Whipsaw

Market Veteran

- Reaction score

- 239

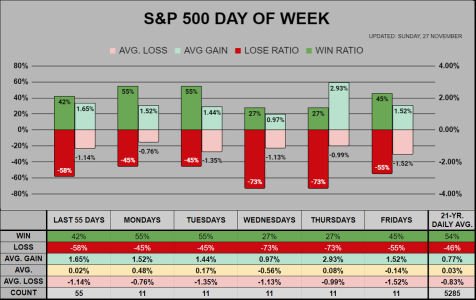

Wait... what? :1244: So, Wednesday was up, and now Friday is up, barely, with no gaps... At resistance at the moment, maybe we punch through on light volume? Not much time left. Worst case we're at a mini double top and we lose some ground next week. Not much I'm thinking as consumers should be out consuming. :nuts: