RealMoneyIssues

TSP Legend

- Reaction score

- 101

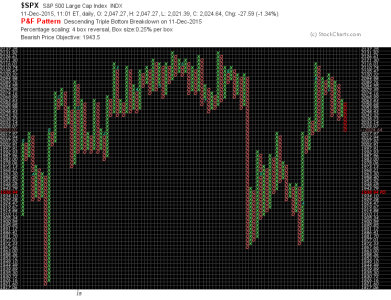

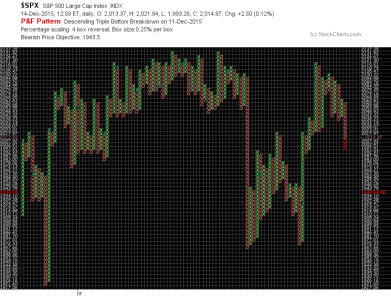

True dat, I've given up on looking for rational reasons for the market's direction, but as ESD and the stats have pointed out, there is a traditional seasonal dip during this time of the month, and I expect we'll get a bottom here very soon.

Instability in the market all year... Knee jerk reaction to everything...

Sent from my (Daughter forcing me to use an) iPhone using Tapatalk...