JTH

TSP Legend

- Reaction score

- 1,158

I love all of you, you're such a great group of people!

IFT EoB Today from 100C to 100S (My account)

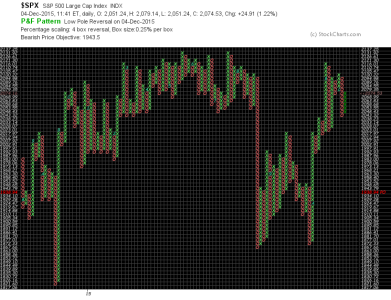

I'm going to follow the stats from my most recent blog, and chase performance in the S-Fund. Below is a price comparison chart of the S&P 500 vs. the Wilshire 4500, with a 20SMA. We can see the most recent price action is favoring the small caps.

View attachment 36073

I am an idiot, I completely forgot to login to TSP.gov and perform an "Actual IFT" :1244: