James48843

TSP Talk Royalty

- Reaction score

- 956

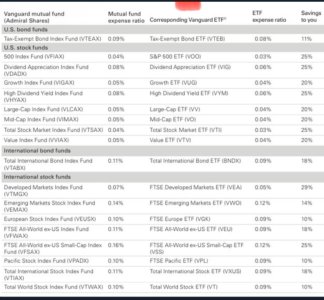

I haven’t used ETF’s myself for anything, but right now I’m looking at Vanguard

VGT (Vanguard Information Technology Index Fund ETF).

I think it has something like 380 companies, representing information technology- not just the Apple/ Nividia/ AI stocks, but a bigger slice. I think it looks like a nice way to hold some of the sector- without any particular technology suddenly losing value as new things are invented.

What do you think about using ETF’s instead of mutual funds, or individual stocks, for a similar portfolio diversity reason?

Is that a good strategy? Or do you think differently? I’m curious.

I just plunked some into VGT and hope to see a bright future. But I have no experience with long term holding ETF’s.

VGT (Vanguard Information Technology Index Fund ETF).

I think it has something like 380 companies, representing information technology- not just the Apple/ Nividia/ AI stocks, but a bigger slice. I think it looks like a nice way to hold some of the sector- without any particular technology suddenly losing value as new things are invented.

What do you think about using ETF’s instead of mutual funds, or individual stocks, for a similar portfolio diversity reason?

Is that a good strategy? Or do you think differently? I’m curious.

I just plunked some into VGT and hope to see a bright future. But I have no experience with long term holding ETF’s.

Last edited: