-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Last Month's Best Fund Method Strategy

- Thread starter McDuck

- Start date

Cactus

TSP Pro

- Reaction score

- 38

Re: Last month's best fund method

Hmmm. I've only calculated the results for 2009 so far, comparing LMBF with the Sell-In-May option. My results agree with the figures posted by ILoveTDs while the result Sniper posted is closer to what is listed in this thread for 2009. There must be some error in calculation somewhere. Here are my calculations:

[TABLE="width: 523"]

[TR]

[TD]Start

[/TD]

[TD]End

[/TD]

[TD]Fund

[/TD]

[TD]Month

[/TD]

[TD]Year

[/TD]

[TD]Fund

[/TD]

[TD]Month

[/TD]

[TD]Year

[/TD]

[/TR]

[TR]

[TD]Date

[/TD]

[TD]Date

[/TD]

[TD][/TD]

[TD]LMBF

[/TD]

[TD]LMBF

[/TD]

[TD][/TD]

[TD="colspan: 2"]F Fund May - Oct

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]2-Jan-09 2-Feb-09

[/TD]

[TD]I

[/TD]

[TD="align: right"]-14.67%

[/TD]

[TD="align: right"]-15.11%

[/TD]

[TD]I

[/TD]

[TD="align: right"]-14.67%

[/TD]

[TD="align: right"]-15.11%

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]2-Feb-09 2-Mar-09

[/TD]

[TD]G

[/TD]

[TD="align: right"]0.21%

[/TD]

[TD="align: right"]-14.93%

[/TD]

[TD]G

[/TD]

[TD="align: right"]0.21%

[/TD]

[TD="align: right"]-14.93%

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]2-Mar-09 1-Apr-09

[/TD]

[TD]G

[/TD]

[TD="align: right"]0.24%

[/TD]

[TD="align: right"]-14.73%

[/TD]

[TD]G

[/TD]

[TD="align: right"]0.24%

[/TD]

[TD="align: right"]-14.73%

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]1-Apr-09 1-May-09

[/TD]

[TD]C

[/TD]

[TD="align: right"]8.36%

[/TD]

[TD="align: right"]-7.60%

[/TD]

[TD]C

[/TD]

[TD="align: right"]8.36%

[/TD]

[TD="align: right"]-7.60%

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]1-May-09 1-Jun-09

[/TD]

[TD]S

[/TD]

[TD="align: right"]7.52%

[/TD]

[TD="align: right"]-0.64%

[/TD]

[TD]F

[/TD]

[TD="align: right"]0.17%

[/TD]

[TD="align: right"]-7.44%

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]1-Jun-09 1-Jul-09

[/TD]

[TD]I

[/TD]

[TD="align: right"]-2.07%

[/TD]

[TD="align: right"]-2.70%

[/TD]

[TD]F

[/TD]

[TD="align: right"]1.32%

[/TD]

[TD="align: right"]-6.22%

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]1-Jul-09 3-Aug-09

[/TD]

[TD]S

[/TD]

[TD="align: right"]9.85%

[/TD]

[TD="align: right"]6.89%

[/TD]

[TD]F

[/TD]

[TD="align: right"]1.18%

[/TD]

[TD="align: right"]-5.11%

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]3-Aug-09 1-Sep-09

[/TD]

[TD]I

[/TD]

[TD="align: right"]-0.46%

[/TD]

[TD="align: right"]6.40%

[/TD]

[TD]F

[/TD]

[TD="align: right"]1.50%

[/TD]

[TD="align: right"]-3.68%

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]1-Sep-09 1-Oct-09

[/TD]

[TD]I

[/TD]

[TD="align: right"]3.58%

[/TD]

[TD="align: right"]10.20%

[/TD]

[TD]F

[/TD]

[TD="align: right"]1.35%

[/TD]

[TD="align: right"]-2.38%

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]1-Oct-09 2-Nov-09

[/TD]

[TD]S

[/TD]

[TD="align: right"]-2.33%

[/TD]

