Call it a modern day Greek Tragedy. After a hard gap down to start the trading day, the major averages appeared to be ready to retrace recent gains as the global economic morass continued to weigh on sentiment. Of course, late day revisions to our own economic outlook as presented by the Fed Chair yesterday hadn't been fully priced in either.

Prior to the open, news that the latest initial jobless claims number had risen to 429,000, which was more than the 413,000 economists were looking for, didn't sit well with market participants and only added to the inclination to sell.

New home sales in May dipped 2% to a rate of 319,000 units per year, which was better than estimates of 305,000 units, but that failed to reverse the bearish tone.

And as ugly as it looked early on, the broader stock market still held its 200-day moving average for the second time in a week as stocks bottomed early before chopping their way higher into the afternoon session. It was only when news that Greece had agreed to a set of austerity measures that buying pressure really kicked in. But that's a temporary fix, which still requires the Greece Parliament's approval, so the Greek saga has yet to run its course.

Here's today's charts:

Given that the Tech sector led the market to some decent gains today, it's not surprising that NAMO improved a bit on today's action, but NYMO dipped as the NYSE was lower at the close. Both remain in a buy condition.

Unfortunately, market internals as measured by NAHL and NYHL fell, with NAHL just barely holding its buy status, while NYHL flipped to a sell.

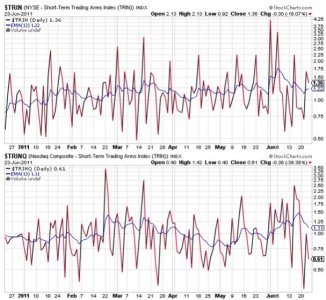

TRIN dipped closer to a neutral reading and remains on a sell, while TRINQ reflected the buying pressure within the tech sector by dropping into a modest overbought condition.

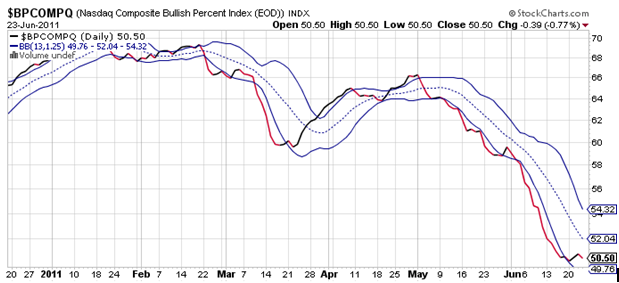

BPCOMPQ also dipped on today's action, but remains in a buy condition.

So the Seven Sentinels remain in an UNCONFIRMED buy status, but officially retain their intermediate term sell condition.

This feels like bottoming action to me, although a confirmed bottom may not be spotted for some time yet. My guess is we may have a short term bottom given the market just bounced off its 200 day moving average again, but I would not be surprised to see the market test the lows again over the coming days or weeks. But for the next few days or so, I'm anticipating higher prices.