Yesterday's 6% trouncing of Japan's Nikkei stock market was followed up today with an additional loss of 10.6%. And that was well off its intra-day lows.

And so the tone was set on a global scale as all the major Asian and European averages saw losses. Many of them in excess of 2%.

In our own market, the S&P 500 was down early on by as much as 2.7%, but managed to battle back to a more moderate 1% loss by the close.

As many of you are already aware, the situation at the Japanese nuclear plant that was heavily damaged during the earthquake and tsunami is worsening, with explosions and fears of radiation causing panic across the island nation. This is just the latest focus of global markets, which have been dealing with one crisis after another these past few weeks.

And even market sectors that were soaring were negatively affected today. Oil prices fell about 4.0%, to $97.18 per barrel. Precious metals also so heavy selling pressure as gold dropped 2.2%, while silver fell a whopping 4.8%.

Treasuries are benefiting from these global fears as the yield on the 10-year Note briefly dropped to a three-month low near 3.20%, before settling at the close to about 3.30%.

Seemingly lost in the major headlines was the latest FOMC statement that was released this afternoon. It was a none factor in today's trading as no surprises were forthcoming. As expected, the FOMC kept its key rate in the range 0.00% to 0.25%. The fed also said that it will keep in place its current QE2 plan, which expires at the end of June. Perhaps the most important piece of today's announcement was that the Fed saw overall economic conditions on firmer footing and that the labor market continues to improve.

So there's a lot going on at the moment. And the crisis in the Middle East has not gone away by any stretch of the imagination. I'm quite sure the focus will shift back to the oil producing countries once Japan gets some stability again.

As a result of today's significant downside action, the Seven Sentinels finally flipped to a sell condition. Let's take a look at the charts:

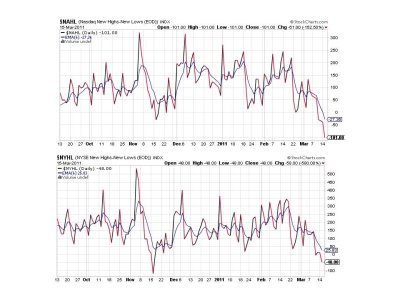

NAMO and NYMO are now well into sell negative territory, with NAMO at multi-month lows and NYMO not far behind.

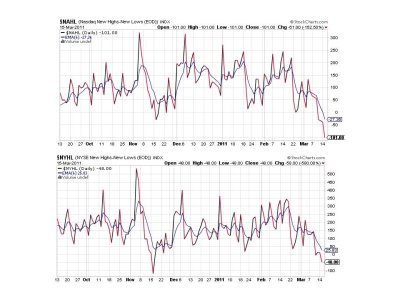

NAHL and NYHL also extended their reach into negative territory.

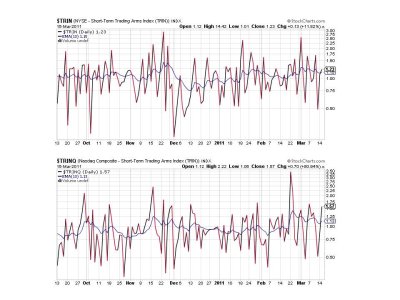

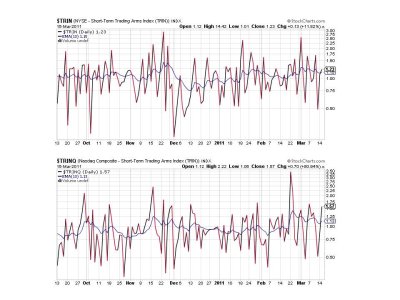

TRIN and TRINQ, the only signals on buys yesterday, flipped to sells today.

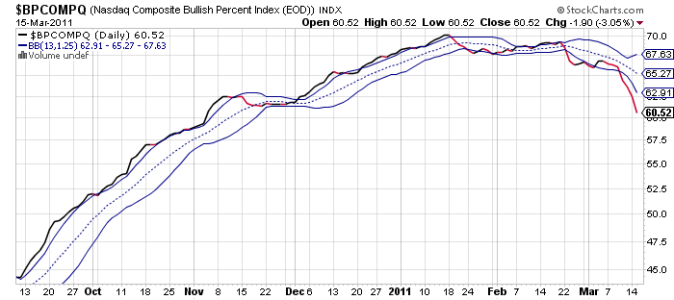

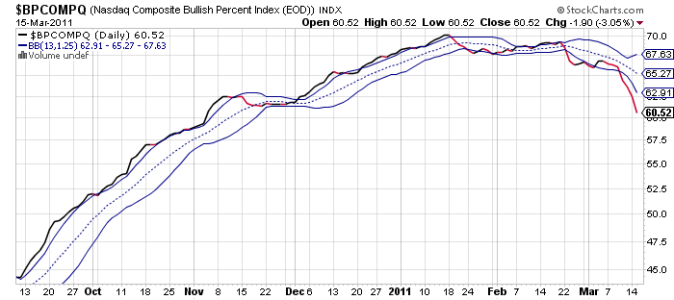

BPCOMPQ went more vertical today. Not good for a trending indicator if one is long.

So all signals are on a sell and NYMO has hit another 28-day trading low in the process. This officially flips the Seven Sentinels to a sell condition.

In spite of this sell condition, the short term is oversold and a bounce is quite likely. And it could be significant, so getting defensive here may be tricky as this volatility cuts both ways.

And so the tone was set on a global scale as all the major Asian and European averages saw losses. Many of them in excess of 2%.

In our own market, the S&P 500 was down early on by as much as 2.7%, but managed to battle back to a more moderate 1% loss by the close.

As many of you are already aware, the situation at the Japanese nuclear plant that was heavily damaged during the earthquake and tsunami is worsening, with explosions and fears of radiation causing panic across the island nation. This is just the latest focus of global markets, which have been dealing with one crisis after another these past few weeks.

And even market sectors that were soaring were negatively affected today. Oil prices fell about 4.0%, to $97.18 per barrel. Precious metals also so heavy selling pressure as gold dropped 2.2%, while silver fell a whopping 4.8%.

Treasuries are benefiting from these global fears as the yield on the 10-year Note briefly dropped to a three-month low near 3.20%, before settling at the close to about 3.30%.

Seemingly lost in the major headlines was the latest FOMC statement that was released this afternoon. It was a none factor in today's trading as no surprises were forthcoming. As expected, the FOMC kept its key rate in the range 0.00% to 0.25%. The fed also said that it will keep in place its current QE2 plan, which expires at the end of June. Perhaps the most important piece of today's announcement was that the Fed saw overall economic conditions on firmer footing and that the labor market continues to improve.

So there's a lot going on at the moment. And the crisis in the Middle East has not gone away by any stretch of the imagination. I'm quite sure the focus will shift back to the oil producing countries once Japan gets some stability again.

As a result of today's significant downside action, the Seven Sentinels finally flipped to a sell condition. Let's take a look at the charts:

NAMO and NYMO are now well into sell negative territory, with NAMO at multi-month lows and NYMO not far behind.

NAHL and NYHL also extended their reach into negative territory.

TRIN and TRINQ, the only signals on buys yesterday, flipped to sells today.

BPCOMPQ went more vertical today. Not good for a trending indicator if one is long.

So all signals are on a sell and NYMO has hit another 28-day trading low in the process. This officially flips the Seven Sentinels to a sell condition.

In spite of this sell condition, the short term is oversold and a bounce is quite likely. And it could be significant, so getting defensive here may be tricky as this volatility cuts both ways.