[TD="align: right"]7.64%

[/TD]

[TD]F

[/TD]

[TD="align: right"]0.04%

[/TD]

[TD="align: right"]-2.34%

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]2-Nov-09 1-Dec-09

[/TD]

[TD]F

[/TD]

[TD="align: right"]1.15%

[/TD]

[TD="align: right"]8.87%

[/TD]

[TD]F

[/TD]

[TD="align: right"]1.15%

[/TD]

[TD="align: right"]-1.22%

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]1-Dec-09 31-Dec-09

[/TD]

[TD]C

[/TD]

[TD="align: right"]0.72%

[/TD]

[TD="align: right"]9.66%

[/TD]

[TD]C

[/TD]

[TD="align: right"]0.72%

[/TD]

[TD="align: right"]-0.51%

[/TD]

[/TR]

[/TABLE]

Hmmm. I've only calculated the results for 2009 so far, comparing LMBF with the Sell-In-May option. My results agree with the figures posted by ILoveTDs while the result Sniper posted is closer to what is listed in this thread for 2009. There must be some error in calculation somewhere. Here are my calculations:

[TABLE="width: 523"]

[TR]

[TD]Start

[/TD]

[TD]End

[/TD]

[TD]Fund

[/TD]

[TD]Month

[/TD]

[TD]Year

[/TD]

[TD]Fund

[/TD]

[TD]Month

[/TD]

[TD]Year

[/TD]

[/TR]

[TR]

[TD]Date

[/TD]

[TD]Date

[/TD]

[TD][/TD]

[TD]LMBF

[/TD]

[TD]LMBF

[/TD]

[TD][/TD]

[TD="colspan: 2"]F Fund May - Oct

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]2-Jan-09 2-Feb-09

[/TD]

[TD]I

[/TD]

[TD="align: right"]-14.67%

[/TD]

[TD="align: right"]-15.11%

[/TD]

[TD]I

[/TD]

[TD="align: right"]-14.67%

[/TD]

[TD="align: right"]-15.11%

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]2-Feb-09 2-Mar-09

[/TD]

[TD]G

[/TD]

[TD="align: right"]0.21%

[/TD]

[TD="align: right"]-14.93%

[/TD]

[TD]G

[/TD]

[TD="align: right"]0.21%

[/TD]

[TD="align: right"]-14.93%

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]2-Mar-09 1-Apr-09

[/TD]

[TD]G

[/TD]

[TD="align: right"]0.24%

[/TD]

[TD="align: right"]-14.73%

[/TD]

[TD]G

[/TD]

[TD="align: right"]0.24%

[/TD]

[TD="align: right"]-14.73%

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]1-Apr-09 1-May-09

[/TD]

[TD]C

[/TD]

[TD="align: right"]8.36%

[/TD]

[TD="align: right"]-7.60%

[/TD]

[TD]C

[/TD]

[TD="align: right"]8.36%

[/TD]

[TD="align: right"]-7.60%

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]1-May-09 1-Jun-09

[/TD]

[TD]S

[/TD]

[TD="align: right"]7.52%

[/TD]

[TD="align: right"]-0.64%

[/TD]

[TD]F

[/TD]

[TD="align: right"]0.17%

[/TD]

[TD="align: right"]-7.44%

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]1-Jun-09 1-Jul-09

[/TD]

[TD]I

[/TD]

[TD="align: right"]-2.07%

[/TD]

[TD="align: right"]-2.70%

[/TD]

[TD]F

[/TD]

[TD="align: right"]1.32%

[/TD]

[TD="align: right"]-6.22%

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]1-Jul-09 3-Aug-09

[/TD]

[TD]S

[/TD]

[TD="align: right"]9.85%

[/TD]

[TD="align: right"]6.89%

[/TD]

[TD]F

[/TD]

[TD="align: right"]1.18%

[/TD]

[TD="align: right"]-5.11%

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]3-Aug-09 1-Sep-09

[/TD]

[TD]I

[/TD]

[TD="align: right"]-0.46%

[/TD]

