JTH

TSP Legend

- Reaction score

- 1,158

Happy Easter

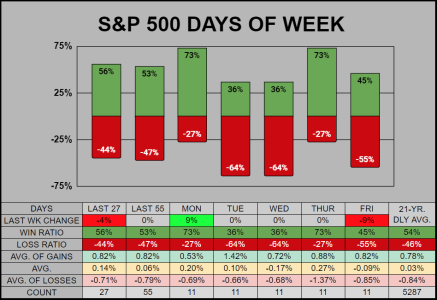

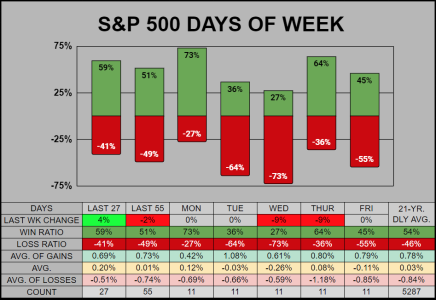

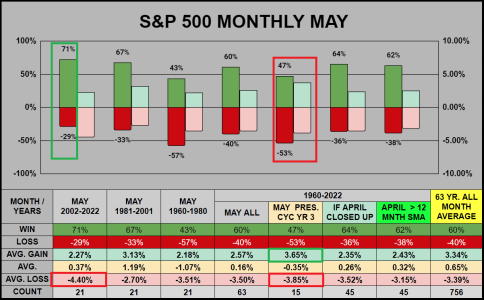

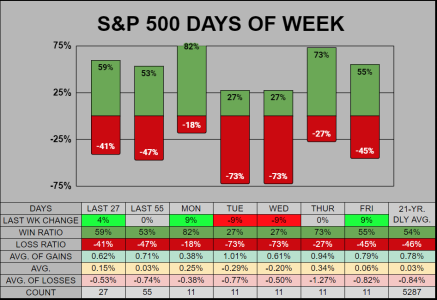

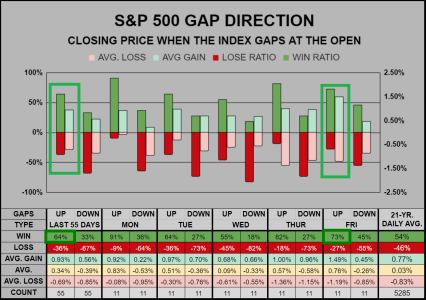

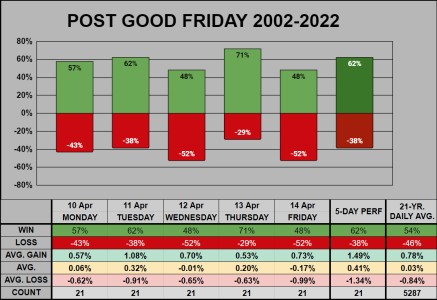

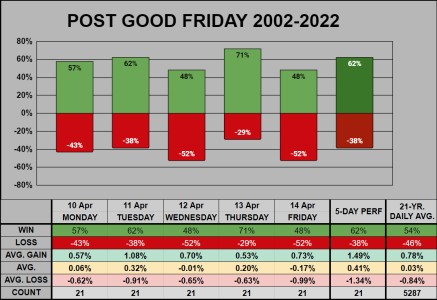

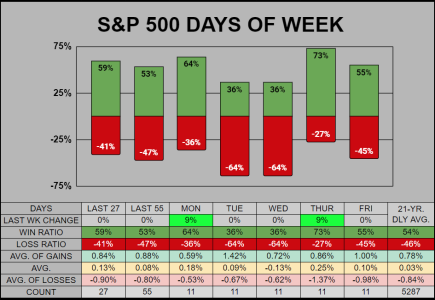

As per the usual, I completely forgot the Stock Market would be closed on Good Friday, thus I forgot to post some pre-holiday stats. These stats don't line up so well when compared to other major holidays that fall on a consistent day. From the past 21 years, 3 Good Friday's fell in March, while the rest fell in April.

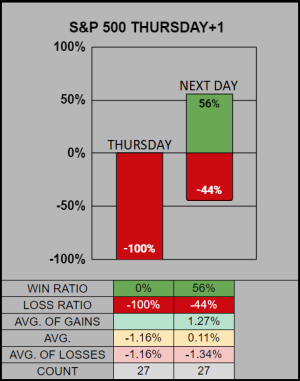

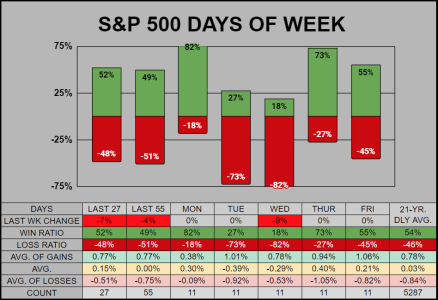

Overall, the week is above average, with Thursday having a 71% win ratio, and Tuesday having a 1.08% average (of all gains counted).

