felixthecat

TSP Analyst

- Reaction score

- 41

- AutoTracker

Re: Sunday: Bears take the lead

Smart move in my humble opinion. S&P was just shy of 4000 which was the selloff point before we begin the next leg down to the bottom. Also…on the inflation front they did not ask me what I thought…well take it from an old timer…inflation is kicking our butts. Eggs are now out of my price I’m willing to pay. Same for real butter. I cut back on meats and chicken. Honestly, I do better using coupons matching to make dollars go further. Wendy is a viable opportunity to spend $4 or $5 dollars to eat a meal with a drink. Yes, saving on gas but everything has gone up. It is all smoke and mirrors…inflation is still way to high and retail prices will stay high for the rest of 2023. Layoffs will be increasing and tougher times ahead. I swear…we are losing middle class folks by the day as consumers are stretched beyond their means. Sad situation unfolding.

Smart move in my humble opinion. S&P was just shy of 4000 which was the selloff point before we begin the next leg down to the bottom. Also…on the inflation front they did not ask me what I thought…well take it from an old timer…inflation is kicking our butts. Eggs are now out of my price I’m willing to pay. Same for real butter. I cut back on meats and chicken. Honestly, I do better using coupons matching to make dollars go further. Wendy is a viable opportunity to spend $4 or $5 dollars to eat a meal with a drink. Yes, saving on gas but everything has gone up. It is all smoke and mirrors…inflation is still way to high and retail prices will stay high for the rest of 2023. Layoffs will be increasing and tougher times ahead. I swear…we are losing middle class folks by the day as consumers are stretched beyond their means. Sad situation unfolding.

Good morning

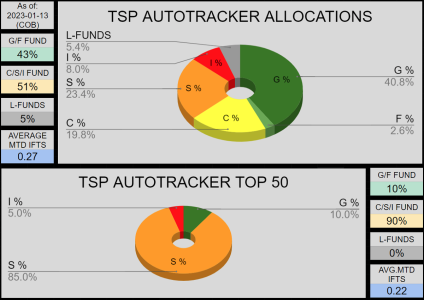

Fortunate to have exited above the 2 previous C-fund buys, as of today, I'm sitting 100G.

We do look to be getting ready for a 4th test of the 200 SMA (previous 3 failed), so perhaps the 4th time can carry us back to the NOV/DEC 4100 double top. As for myself, I'll wait for a lower entry, I certainly do not want to chase the rally I just exited, so I'll be cheering from the sidelines.

View attachment 56915