The trading session started on a down note right out of the gate this morning, and it was relatively contained too, until news hit that Goldman Sachs and one of its VPs was being charged by the SEC with fraud related to subprime securities. Then it got rather ugly and stayed that way into the close.

Volume was very high, but it was Options Expiration day, which makes it difficult to know how serious today's sell-off really was and more importantly, if it will reverse the trend.

Here's the charts:

NAMO and NYMO both flipped to sells today, but remain relatively neutral.

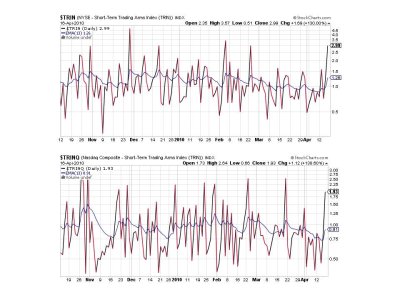

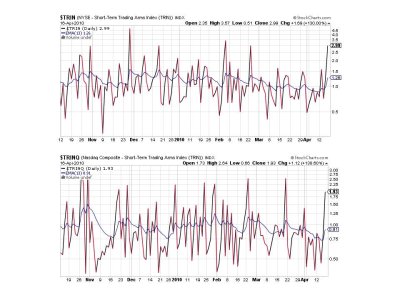

Big reversal here for both signals, which are now on a sell.

Spiked here too and on a sell.

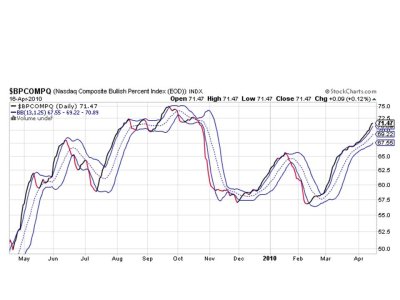

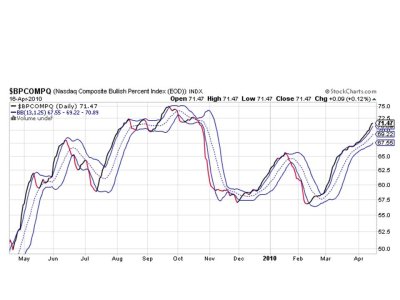

BPCOMPQ managed to hold steady today and is the only buy signal left.

So it's 6 of 7 signals on a sell, but that still keeps the system on a buy. We need all 7 to roll over to a sell at the same time to get a system sell signal. Monday's have been mostly green for months, so it will be interesting to see if that trend holds up given today's carnage. But things may not be as bad as they seem. We'll have to see how sentiment shapes up. If it gets bullish, we may be in trouble. If it's bearish, we may recover quickly. We'll just have to see how it plays out.

I'll be posting Top 15 and Top 50 charts this weekend. See you then.

Volume was very high, but it was Options Expiration day, which makes it difficult to know how serious today's sell-off really was and more importantly, if it will reverse the trend.

Here's the charts:

NAMO and NYMO both flipped to sells today, but remain relatively neutral.

Big reversal here for both signals, which are now on a sell.

Spiked here too and on a sell.

BPCOMPQ managed to hold steady today and is the only buy signal left.

So it's 6 of 7 signals on a sell, but that still keeps the system on a buy. We need all 7 to roll over to a sell at the same time to get a system sell signal. Monday's have been mostly green for months, so it will be interesting to see if that trend holds up given today's carnage. But things may not be as bad as they seem. We'll have to see how sentiment shapes up. If it gets bullish, we may be in trouble. If it's bearish, we may recover quickly. We'll just have to see how it plays out.

I'll be posting Top 15 and Top 50 charts this weekend. See you then.