Does anyone remember that last sell off? You know, the one where the market was poised to fall off a cliff? Yeah, that one. How long ago was that again? Seven trading days!

And in just seven trading days the S&P 500 is up about 13.5% from its intra-day low on the 4th of October to its intra-day high today.

But let's put this in perspective. If one had bought this market on Oct. 4th when the S&P 500 had bottomed out around 1075, you would have a buy in price of about 1124. If you sold today at 1207, you would have a gain of about 7.4%. But if you waited just one more day to buy this market (Oct 5th; remember, the rally started late in the afternoon of the 4th), then your buy in price would have been about 1144 and selling today would give you a gain of about 5.5%.

My point is simply that in spite of the big numbers the market has put up, it would have been very difficult to capture more than about half of the overall gains the media likes to use for their headlines. Just because the S&P 500 is up 13.5% doesn't necessarily mean we had a shot at a gain of 13.5%. The very best we could have done was buy on the 3rd of October when the S&P closed around 1099. Buying at that level and selling today would have netted 9.8%.

Yes, there was some opportunities to grab some nice gains this past week, but those TSP limitations can really temper our market gain potential.

So on the day, the market tacked on more gains on light volume and it's still taking its cues from Europe. Along those lines, financials have been one of the sectors most favored of late, as concern over European banking risk is beginning to diminish as plans to shore up financial services appears to be taking shape.

On the home front, the FOMC minutes were posted and they offered no additional insight about economic conditions or monetary policy.

And the Seven Sentinels have flipped to an official buy condition as NYMO closed at a fresh 28 day trading high. You know the market must have been ready to fall off a cliff when it takes huge market gains to flip this system back to a buy condition.

Here's the charts:

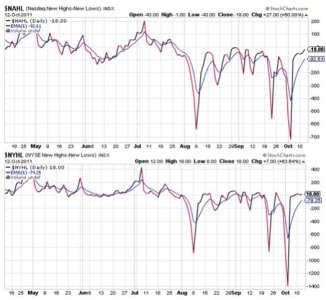

NAMO and NYMO are reaching multi-month highs after today and NYMO easily tagged a new 28 day trading high.

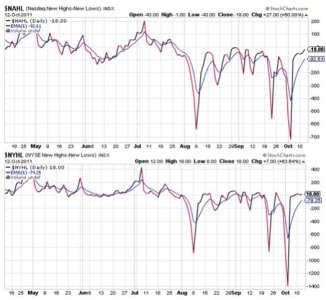

NAHL and NYHL remain on buys, but continue to track in a tight range.

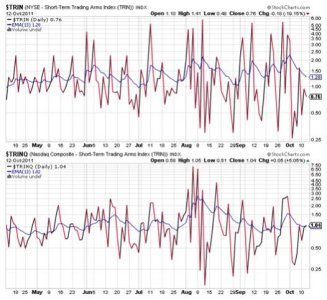

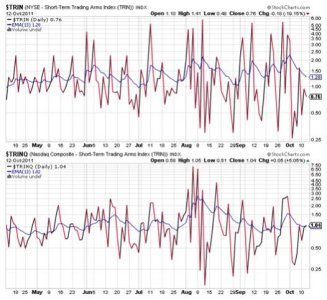

TRIN remained on a buy today, while TRINQ flipped to a sell (barely).

