-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

JTH's Account Talk

- Thread starter JTH

- Start date

JTH, so far we have followed the course that you laid out: Monday will give us a positive close, but nothing special

Tuesday will give us a very strong close

Wednesday will be a continuation of Tuesday, but not as strong

Thursday will close down, but SPX will close the quarter up for the year

Friday is a mixed bag, so have any of your price objectives changed going into April? I'm still invested in 30% each C,S & I, 10% F. Thanks for the update.

Tuesday will give us a very strong close

Wednesday will be a continuation of Tuesday, but not as strong

Thursday will close down, but SPX will close the quarter up for the year

Friday is a mixed bag, so have any of your price objectives changed going into April? I'm still invested in 30% each C,S & I, 10% F. Thanks for the update.

JTH

TSP Legend

- Reaction score

- 1,158

JTH, so far we have followed the course that you laid out: Monday will give us a positive close, but nothing special

Tuesday will give us a very strong close

Wednesday will be a continuation of Tuesday, but not as strong

Thursday will close down, but SPX will close the quarter up for the year

Friday is a mixed bag, so have any of your price objectives changed going into April? I'm still invested in 30% each C,S & I, 10% F. Thanks for the update.

Thanks, I was wanting today to be stronger than what it is, but when compared to the previous 5 days, it is strong.

I can never predict with accuracy how these things play out. If the Markets close the quarter up (thus the year up) then I'm optimistic this will push more money into the markets, just like in March. Here's what I can say (historically speaking for the S&P 500) 4 of the 5 best weeks of the second quarter are in the April. The same does not hold true for W4500.

For today, I'll just be happy if we get a close above 2040, which recaptures 50% of the 1.7% retracement.

JTH

TSP Legend

- Reaction score

- 1,158

Lucky day for you! Good call. :smile:

Ha, you know I don't believe in luck, that's a dirty 4-letter word. Now I do believe in speculation, but that's an 11-letter word, which is much stronger than luck...

Damm W4500 is gonna outperform me...;swear

Cactus

TSP Pro

- Reaction score

- 38

Join the club. That's been the story of my life. This is going to be another 2014 for me.Damm W4500 is gonna outperform me...;swear

On a side note, it would be interesting to see a 5 year average for the people and systems on this site to see if anyone is actually doing better than Buy-N-Hold. I dare say that most of us aren't.

Join the club. That's been the story of my life. This is going to be another 2014 for me.

On a side note, it would be interesting to see a 5 year average for the people and systems on this site to see if anyone is actually doing better than Buy-N-Hold. I dare say that most of us aren't.

im buy n hold and in the hole a bit

Tsunami

TSP Pro

- Reaction score

- 62

On a side note, it would be interesting to see a 5 year average for the people and systems on this site to see if anyone is actually doing better than Buy-N-Hold. I dare say that most of us aren't.

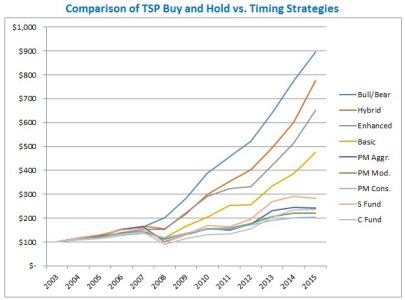

Count me in the club that hasn't beaten buy & hold. But I've been crunching data for over a year now on a way to permanently fix that. One person that I know is beating buy & hold is Intrepid Timer, he'd have to confirm it but since 2008 I think he's averaged being near the top 20% in the tracker. As for the mechanical systems I've been developing, here's a chart of how they performed from 12/31/2003 through 2015. The "bull/bear" strategy would have averaged being in the top 13% in the tracker, with a CAR of an amazing 20.04% (thanks in part to avoiding over 40% of the losses of the 08-09 bear market). The "PM" systems are Paul Merriman's recommended conservative/moderate/aggressive buy & hold portfolios for the TSP which you can Google. They're not great either. The four systems above that are mine...and of course I had to torture myself and calculate where my TSP would be if I'd been following it since 2003...a very painful exercise indeed...I had $141K on 12/31/03...and as of now, contributions included, if I'd followed the "bull/bear" strategy verbatim my account would have gone over $2 million this week with that cumulative annual return of just over 20%/year....gulp. I read that there are only something like 3,500 people with TSP accounts over $1 million...where would $2 million rank?!

I'm following that bull/bear system now, but it's on a bear market signal so it's painful to miss out on this big rally sitting in the F fund, and of course I had to go and try and time the market twice so far this year and screw it up both times...and if 2135 is exceeded I'll have to concede it was a false signal last summer when it flipped to bear market rules and I'll go back to the "Hybrid" strategy, which ain't too shabby either...it's up 12.38% this year as of today...I'm still working on making all this available to anyone that wants to see it and consider using it, I'm sure many are interested...I've bought a website domain for it, two in fact since it can also be done with ETFs so I'm working on that angle too...it's a ton of work, and I'm aiming for year-end at the latest to get it going as a retirement hobby.

