucky as a dollar rally helped pin a 1.26% loss against that fund.

Treasuries saw strength in today's session, as the yield on the 10-year Note fell below 2.75% for the first time since November.

While it wasn't particularly surprising that Congressional Leaders were able to cut a deal over the weekend, that deal still has to be approved by the House and Senate. And approval will not be a given as members on both sides of the political landscape have members who are adamantly opposed to this deal. And that may be an understatement given some of the heated rhetoric finding its way into media venues. In any event, debates are underway with voting on the agreement anticipated to commence sometime this evening. That outcome will probably drive what the market does next.

Here's today's charts:

While the Seven Sentinels are now in an official sell condition, NAMO and NYMO have recently hit deep lows that often see a reversal soon after. Today's action lifted these two signals a bit. Is this a sign of a coming rally? Perhaps. But they do remain in sell conditions for now.

NAHL and NYHL also improved modestly today, with NYHL actually flipping to a buy condition.

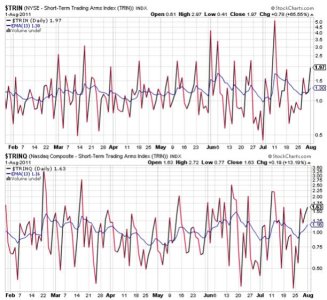

TRIN and TRINQ remain on a sells, but both suggest modestly oversold conditions.

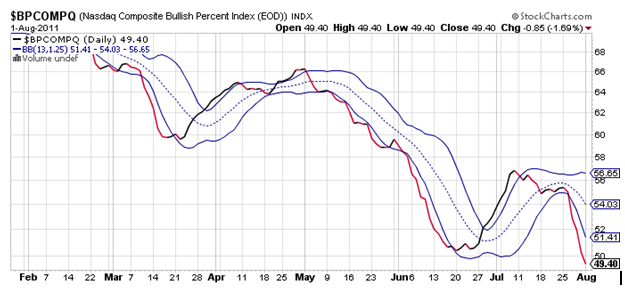

BPCOMPQ is bit trickier as it isn't showing any sign of reversing its decent, and that could be problematic if the market doesn't get satisfaction from our pols soon. But this signal also doesn't turn as quick as the others.

So the system remains in an intermediate term sell condition, but it may be showing signs of an impending rally (short term only). That remains to be seen and while I believe the market will ultimately like whatever deal is made, anything can happen. There will be winners and losers regardless of the outcome. But it's what the market thinks that matters most, and tomorrow's action could be pivotal since that's when the U.S. hits a financial wall without a debt ceiling deal.