[TD="align: right"]6.40%

[/TD]

[TD]F

[/TD]

[TD="align: right"]1.50%

[/TD]

[TD="align: right"]-3.68%

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]1-Sep-09 1-Oct-09

[/TD]

[TD]I

[/TD]

[TD="align: right"]3.58%

[/TD]

[TD="align: right"]10.20%

[/TD]

[TD]F

[/TD]

[TD="align: right"]1.35%

[/TD]

[TD="align: right"]-2.38%

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]1-Oct-09 2-Nov-09

[/TD]

[TD]S

[/TD]

[TD="align: right"]-2.33%

[/TD]

[TD="align: right"]7.64%

[/TD]

[TD]F

[/TD]

[TD="align: right"]0.04%

[/TD]

[TD="align: right"]-2.34%

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]2-Nov-09 1-Dec-09

[/TD]

[TD]F

[/TD]

[TD="align: right"]1.15%

[/TD]

[TD="align: right"]8.87%

[/TD]

[TD]F

[/TD]

[TD="align: right"]1.15%

[/TD]

[TD="align: right"]-1.22%

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]1-Dec-09 31-Dec-09

[/TD]

[TD]C

[/TD]

[TD="align: right"]0.72%

[/TD]

[TD="align: right"]9.66%

[/TD]

[TD]C

[/TD]

[TD="align: right"]0.72%

[/TD]

[TD="align: right"]-0.51%

[/TD]

[/TR]

[/TABLE]

wavecoder

TSP Pro

- Reaction score

- 24

Re: Last month's best fund method

Where's the errors in my post? just curious, I got all those numbers from the autotracker results. and the doubling balance from 2001-2007 I went by testing an account balance of 10k, and from 2001, the balance after 2007's gain was at a little over 21k

About LMBF method though, the best thing about the system is it's safe. it avoided heavy losses in 2001 & 2002 and avoided disaster in 2008. And made a pretty good gain in 2011 when holding the S fund would have been a net loss. Probably a great strategy to adopt for investors that aren't big risk takers, but at the same time, want something not overly conservative as holding G or F

Hmmm. I've only calculated the results for 2009 so far, comparing LMBF with the Sell-In-May option. My results agree with the figures posted by ILoveTDs while the result Sniper posted is closer to what is listed in this thread for 2009. There must be some error in calculation somewhere. Here are my calculations:

Where's the errors in my post? just curious, I got all those numbers from the autotracker results. and the doubling balance from 2001-2007 I went by testing an account balance of 10k, and from 2001, the balance after 2007's gain was at a little over 21k

About LMBF method though, the best thing about the system is it's safe. it avoided heavy losses in 2001 & 2002 and avoided disaster in 2008. And made a pretty good gain in 2011 when holding the S fund would have been a net loss. Probably a great strategy to adopt for investors that aren't big risk takers, but at the same time, want something not overly conservative as holding G or F

Cactus

TSP Pro

- Reaction score

- 38

Re: Last month's best fund method

I'm sorry. I didn't mean to imply your figures are incorrect. In fact your figures are in agreement with those given in this thread. I'm just saying I tried computing the LMBFM using 2009 data because I found the comment made ILoveTDs surprising for that year. Now I'm surprised that my number agrees with his but doesn't match the results given in this thread, including yours. Given that I'm the one different and new to all this I figure my calculations are the ones in errror. I posted my results thinking someone could show me where I went astray.

I'm sorry. I didn't mean to imply your figures are incorrect. In fact your figures are in agreement with those given in this thread. I'm just saying I tried computing the LMBFM using 2009 data because I found the comment made ILoveTDs surprising for that year. Now I'm surprised that my number agrees with his but doesn't match the results given in this thread, including yours. Given that I'm the one different and new to all this I figure my calculations are the ones in errror. I posted my results thinking someone could show me where I went astray.

James48843

TSP Talk Royalty

- Reaction score

- 951

Re: Last month's best fund method

Looking for some assistance here. I will not be on-line when the next end-of-month rolls by next week. Going to be traveling and not near a computer.