One thing it's proved to me is that it's a very bad idea to leave the TSP when you retire, so I think Greg Long will be happy with me when I post that LOL....the "basic" and "enhanced" strategies take just 9 IFT's per year, the Hybrid and Bull/Bear are no more than 15 IFT's/year....totally mechanical except for the bull/bear market signal thing, which can be ignored if using the other strategies...I've already got the future IFT dates mapped out through the year 2020...and I'm confident it will continue to beat buy and hold...no guarantees of course, have to add that disclaimer...Stay tuned.

FAB1

Market Veteran

- Reaction score

- 34

Today is looking pretty strong to me. S fund is really kicking up!

Good call! :smile:

:aargh4: Woe! Woe! Woe! All Ye who gained in stocks yesterday will lose it today! Woe! Woe! Woe is you! :ban:

JTH

TSP Legend

- Reaction score

- 1,158

Nevermind me

I am just practicing to be a Harbinger of DOOM!!! :Flush:

Lol, I told everyone to stick it out...

Lol, I told everyone to stick it out...

Hi JTH!

I still have some dry powder to invest. What is your take going forward to April. Are we too overbought or are there a significant amount of underinvested people to fuel this rally into April? Maybe we get a pullback to end this Fed-inspired rally?

FAB1

Market Veteran

- Reaction score

- 34

Lol, I told everyone to stick it out...

:haha:

Sheer projection of my selfish desire.

If stock gains hold today - my F fund is bound to go down.

backlash.

Cactus

TSP Pro

- Reaction score

- 38

Oh yeah? Can you beat my contrarian indicator (Cactus' Reverse And Profit)?

Here are the 2016 returns through yesterday:

[TABLE="width: 150"]

[TR]

[TD]Cactus

[/TD]

[TD]CRAP

[/TD]

[/TR]

[TR]

[TD](5.62%)

[/TD]

[TD]7.57%

[/TD]

[/TR]

[/TABLE]

For me it is 2014 all over again.

Here are the 2016 returns through yesterday:

[TABLE="width: 150"]

[TR]

[TD]Cactus

[/TD]

[TD]CRAP

[/TD]

[/TR]

[TR]

[TD](5.62%)

[/TD]

[TD]7.57%

[/TD]

[/TR]

[/TABLE]

For me it is 2014 all over again.

JTH

TSP Legend

- Reaction score

- 1,158

Hi JTH!

I still have some dry powder to invest. What is your take going forward to April. Are we too overbought or are there a significant amount of underinvested people to fuel this rally into April? Maybe we get a pullback to end this Fed-inspired rally?

I don't see you on the tracker, so it would be difficult for me to answer your question, since I don't know how you're positioned or where you've been. I'll be posting April's blog over the weekend.

JTH

TSP Legend

- Reaction score

- 1,158

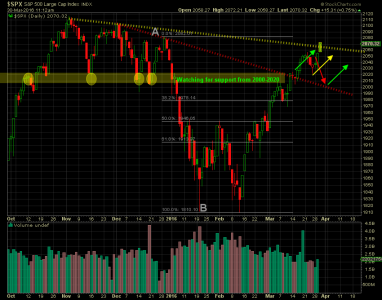

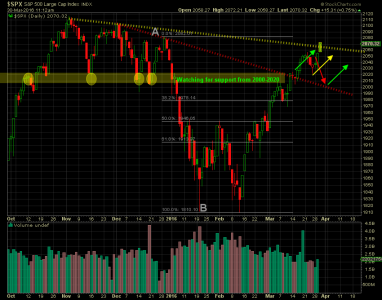

Best estimate I can give you. We will not close above 2065 today, meaning we will not close above the upper descending yellow trendline. IMHO, markets do not like to give us validation on the first try, they like to leave us hanging, wondering & pondering the age old question, "what will price do next?"

FAB1

Market Veteran

- Reaction score

- 34

Oh yeah? Can you beat my contrarian indicator (Cactus' Reverse And Profit)?

Here are the 2016 returns through yesterday:

[TABLE="width: 150"]

[TR]

[TD]Cactus

[/TD]

[TD]CRAP

[/TD]

[/TR]

[TR]

[TD](5.62%)

[/TD]

[TD]7.57%

[/TD]

[/TR]

[/TABLE]

For me it is 2014 all over again.

I hereby bequeath you with the Golden Flush Award. :Flush:

May the remainder of 2016 see you catch up with CRAP (in a good sense, ok?)

Similar threads

- Replies

- 0

- Views

- 80

- Replies

- 0

- Views

- 82

- Replies

- 0

- Views

- 102

- Replies

- 1

- Views

- 213