So... in the premium threads, I saw a discussion about "How could the Bureau of Labor Statistics be off by 11 million jobs???"

That was friday. Today, there are a couple of good articles floating around saying that it isn't necessarily as good as people thought- it may be nothing more than some readjusting, and incorrect classifying that happened, just because it's trying to figure out what it is. Remember, the businesses and the states that are juggling this are still trying to figure out what the economy is doing.

Good article here:

https://finance.yahoo.com/news/may-...autious-optimism-morning-brief-101134754.html

It says the real unemployment number is likely to be 16%, not the 13% reported. The problem is the way non-working people were reported by companies, in the absence of detailed guideance.

For example, the article makes these points:

"

The BLS cautioned that due to the COVID-19 lockdowns, many survey respondents identified themselves as “employed but absent due to other reasons,” when they should more accurately be identified as “unemployed on temporary layoff.” This is not a new issue. According to the BLS, had these respondents been more accurately recorded, “the overall unemployment rate would have been about 3 percentage points higher than reported.”

The labor participation rate also plunged in May, meaning the actual unemployment rate could very well be 20% instead of the 13% reported- so we best wait another month or two for things to shake out before understanding where we really stand.

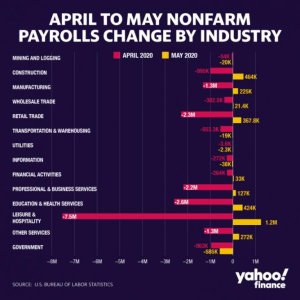

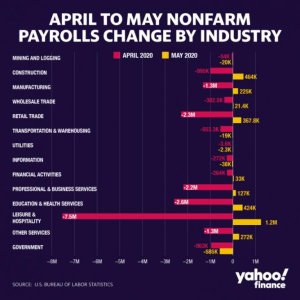

Now-here is a good set of pictures that explains a lot to me: (Kudo's to the graphic creation department- you guys rock).

You see that big drop of over 7.5 million jobs lost in April, and then 1.2 million back to work in May? Think about that. That's the 7.5 million laid of when everything shut down. Hardly anybody worked at all in April in the Leisure and hospitality industry! Think about shut down airlines flying empty airplanes, and Casinos in Vegas closed. Well, yes, we may have gotten a few hotels back open again in May- but I would venture to guess that some of those employees are called back only because it is part of the terms of the loan- that if they are kept on until August, the paycheck protection loans will turn into grants for those employers. And some of them are affected by that extra $600 in federal cash to stay laid off, too. Employment of who is, and who is not, working, is going to be artificially affected for a while.

If things aren't considerably improved by the time the money runs out, and if there isn't any more stimulus added, then I fear those folks who ARE working today, will be quickly dropped off the rolls of the employed again, and may show up in October UN-employment lines and figures.

It's going to be a bumpy ride, without a good clear direction for some time to come. Keep your fingers crossed that we're past the hard part.