burrocrat

TSP Talk Royalty

- Reaction score

- 162

Whew! At first I thought you said two booms and three busts...read it again and saw that it was three booms. All in on Monday!

uhhh, i don't think that is a very good idea...

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

Whew! At first I thought you said two booms and three busts...read it again and saw that it was three booms. All in on Monday!

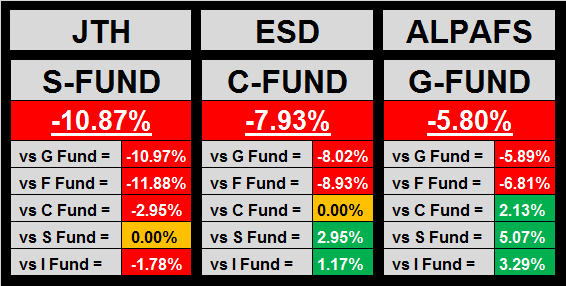

Nothing like having your worst yearly start ever!

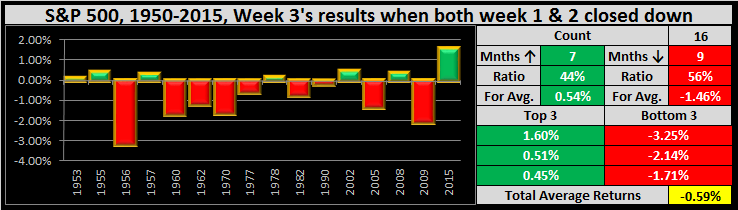

Trading the Stats:**Week 2

View attachment 36615

View attachment 36616

Huh! It's striking that 20 of the worst Week 1 starts occurred in just the last 39 years. Not sure what that means exactly, but more than half are among the worst ever. That says something! Market character has obviously become more volatile as compared to pre-1977.

My bad, I should have reflected the time range on that chart, like I usually do. Actually, the data reflected in that chart just covered 1975-2015, I listed the bottom 20 from that period only. I try to use only the most recent 41 year data, to keep the data more current, since trends change over long periods of time. Having said this Week 1 of 2016 is the worst week 1, going back to 1950.

That is one butt ugly chart JTH!!

Sometime line charts can give you a different perspective..Here's one for the SPX...

After reviewing the chart....GUESS NOT!!!!

FS

I agree. I think that this situation will only continue down in a spiral. I started to bail last week but stayed in due to one of the service I use. Even the best of the best are getting it wrong this time. I am starting to believe we will see 1600 on the S & P this year maybe sooner than later. The Fed could make a statement to try to smooth things over but are really out of ammunition to help what looks like it could be the start of something bigger than a recession. It's hard to make a decision on when to bail out because of our limitations and end of day prices. Good luck to those of us that are on the pain train.

Maybe we can all write emails, daily, to Mr. Long and complain about this change to the TSP, where they limit our trades.

I have not looked, but is there an email for this guy? Something should be done, I lost all my earnings for 2015 between 12/24 and 1/7/16, that sucks.

I had been doing pretty good all year, shoot, I was in the top 50 for a little while. Oh well, a lot of work to do to get that money back.

Not sure if this has been done, the emailing the guy, but it sure as heck would be a good thing to do. I wish they would give us at least 10 trades a month.

Anyways, thinking out loud.

Good luck everyone,

Boricua

minus 3% then plus 3% intraday to break even with no way to trade it in our time-delayed tsp accounts? that bites. i hope that wasn't the relief rally right there. does anybody have a good reason why the market changed course or is it just magic?