Would somebody please volunteer to give me a hand, and clip the closing share data on Jan 31, and initiate the expected change in allocation? I'm looking for a partner to help me out on the LMBF method data next week. Obligation is just to make sure everything transpires correctely when we hit the end of Jan data.

If interested, please PM me and I'll write you back.

Thanks

Looking for some assistance here. I will not be on-line when the next end-of-month rolls by next week. Going to be traveling and not near a computer.

Would somebody please volunteer to give me a hand, and clip the closing share data on Jan 31, and initiate the expected change in allocation? I'm looking for a partner to help me out on the LMBF method data next week. Obligation is just to make sure everything transpires correctely when we hit the end of Jan data.

If interested, please PM me and I'll write you back.

Thanks

James48843

TSP Talk Royalty

- Reaction score

- 951

Re: Last month's best fund method

Thanks for Mr. JohnRoss for stepping up and volunteering to take care of the LMBF end-of-month data this month. I'm all set.

Thanks JohnRoss, and the other folks who also sent me a PM this afternoon. Thanks- but we now have it covered with JR.

Have a great dayl

Thanks for Mr. JohnRoss for stepping up and volunteering to take care of the LMBF end-of-month data this month. I'm all set.

Thanks JohnRoss, and the other folks who also sent me a PM this afternoon. Thanks- but we now have it covered with JR.

Have a great dayl

Cactus

TSP Pro

- Reaction score

- 38

Re: Last month's best fund method

I back-tested a simplified LMBF method I thought of and it also seams to generate greater returns than the LMBF. I'll describe it and post my data after rechecking the numbers. I'll probably create a new thread called something like 'Alternate LMBF methods' instead of hijacking this one.

I stand corrected! I went back and computed the total returns for the data ILoveTDs posted and the seasonal modification generated greater returns over that time period. If I figured it right, the LMBF returned 102.37% while the seasonal returned 124.13%. Wow, that surprised me.From your figures it looks like "LMBF seasonal" came out ahead in: 2004, 2006, 2008, 2010, 2011 while LMBF came out ahead in: 2003, 2005, 2007, 2009. This seams to be pretty much a draw if you ask me. I can't say one is really better than the other.

I back-tested a simplified LMBF method I thought of and it also seams to generate greater returns than the LMBF. I'll describe it and post my data after rechecking the numbers. I'll probably create a new thread called something like 'Alternate LMBF methods' instead of hijacking this one.

MrJohnRoss

Market Veteran

- Reaction score

- 58

Re: Last month's best fund method

Got you covered. No problem at all. Glad to help out.

Thanks for Mr. JohnRoss for stepping up and volunteering to take care of the LMBF end-of-month data this month. I'm all set.

Thanks JohnRoss, and the other folks who also sent me a PM this afternoon. Thanks- but we now have it covered with JR.

Have a great dayl

Got you covered. No problem at all. Glad to help out.

PLANO

TSP Pro

- Reaction score

- 79

I think you would include closing prices today and then go with whichever fund did the best since Jan 1st. I think the easiest place to get that answer is to go here: TSP Share Prices after today's prices are posted later tonight.

Looks like it will be S Fund for next month unless something crazy happens today.

Looks like it will be S Fund for next month unless something crazy happens today.

- Reaction score

- 2,595

Dec 31.I typically just wait to see what I'm told to move into each month, but to clarify - Do we compare 31st to 31st or 31st to whatever we first moved into the month at?

Are we comparing tomorrow to Jan 02 or to Dec 31st?

Thank you.

(Jan 31 - Dec 31) / Dec 31

Dec 31.

(Jan 31 - Dec 31) / Dec 31

Thanks!

uscfanhawaii

TSP Pro

- Reaction score

- 18

Deleted...John says it all!!

