Mcqlives

Market Veteran

- Reaction score

- 24

Im in the ALPAFS camp...but, referencing your blog post (I cut and pasted it below) we had both of these happen today! I wish this market would pick a direction for more than a couple of days...but the swings are getting the buyers and sellers sorted out. Just which ones will prove to be right? I would love these swings if we had more moves but, as it is, we are trading as if we were handcuffed, blindfolded, and then told to throw the dart at the balloon!

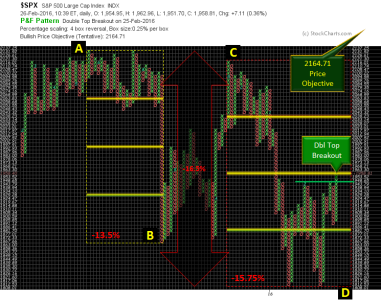

__The Bears need to break below 1902's tweezers bottom to begin filling the open gaps at 1895.77 & 1864.73

__The Bulls, need to break above 1930 and make a run for the previous 1940 double top

Happy Trading all!

__The Bears need to break below 1902's tweezers bottom to begin filling the open gaps at 1895.77 & 1864.73

__The Bulls, need to break above 1930 and make a run for the previous 1940 double top

Happy Trading all!