-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

JTH's Account Talk

- Thread starter JTH

- Start date

JTH

TSP Legend

- Reaction score

- 1,158

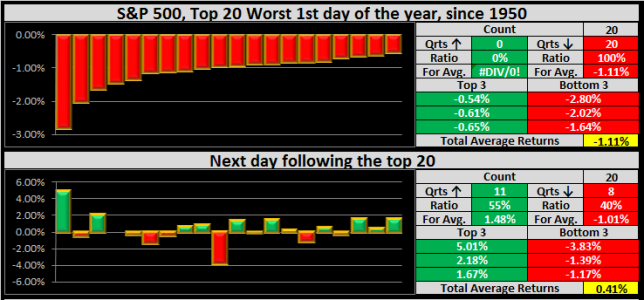

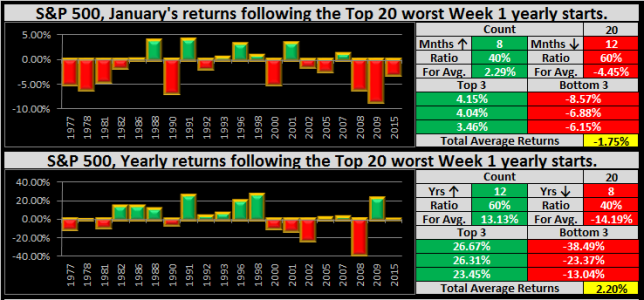

For those of you who read the stats posted in my blog.

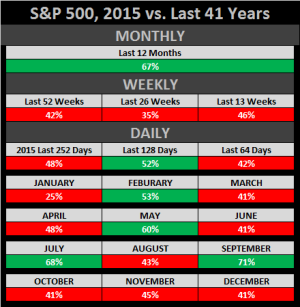

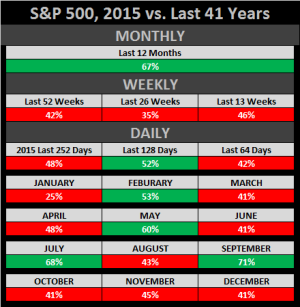

As previously mentioned, 2015 was not a good year when aligned side-by-side with statistics. I've reviewed how my stats matched up with 2015, by comparing 2015's results, with the results of the statistical average returns I post. Theoretically speaking, if 2015 had been a good year, then we would have seen more green.

Posted below is the percentage of time 2015 traded in the same direction of the statistical average gains over the past 41 years. I consider this further evidence the markets aren't operating under healthy conditions.

As previously mentioned, 2015 was not a good year when aligned side-by-side with statistics. I've reviewed how my stats matched up with 2015, by comparing 2015's results, with the results of the statistical average returns I post. Theoretically speaking, if 2015 had been a good year, then we would have seen more green.

Posted below is the percentage of time 2015 traded in the same direction of the statistical average gains over the past 41 years. I consider this further evidence the markets aren't operating under healthy conditions.

JTH

TSP Legend

- Reaction score

- 1,158

I've heard Youtubers mention the Bull Flag on the S&P 500. From my perspective, I'd rather call it a descending parallel price channel, since it’s large in price & long in time. This same pattern is not present on the Wilshire 4500, TRAN, nor NDX. At this point (with the lower highs & lows, I’m more inclined to believe we’ll tag the 1840 Price objective, then breach new highs above.

JTH

TSP Legend

- Reaction score

- 1,158

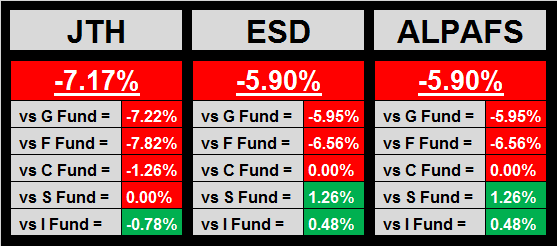

For myself, I'm going to continue to ride out this disaster of a yearly start, and seek to gain an edge later in the month.

JTH-ESD will hold in the C-Fund and not make its scheduled move into the S-Fund today, I'm delaying this signal because the C-Fund is out-performing the S-Fund.

JTH-ALPAFS is holding in the C-Fund (too late in the game to make an exit)

JTH-ESD will hold in the C-Fund and not make its scheduled move into the S-Fund today, I'm delaying this signal because the C-Fund is out-performing the S-Fund.

JTH-ALPAFS is holding in the C-Fund (too late in the game to make an exit)

For myself, I'm going to continue to ride out this disaster of a yearly start, and seek to gain an edge later in the month.

JTH-ESD will hold in the C-Fund and not make its scheduled move into the S-Fund today, I'm delaying this signal because the C-Fund is out-performing the S-Fund.

JTH-ALPAFS is holding in the C-Fund (too late in the game to make an exit)

Ol' sticky-pants Birch would be mighty proud!

JTH

TSP Legend

- Reaction score

- 1,158

Ol' sticky-pants Birch would be mighty proud!

Agreed, but we're already at, or near a point where I should be "fading the rallies" scalping (not investing). This current passive strategy has not been panning out for me, I'm fixing to get aggressive, seeking to be invested less than 50% of the time. I'm going to give it a bit more time, but there comes a point where if you step in sh!t, it looks like sh!t, smells like sh!t, then it's exactly what you think it is...