Last edited:

MrJohnRoss

Market Veteran

- Reaction score

- 58

< In my best James voice... >

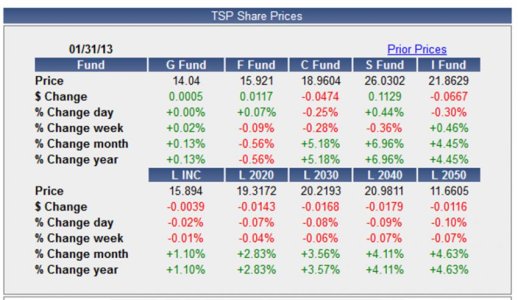

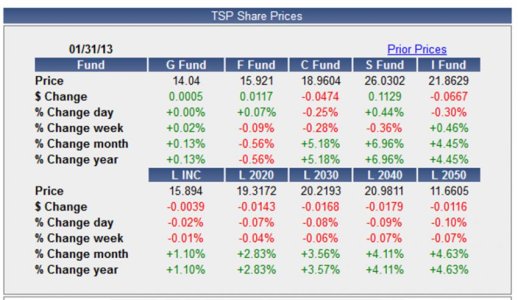

For those of you who follow the LMBF system, it's time to switch to the S Fund before the deadline tomorrow morning.

Below are the results for the month of January for each of the funds. The S Fund led the pack with a monthly gain of 6.96%.

Just think.... if we got 6.96% each and every month, we'd have a 83% return by the end of the year!! Wa-hooo! :nuts:

Best of luck to everyone!

For those of you who follow the LMBF system, it's time to switch to the S Fund before the deadline tomorrow morning.

Below are the results for the month of January for each of the funds. The S Fund led the pack with a monthly gain of 6.96%.

Just think.... if we got 6.96% each and every month, we'd have a 83% return by the end of the year!! Wa-hooo! :nuts:

Best of luck to everyone!

F for March?

From what I see it will be the C fund. Lets wait for the link.

James48843

TSP Talk Royalty

- Reaction score

- 951

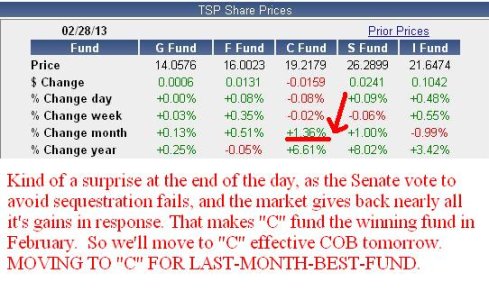

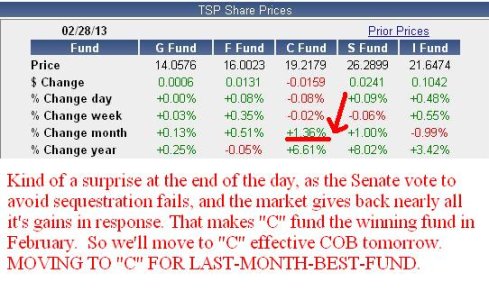

Share prices are posted. Looks like we have a change. End of the month, and the Senate vote killed the market in the last half-hour, so we run into the sequester season by moving our assets to "C".

"Last-month-best-fund) Changes (IFTs) to "C" before noon tomorrow, effective COB tomorrow.

Good luck. I think we're going to need it moving forward!

"Last-month-best-fund) Changes (IFTs) to "C" before noon tomorrow, effective COB tomorrow.

Good luck. I think we're going to need it moving forward!

Share prices are posted. Looks like we have a change. End of the month, and the Senate vote killed the market in the last half-hour, so we run into the sequester season by moving our assets to "C".

"Last-month-best-fund) Changes (IFTs) to "C" before noon tomorrow, effective COB tomorrow.

View attachment 22657

Good luck. I think we're going to need it moving forward!

What connection am I not making?

F went from 15.90 to 16.00, a 10 cent gain.

C went from 19.15 to 19.21, only a 6 cent gain.

The F gain a larger % because its a smaller # also.... am I an idiot?

Similar threads

- Replies

- 0

- Views

- 181

- Replies

- 0

- Views

- 355