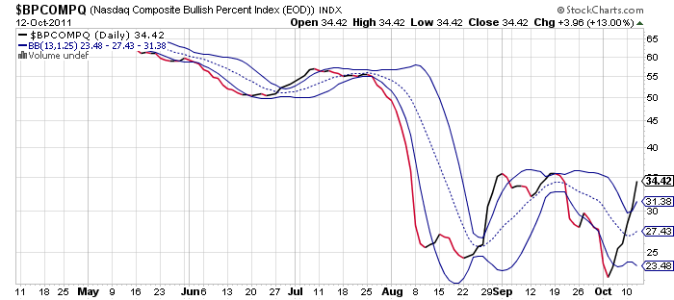

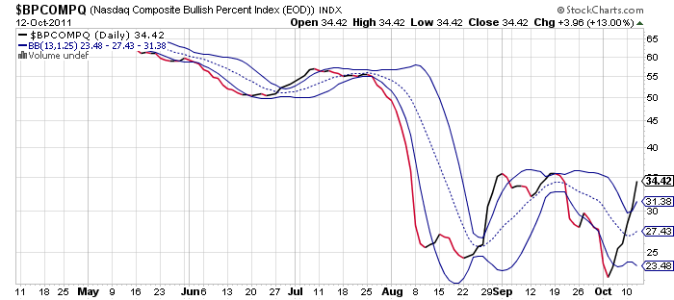

BPCOMPQ is taking off and pulling away from that upper bollinger band. It obviously remains in a buy condition.

For the past month or so, many professionals had been talking about an end of year rally. But I'm starting to think it's already here, which makes me wonder what the fourth quarter really has in store for us. I'm not trying to be bearish here, but this market is doing a great job of being weeks, if not months ahead of most professional opinions. And with the kind of volatility we've been getting, it seems the powers that be are perfectly willing to let the big money take control of this market and leave the little guy on the sidelines. After all, the banks don't need us any more. Why should Wall Street?

It just doesn't feel like investing any more does it? Maybe it's about time the NYSE moved to Las Vegas.

And in just seven trading days the S&P 500 is up about 13.5% from its intra-day low on the 4th of October to its intra-day high today.

But let's put this in perspective. If one had bought this market on Oct. 4th when the S&P 500 had bottomed out around 1075, you would have a buy in price of about 1124. If you sold today at 1207, you would have a gain of about 7.4%. But if you waited just one more day to buy this market (Oct 5th; remember, the rally started late in the afternoon of the 4th), then your buy in price would have been about 1144 and selling today would give you a gain of about 5.5%.

My point is simply that in spite of the big numbers the market has put up, it would have been very difficult to capture more than about half of the overall gains the media likes to use for their headlines. Just because the S&P 500 is up 13.5% doesn't necessarily mean we had a shot at a gain of 13.5%. The very best we could have done was buy on the 3rd of October when the S&P closed around 1099. Buying at that level and selling today would have netted 9.8%.

Yes, there was some opportunities to grab some nice gains this past week, but those TSP limitations can really temper our market gain potential.

So on the day, the market tacked on more gains on light volume and it's still taking its cues from Europe. Along those lines, financials have been one of the sectors most favored of late, as concern over European banking risk is beginning to diminish as plans to shore up financial services appears to be taking shape.

On the home front, the FOMC minutes were posted and they offered no additional insight about economic conditions or monetary policy.

And the Seven Sentinels have flipped to an official buy condition as NYMO closed at a fresh 28 day trading high. You know the market must have been ready to fall off a cliff when it takes huge market gains to flip this system back to a buy condition.

Here's the charts:

NAMO and NYMO are reaching multi-month highs after today and NYMO easily tagged a new 28 day trading high.

NAHL and NYHL remain on buys, but continue to track in a tight range.

TRIN remained on a buy today, while TRINQ flipped to a sell (barely).

BPCOMPQ is taking off and pulling away from that upper bollinger band. It obviously remains in a buy condition.

For the past month or so, many professionals had been talking about an end of year rally. But I'm starting to think it's already here, which makes me wonder what the fourth quarter really has in store for us. I'm not trying to be bearish here, but this market is doing a great job of being weeks, if not months ahead of most professional opinions. And with the kind of volatility we've been getting, it seems the powers that be are perfectly willing to let the big money take control of this market and leave the little guy on the sidelines. After all, the banks don't need us any more. Why should Wall Street?

It just doesn't feel like investing any more does it? Maybe it's about time the NYSE moved to Las Vegas.