jpcavin

TSP Legend

- Reaction score

- 97

Going out with some friends for dinner & drinks.

That green neckline continues to hold my interest.

View attachment 37708

Neck up or neck down? :laugh:

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

Going out with some friends for dinner & drinks.

That green neckline continues to hold my interest.

View attachment 37708

So....where do you think it's headed, up or down? :blink: My guess is up. Don't kill my mojo.

My opinion is this rally still isn't out of the woods until SPX breaks and holds above 2082, needs to break that to get out of this long-term downtrend. JTH is probably more qualified than I am though, but that's just my thoughts

I'm just trying to will the markets higher with my Qi.

Ok, well...I'm happy I am mostly in C and not in the other equity funds. :blink:

I see you exited to the sidelines, this might be my best opportunity to narrow the gap between us on the ark...

I read Tom's daily column and the SPX seems to be following the typical behavior from the H&S pattern.

Plenty of support below for it but not so much the S & I funds. I think waiting for a breakout over the middle of the "head" line is a good strategy (besides I am stuck with no IFTs anyway)

=^___^=

I'm just trying to stay ahead of Whipsaw. I guess it's good to have a goal.Good luck with that! :laugh:

Where do you think the market will go next week? GDP is up, but seems like stock prices haven't been following fundamentals for some time

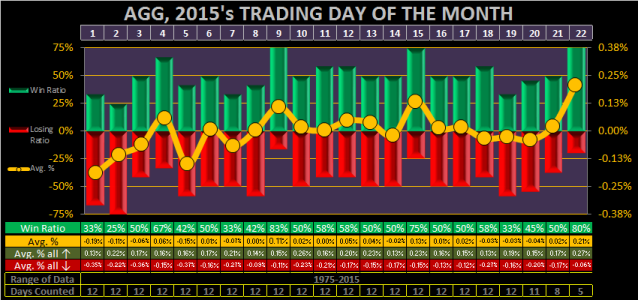

The results show SPX has an edge over W4500, and AGG is an abomination...

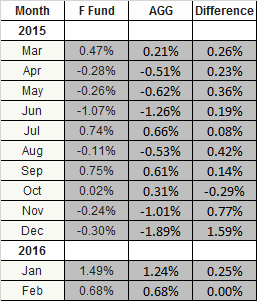

Doesn't AGG typically have a dividend payout on the 1st of the month? I could see how that could contaminate the 3-day stat near the beginning/end of a month. Any thoughts?

Well, I made an attempt to do a Good Friday stat, but there's just too much to do in one session, and with this being a March/April holiday, I would have had to be extra careful to produce the right results, so I quit. Instead I've opted to rebuild the filter on the 3-day price performance stats, so I can get to them quickly each month.

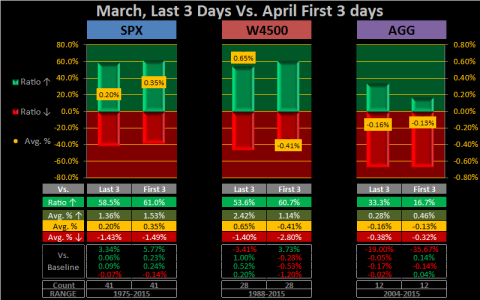

Here's the last 3 days of March Vs. the first 3 days of April (helping the reader decide if they want to gut it out invested as we enter the new month).

The results show SPX has an edge over W4500, and AGG is an abomination...

View attachment 37740

With those stats on F fund, wondering I should exit it on Monday....

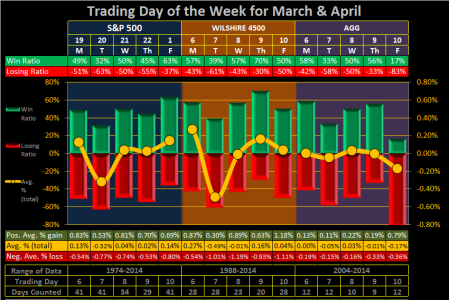

Well, either I'm wrong, or the forum seems overly bearish to me. Trading day 20 (this Tuesday) is statistically the worst trading day of the March, and while the last 3 Tuesdays have closed down, they were each a short-term bottom off the 30-day rally. Aside from that, the last time I did a Day-of-Week stat was on 27 Feb and at that time, Tuesday had a 69% winning ratio. In addition, I have 2 systems in the C-Fund and I consider myself to be the 3rd system (also in the C-Fund). We are all in agreement, to be invested next week.

If I had a choice:

Monday will give us a positive close, but nothing special

Tuesday will give us a very strong close

Wednesday will be a continuation of Tuesday, but not as strong

Thursday will close down, but SPX will close the quarter up for the year

Friday is a mixed bag

But to be fair, I'm going against the daily stats on this one...