BuddyAnalog

First Allocation

- Reaction score

- 0

That would explain why the sticky pants are getting sticky on both sides.

JamesE

TSP Strategist

- Reaction score

- 4

Ol' sticky-pants Birch would be mighty proud!

Speaking of which, I know I'm a little out of tune lately, but what happened to Birch??

Intrepid_Timer

TSP Talk Royalty

- Reaction score

- 79

Nothing like having your worst yearly start ever!

You and me both. It's actually quite embarrassing................

DreamboatAnnie

TSP Legend

- Reaction score

- 847

Well.... All you can do is try your best. Sometimes lose and sometimes win. Market is pretty tough right now...in 8th year now since 2008. Time to re-think strategies and system settings.You and me both. It's actually quite embarrassing................

Best wishes to everyone!!!! :smile: ....and try to keep smiling...this too shall pass.

Well.... All you can do is try your best. Sometimes lose and sometimes win. Market is pretty tough right now...in 8th year now since 2008. Time to re-think strategies and system settings.

Best wishes to everyone!!!! :smile: ....and try to keep smiling...this too shall pass.

Is it a lock-in that the C fund will likely keep outperforming the S fund for a long, long time; or will the S fund recover soon and surpass the C fund? Which behaves better under the pressure of lower oil prices? Anyone?

Tsunami

TSP Pro

- Reaction score

- 62

Is it a lock-in that the C fund will likely keep outperforming the S fund for a long, long time; or will the S fund recover soon and surpass the C fund? Which behaves better under the pressure of lower oil prices? Anyone?

In my opinion, the long underperformance of small and mid-caps is setting them up to outperform large caps once the next bull market gets underway. When is that?...who knows, I'm hoping no later than October of this year.... for anyone that's into TA, here's a great webinar I watched this morning...the 2nd half is a presentation by Tom McClellan and he lays out his roadmap for the rest of this year. I think there's a decent chance it pans out pretty much like he says...

https://vimeo.com/channels/sccwebinars/151250013 (quite long, but worth it in my opinion...just skip the first 50 minutes or so if you want to jump to McClellan)

P.S. - Most of what I'm reading tells me oil (and commodities in general) are at or near a major bottom here. Gold/silver have already bottomed.

In my opinion, the long underperformance of small and mid-caps is setting them up to outperform large caps once the next bull market gets underway. When is that?...who knows, I'm hoping no later than October of this year.... for anyone that's into TA, here's a great webinar I watched this morning...the 2nd half is a presentation by Tom McClellan and he lays out his roadmap for the rest of this year. I think there's a decent chance it pans out pretty much like he says...

https://vimeo.com/channels/sccwebinars/151250013 (quite long, but worth it in my opinion...just skip the first 50 minutes or so if you want to jump to McClellan)

P.S. - Most of what I'm reading tells me oil (and commodities in general) are at or near a major bottom here. Gold/silver have already bottomed.

Okay, I'll bite - what is the Reader's Digest version of Mr. McClellan's outlook?

burrocrat

TSP Talk Royalty

- Reaction score

- 162

Okay, I'll bite - what is the Reader's Digest version of Mr. McClellan's outlook?

boom. then bust. then some more boom, but just a little bit. then more bust. after that more boom.

Tsunami

TSP Pro

- Reaction score

- 62

Okay, I'll bite - what is the Reader's Digest version of Mr. McClellan's outlook?

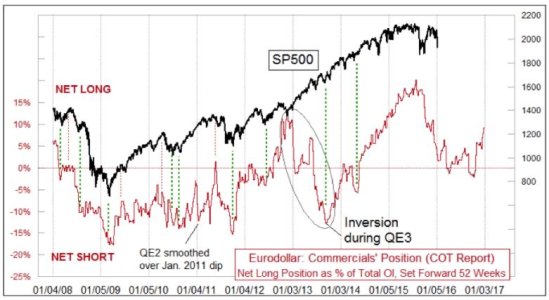

That basically it will follow the highs and lows on this chart, which I snipped from the presentation...it's freely available so I can post it...but if you look back at the last few years you can see that you certainly can't rely on this chart at all (at least for the short-term squiggles)...but regardless, he expects a low very soon, maybe yesterday...a rally into Feb/Mar...a lower low in early April...rally into the summer...then another big fall into October...then year-end rally. Play that like a fiddle and you can be #1 in the tracker.

boom. then bust. then some more boom, but just a little bit. then more bust. after that more boom.

Whew! At first I thought you said two booms and three busts...read it again and saw that it was three booms. All in on Monday!

That basically it will follow the highs and lows on this chart, which I snipped from the presentation...it's freely available so I can post it...but if you look back at the last few years you can see that you certainly can't rely on this chart at all (at least for the short-term squiggles)...but regardless, he expects a low very soon, maybe yesterday...a rally into Feb/Mar...a lower low in early April...rally into the summer...then another big fall into October...then year-end rally. Play that like a fiddle and you can be #1 in the tracker.

View attachment 36618

Thanks, Tsunami. I like McClellan's thoughts that the low may already be afoot.

T

Similar threads

- Replies

- 0

- Views

- 84

- Replies

- 0

- Views

- 85

- Replies

- 0

- Views

- 106

- Replies

- 1

- Views

- 213