david.alan.williams

TSP Strategist

- Reaction score

- 10

Re: Contribution Allocation Questions

Congrats on a successful 2011 James!

Congrats on a successful 2011 James!

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

I think I might follow this method. Does the switch need to be exactly on the 1st day of the month?

That would be a more conservative way to handle your account. The 30% in G would always be safe from losses, but wouldn't make any money for you either. As far as whether it would "mess things up", you would probably think so if the LMBF was making money, but wouldn't think so if it was losing. You would end up with a different return, yes.I have another question, please remember my Newbness, will it mess things up if I keep like 30 in the G fund and then move my other 70 around doing to last months best fund? Or am I over thinking it?

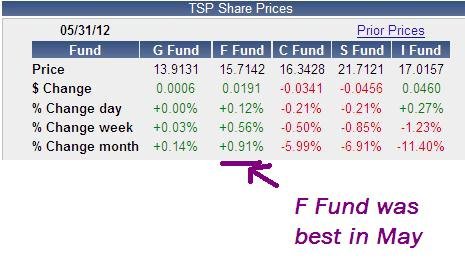

What is the best way to see the best performing fund for the month of May? I keep pulling up 1day, 5day, then 3 month or yearly, I have a feeling I am not looking in the right place, it shouldn't be this hard...

Say 2 Hail Mary's and you shall be absolved.Foregive me Father for I have sinned, and failed to post the LAST MONTH BEST FUND results for May before the noon deadline.

I suckered myself into thinking the S fund was good, so I'm personally a bit bloody right now. I have GOT to get myself some LMBF discipline!