FAB1

Market Veteran

- Reaction score

- 34

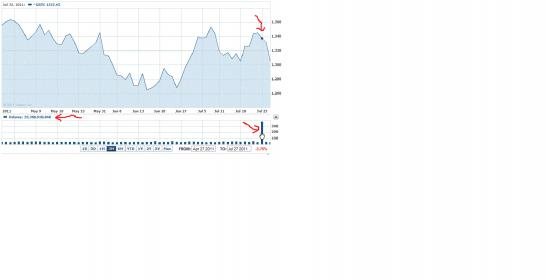

I was dying to jump in today but I am also looking at some ROC measurements and the momentum of decline is not giving me any good vibes. I am waiting for advance warning of market reversal before I jump in. Hopefully it turns around for everyone's sake.

Youre not in yet?? Maybe too late now, could be a 6% jump tomorrow, Jp. Lol.