This has been a big year for divergences, so much so that I'm at the point where I only care what fund I'm in and if it's making money. The pullback everyone has been calling for has yet to materialize, I made 3.85% this month and still managed to vastly under-perform the majority on the monthly tracker.

I still contend this is the best time of year to be invested.

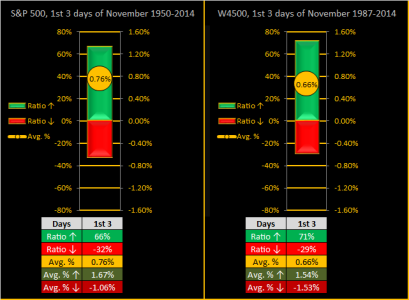

Trading the Stats:***Week 44[/QUOTE

JTH,

Can you please explain the fundamental reasons why small caps should now do better than large caps or the SPX going forward? I will appreciate your help in clarifying this. In addition to valuation, and the relative strength of the dollar, what other factors favor weighing more toward small caps than large caps? Tia.

Hi Airlift

I've never said I expect the small caps to do better going forward. I did say in my blog that I expect that to happen next year, mostly due to the under performance of investors and the fact most hedge funds are going to dress their portfolios at the end of the year.

Statistically speaking, small caps outperform large caps in the 3rd quarter. At some point in time a rotation will take place, but until it does, I'm inclined to follow the current trend until it is broken.