Since it was the 1st of the month, it shouldn't have been a surprise that the market gapped higher to begin the trading day. That's been fairly typical action for some time. What wasn't typical was the selling pressure that came after the early run higher.

Oil jitters continue to play a role in market activity as geopolitical uncertainty surrounding the Middle East and North Africa continue. In fact, oil prices moved higher by 2.7% to settle at $99.63 per barrel, which was a two-year closing high. News reports had it that Saudi Arabia sent tanks into neighboring Bahrain to help quell social unrest. Saudi Arabia itself is nervous of possible protests within its borders and their stock market revealed those concerns as their stock market dove 7%.

In market data today, the February ISM Manufacturing Index tagged a multi-year high of 61.4, which was higher than expected, but January construction spending declined 0.7%, which was a tad more than anticipated.

By the end of the trading day the major averages took significant losses, with the S&P dropping 1.57%, while the Wilshire 4500 was hit for a 1.82% loss.

Here's today's charts:

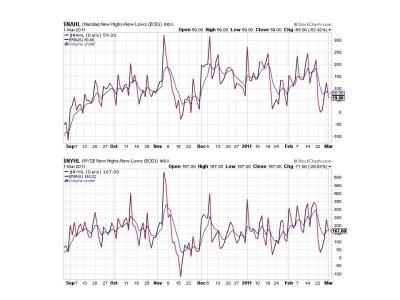

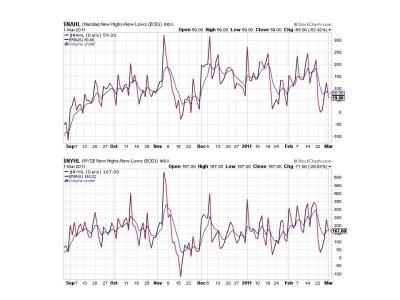

Surprisingly, NAMO and NYMO didn't fall as much as one might have expected given today's losses. But they are both now flashing sells.

NAHL flipped to a sell, while NYHL barely remained on a buy.

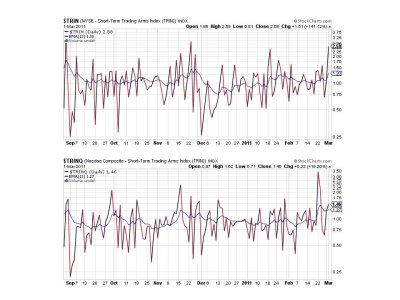

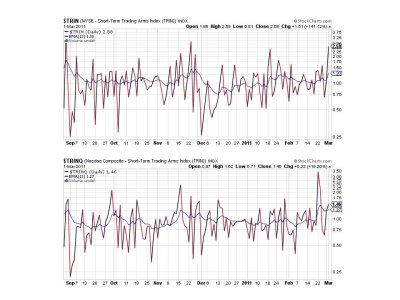

TRIN spiked much higher and suggests today's losses were overdone, while TRINQ posted a much more tame reading. Both are flashing sells.

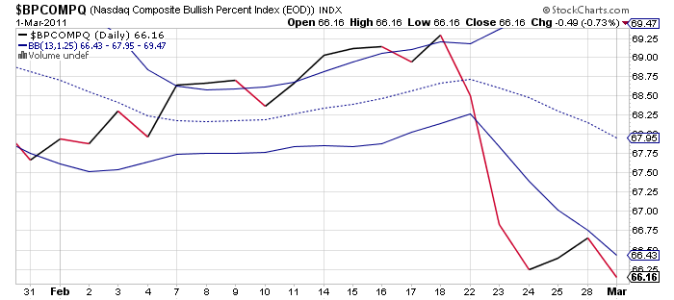

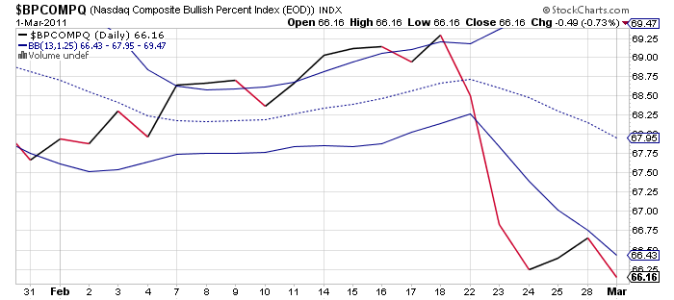

BPCOMPQ dipped lower on today's action, but is not far from that lower bollinger band. If it can cross back up through it this signal will flip back to a buy.

So the system remains on buy and the market is oversold. A bounce should be near, but geopolitical uncertainty could temper any rally. Especially if oil continues its march higher (something that's actually expected right now). Liquidity remains at high levels, so selling pressure "should" be somewhat contained, but I wouldn't necessarily bet the farm on that. Should institutional money managers decide to go into distribution, things could get real ugly, real fast. So far that's not the case.

In any event, the market is nervous right now so I would expect volatility to remain with us for the foreseeable future.

Oil jitters continue to play a role in market activity as geopolitical uncertainty surrounding the Middle East and North Africa continue. In fact, oil prices moved higher by 2.7% to settle at $99.63 per barrel, which was a two-year closing high. News reports had it that Saudi Arabia sent tanks into neighboring Bahrain to help quell social unrest. Saudi Arabia itself is nervous of possible protests within its borders and their stock market revealed those concerns as their stock market dove 7%.

In market data today, the February ISM Manufacturing Index tagged a multi-year high of 61.4, which was higher than expected, but January construction spending declined 0.7%, which was a tad more than anticipated.

By the end of the trading day the major averages took significant losses, with the S&P dropping 1.57%, while the Wilshire 4500 was hit for a 1.82% loss.

Here's today's charts:

Surprisingly, NAMO and NYMO didn't fall as much as one might have expected given today's losses. But they are both now flashing sells.

NAHL flipped to a sell, while NYHL barely remained on a buy.

TRIN spiked much higher and suggests today's losses were overdone, while TRINQ posted a much more tame reading. Both are flashing sells.

BPCOMPQ dipped lower on today's action, but is not far from that lower bollinger band. If it can cross back up through it this signal will flip back to a buy.

So the system remains on buy and the market is oversold. A bounce should be near, but geopolitical uncertainty could temper any rally. Especially if oil continues its march higher (something that's actually expected right now). Liquidity remains at high levels, so selling pressure "should" be somewhat contained, but I wouldn't necessarily bet the farm on that. Should institutional money managers decide to go into distribution, things could get real ugly, real fast. So far that's not the case.

In any event, the market is nervous right now so I would expect volatility to remain with us for the foreseeable future.