___

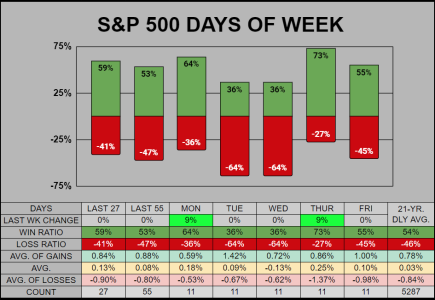

For the Day of Week stats, Mon/Thur look great, with Tue/Wed looking weak.

-- Last 8 of 11 days have closed up.

-- Last 3 Mondays closed up, last 6 of 7 closed up.

-- Last 4 Thursdays have closed up.

___

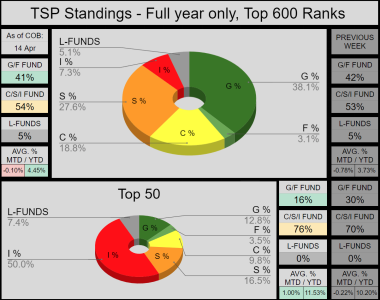

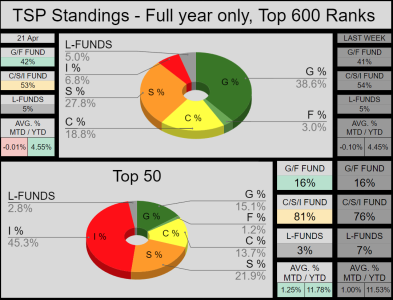

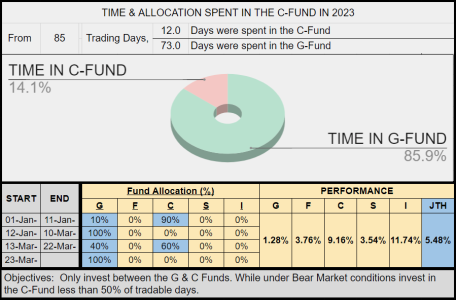

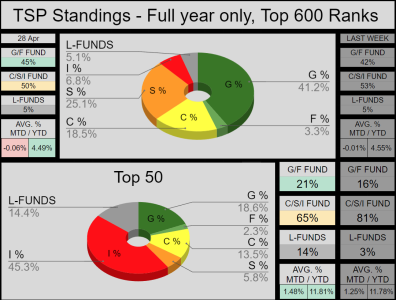

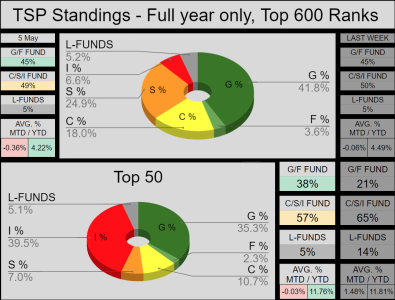

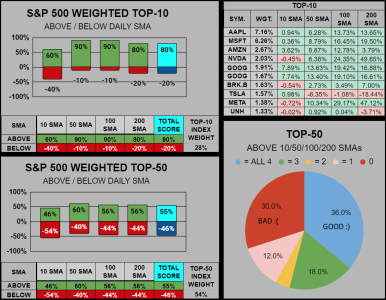

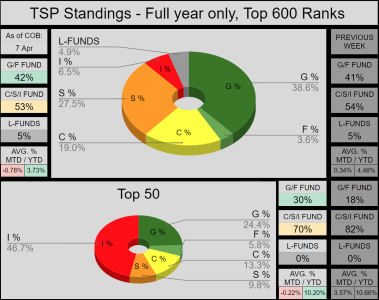

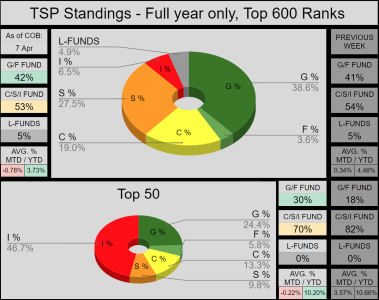

There was little change on the Top 600 participants, we lost -.73% last week. The top 50 lost -.46% last week, but also reduced their risk, with the CSI allocation average decreasing 12%. The I-Fund allocation is 46.7% maybe that's the smart money

Have a great week

As per the usual, I completely forgot the Stock Market would be closed on Good Friday, thus I forgot to post some pre-holiday stats. These stats don't line up so well when compared to other major holidays that fall on a consistent day. From the past 21 years, 3 Good Friday's fell in March, while the rest fell in April.

Overall, the week is above average, with Thursday having a 71% win ratio, and Tuesday having a 1.08% average (of all gains counted).

___

For the Day of Week stats, Mon/Thur look great, with Tue/Wed looking weak.

-- Last 8 of 11 days have closed up.

-- Last 3 Mondays closed up, last 6 of 7 closed up.

-- Last 4 Thursdays have closed up.

___

There was little change on the Top 600 participants, we lost -.73% last week. The top 50 lost -.46% last week, but also reduced their risk, with the CSI allocation average decreasing 12%. The I-Fund allocation is 46.7% maybe that's the smart money

Have a great week